With shares of the highly-anticipated ride-sharing company Lyft (LYFT) trading lower by nearly 20% from its late March IPO price, there was little to suggest investors had “irrational exuberance” heading into yesterday’s IPO of Beyond Meat (BYND).

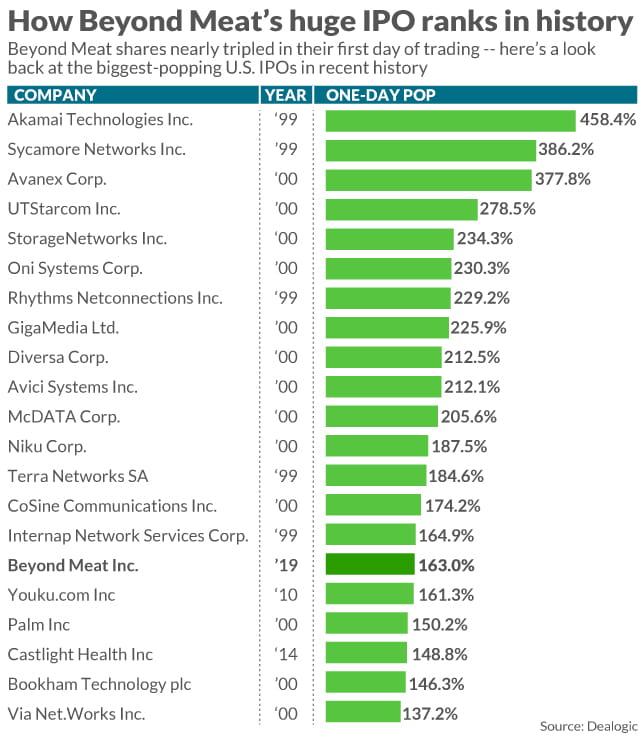

Beyond Meat, a provider of plant-based meat alternatives, initially priced its IPO in the $19-$21 range before raising both the offering range ($23-$25) and number of shares (by 1 million) on strong demand earlier this week. Even that elevated price point failed to satiate investors’ demand, as shares rocketed higher by more than 160% in their first day of trade yesterday, followed by a bullish gap higher in today’s US session.

BYND’s surge represents the largest one-day rally in an IPO since 2000 among companies with a market capitalization of at least $200M.

Source: Dealogic

Below, we outline both the bull and bear cases for the stock moving forward:

The Bull Case

BYND sits at the crossroads of several major secular trends, including fears about climate change, a focus on healthier eating, and the growing popularity of veganism/vegetarianism. The first company to create a tasty, affordable alternative to traditional meat sources will capture a substantial portion of the massive global meat market, which is estimated at $1.4T annually.

Tyson Foods (TSN) is currently one of the leaders in the space and sports a market capitalization of more than $22B. Even after BYND’s surge yesterday, the company’s market cap is less than a fifth of TSN’s, and some analysts suggest BYND should eventually trade at a premium, given its stellar 20%+ gross margins.

The Bear Case

The bear case for the stock comes down to valuation. At just $88M in global revenue, the company trades at an astronomical 43X its current sales. While those sales are growing rapidly (170% from 2017 to 2018), the company nonetheless saw $19M post-tax operating loss last year.

Though the global meat market is massive, as we noted above, competition is heating up. Impossible Foods recently announced a deal to bring non-meat burgers to Burger King, and even Tyson is developing its own plant-based meat products.

After yesterday’s surge, BYND looks like it may be priced to perfection. The meat of the matter is this: while the stock could certainly grow into its lofty valuation, the company’s successful IPO will ironically draw even more competition into the space, potentially planting the seeds for disappointment moving forward.