How did Amazon become the world’s largest e-commerce company?

Amazon started out of Jeff Bezos’s garage in Bellevue, Washington in 1994. It’s now one of the Big Five companies in the US information technology industry, along with Alphabet (Google), Apple, Microsoft, and Meta (Facebook).

Learn more about Amazon shares

This success comes down to the growth of the internet. In 1994, there were only 40 million people using the internet in the US but now over 5.18 billion people are using the internet as of 2023 – that's around two thirds of the population.

When Amazon was launched, it sold books online but quickly expanded to sell everything from electronics and software, to food, toys, clothing and furniture. Amazon grew its revenue from $8.47 million in Q4 1996 to $16 million in Q1 1997. Despite this being considered a relatively small income, Amazon went public in 1997, at $18 per share. This gave the company a market value of about $438 million.

By 2015, Amazon had become the most valuable retailer in the US by market capitalisation – surpassing grocery store Walmart. It is now in the rarified club of companies with a valuation in excess of $1 trillion.

Amazon’s share price has had an equally meteoric rise. For investors, every $10,000 invested at the time of Amazon’s 1997 IPO would be worth more than $14 million today.

Discover Amazon’s share price history under Jeff Bezos

What companies does Amazon own?

Amazon owns more than 100 companies across a variety of market sectors – including tech, groceries, media and medicine. Many have attributed this vast empire of businesses to Amazon’s need-to-win mentality – if it can’t dominate the market on its own, it’ll just buy the market leader.

Amazon's biggest acquisitions

Amazon’s biggest acquisition was Whole Foods in 2017, which it acquired for $13.7 billion. It provided a brick-and-mortar retail space for Amazon, as well as insights into high street shoppers.

Here are Amazon’s biggest acquisitions ranked by cost value:

- Whole Foods: 2017, Food and Beverage, Grocery and Organic Food, for $13.7 billion

- Metro-Goldwyn-Mayer: 2021, Media Production and Film, for $8.5 billion

- One Medical: 2022, Healthcare, for $2.9 billion

- iRobot: 2022, Robotics, for $1.4 billion

- Zoox: 2020, Autonomous Vehicles, Robotics and Transportation, for $1.2 billion

- Zappos: 2009, E-Commerce, Retail and Shoes, for $1.2 billion

- Twitch: 2014, Social Media, Video, Video Games and Video Streaming, for $970 million

- Ring: 2018, Home Security and Smart Home, for $840 million

- Kiva Systems: 2012, Hardware, Mobile, Robotics and Software, for $775 million

- PillPack: 2018, Pharmacy and E-Commerce, for $753 million

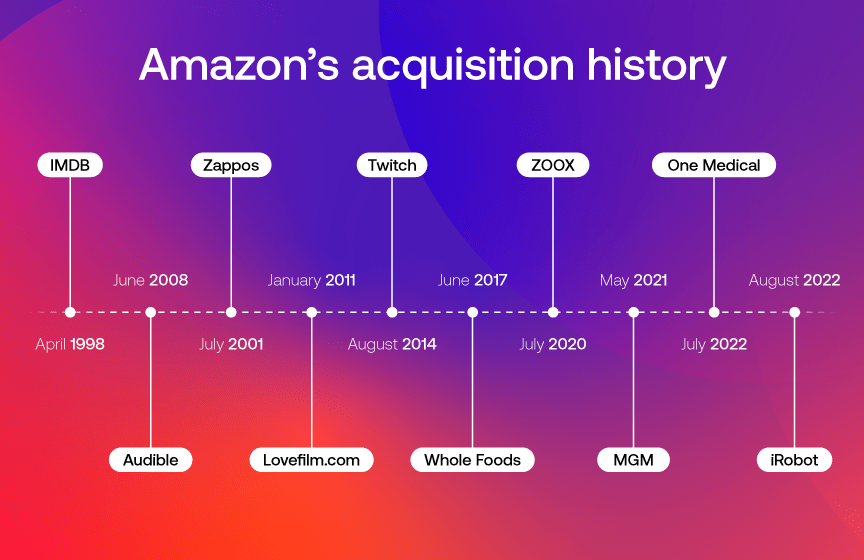

Amazon acquisition history

As Amazon owns so many companies, we’ll just take a look at the acquisition history of some of Amazon’s most famous acquisitions.

What companies does Jeff Bezos own?

Jeff Bezos owns a number of companies; naturally the most famous is Amazon. While he stepped down as CEO in Q3 2021, he’s still the largest single shareholder, with more than a 10% stake in the company.

One of the reasons cited for Bezos’s decision to vacate his position at Amazon was to focus on his other businesses. These include:

- The Washington Post – the newspaper was bought in 2013 for $250 million

- Blue Origin – the aerospace company was created in 2000 aiming to have a moon lander in the next few years

- Bezos Expeditions – this company is Bezos’s personal venture capital investments firm. As of 2020, Bezos Expeditions invested in more than 66 companies including famous companies like Airbnb and Uber

- Bezos Day One Fund – a philanthropic organisation Bezos founded to help low-income families

How to trade shares with City Index

You can trade Amazon, and over 4500+ global shares with us in just four steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade