After a drawn-out selection process, that exposed more than a few cracks in the bloc, European Leaders threw a curve ball appointing Christine Lagarde as the head of the ECB. The choice of the head of the ECB is important to investors because of the monetary policy implications that it brings with it.

Background

Christine Lagarde, Managing Director of the International Monetary Fund is a rather unexpected choice for the position given her lack of formal training for the job. Formally a lawyer (like Fed Chair Jerome Powell) she served as France’s finance minister prior to 8 years at the helm of the IMF. Any lacking in formal training, she compensates with plenty of hands on experience.

Too political?

She is a political figure, well known for her political finesse rather than being a renowned economic mind. Whilst some are raising an eyebrow at her background, this shouldn’t necessarily create a problem. As the first person to take the helm at the ECB without being a career central banker, she will, no doubt surround herself with a strong team of economists, depending more on the capacity of ECB policymakers and committees for crafting solutions to the seemingly endless eurozone economic challenges. She clearly has a lot of credibility with the markets, the question is whether she will have the same credibility with the financial markets as her predecessor Mario Draghi?

The euro?

The euro has barely flinched at her appointment, which is a good start. The markets will be looking for Christine Lagarde to follow in Draghi’s footsteps. She is the continuation candidate. Her appointment does of course mean that Germany’s Weidmann is not taking control, which is a relief for many. He was seen as the candidate for change, with a much more hawkish stance.

Christine Lagarde has previously been vocal in her support for Draghi’s quantitative easing programme and outspoken in her warning over global trade tensions, often calling for governments and central bankers to do more. With this in mind there is a good chance that she will want to continue with Draghi’s accommodative stance which could keep pressure on the euro going forwards. We already know that the ECB stands ready to ease policy. Given the lacklustre inflation in the eurozone and concerns that the current manufacturing slump could turn into a broader economic downturn, Lagarde could be stepping up accommodative policy as soon as she begins her role in October.

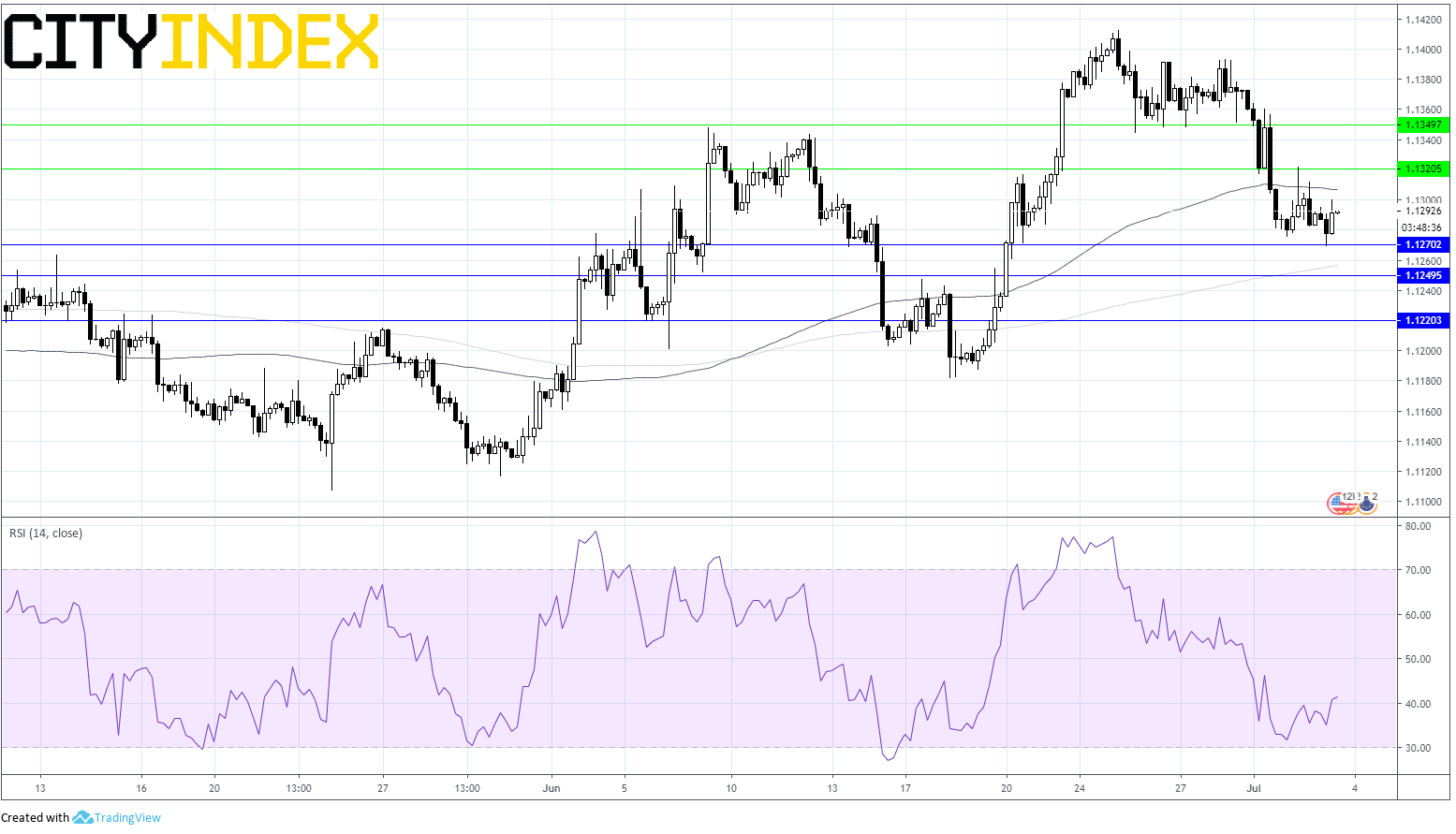

EUR/USD Levels to watch:

The pair has risen 0.1% following better than forecast service pmi figures from the bloc. Attention will now turn to ADP payrolls ahead of Friday’s NFP.

The pair has fallen below its 100 SMA on the 4 hour chart. The RSI is also lower.

Support can be seen at $1.1270, $1.1250 prior to $1.1220.

Resistance at $1.1320, $1.1350