Welcome to Second Quarter Earnings Season and the Market Forecast for the Week of July 13th

On Tuesday, J.P. Morgan Chase (JPM) is likely to unveil 2Q EPS of $1.01 vs. $2.59 the prior year on revenue of $29.4B compared to $29.6B last year. The Co is the largest financial services and retail bank in the U.S., and on July 6th, the Turkish stock exchange barred 6 Global firms, including the Co, from short selling an of the nation's stocks for 1 month. In other news, on June 18th, the Co became the first foreign firm to completely own a futures venture in China, according to Bloomberg. Looking at a daily chart, the RSI is above its neutrality area at 50. The MACD is below its signal line and negative. The penetration of 50 on the RSI would call for further downside. Moreover, the stock is below its 20 day MA ($97.23) but above its 50 day MA ($93.94). We are looking at the final target of $109.30 with a stop-loss set at $85.90.

On Wednesday, Unitedhealth Group (UNH) is expected to announce 2Q EPS of $4.91 vs. $3.60 the prior year on revenue of $63.4B compared to $60.6B in the year before. The Co is a private health insurance provider and on June 24th, the Co's Dental division announced the launch of its teledentistry services, which will improve access to oral care while reducing unnecessary visits to the emergency room. From a technical point of view, the RSI is below 50. The MACD is below its signal line and positive. The MACD must penetrate its zero line to expect further downside. Moreover, the stock is trading under both its 20 and 50 day MA (respectively at $292.83 and $293.27). We are looking at the final target of $258.20 with a stop-loss set at $306.60.

On Thursday, Netflix (NFLX) is anticipated to release 2Q EPS of $1.81 vs. $0.60 the prior year on revenue of $6.1B compared to $4.9B last year. The Co operates a video streaming service and on June 17th, company Chief Executive Officer Reed Hastings and his wife pledged to donate 120 million dollars to fund scholarships at historically Black colleges and universities. On a different note, the Co's current analyst consensus rating is 29 buys, 9 holds and 6 sells, according to Bloomberg. From a chartist's point of view, the RSI is above 70. It could mean either that the stock is in a lasting uptrend or just overbought and therefore bound to correct (look for bearish divergence in this case). The MACD is positive and above its signal line. The configuration is positive. Moreover, the stock is above its 20 and 50 day MA (respectively at $467.04 and $444.99). We are looking at the final target of $614.00 with a stop-loss set at $485.00.

On Friday, Kansas City Southern (KSU) is awaited to post 2Q EPS of $1.21 vs. $1.64 the prior year on revenue of $573.1M compared to $714.0M last year. The Co operates a commercial railroad system and on July 1st, the Co reported that President, General Manager and Executive Representative of Kansas City Southern de Mexico, Dr. Jose Guillermo Zozaya Delano will retire as of August 1st, he will be succeeded by Vice President and Director General Oscar Augusto Del Cueto Cuevas. Technically speaking, the RSI is below 50. The MACD is below its signal line and negative. The configuration is negative. Moreover, the stock is below its 20 day MA ($146.30) but above its 50 day MA ($144.32). We are looking at the final target of $126.30 with a stop-loss set at $151.90.

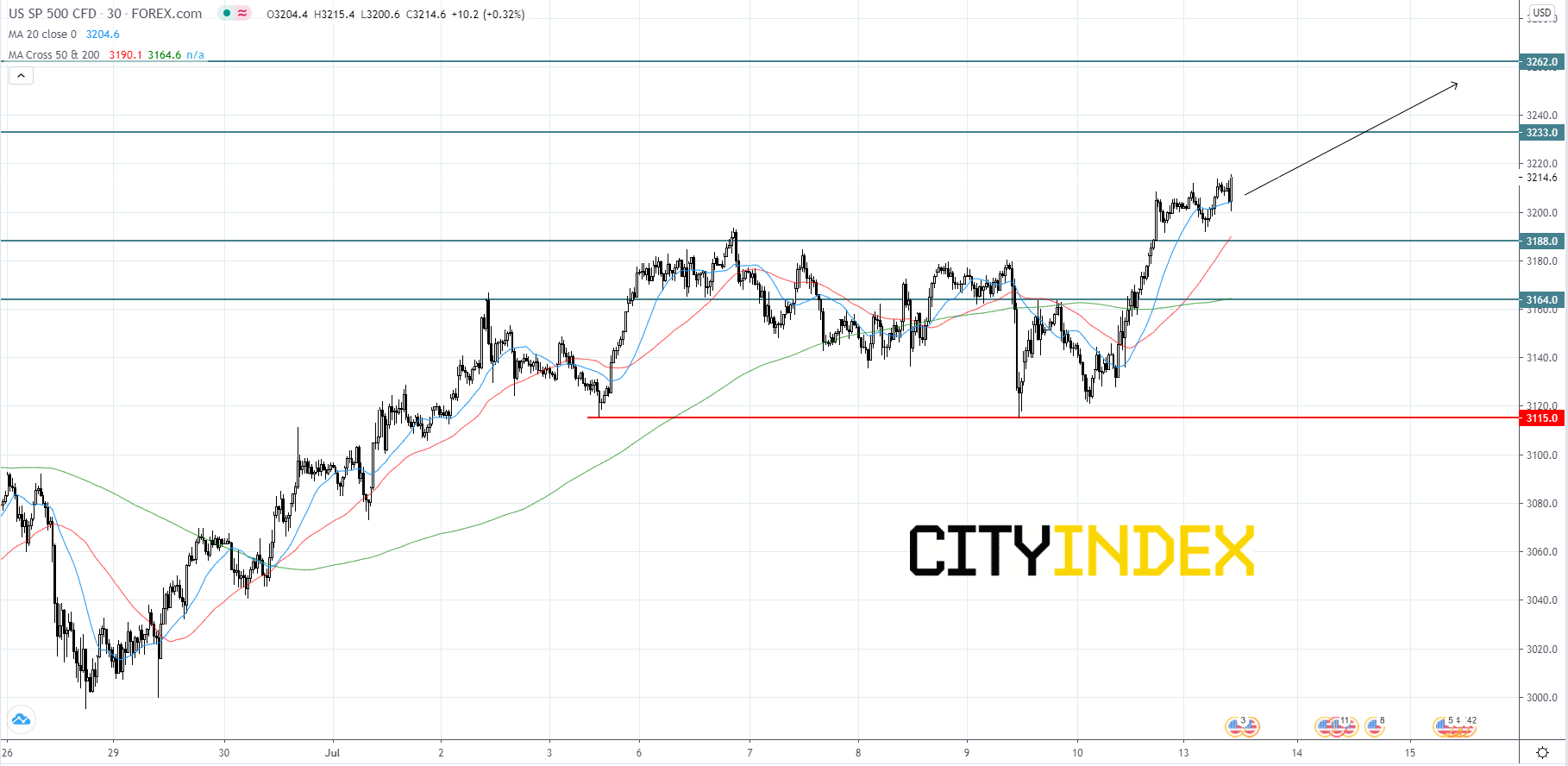

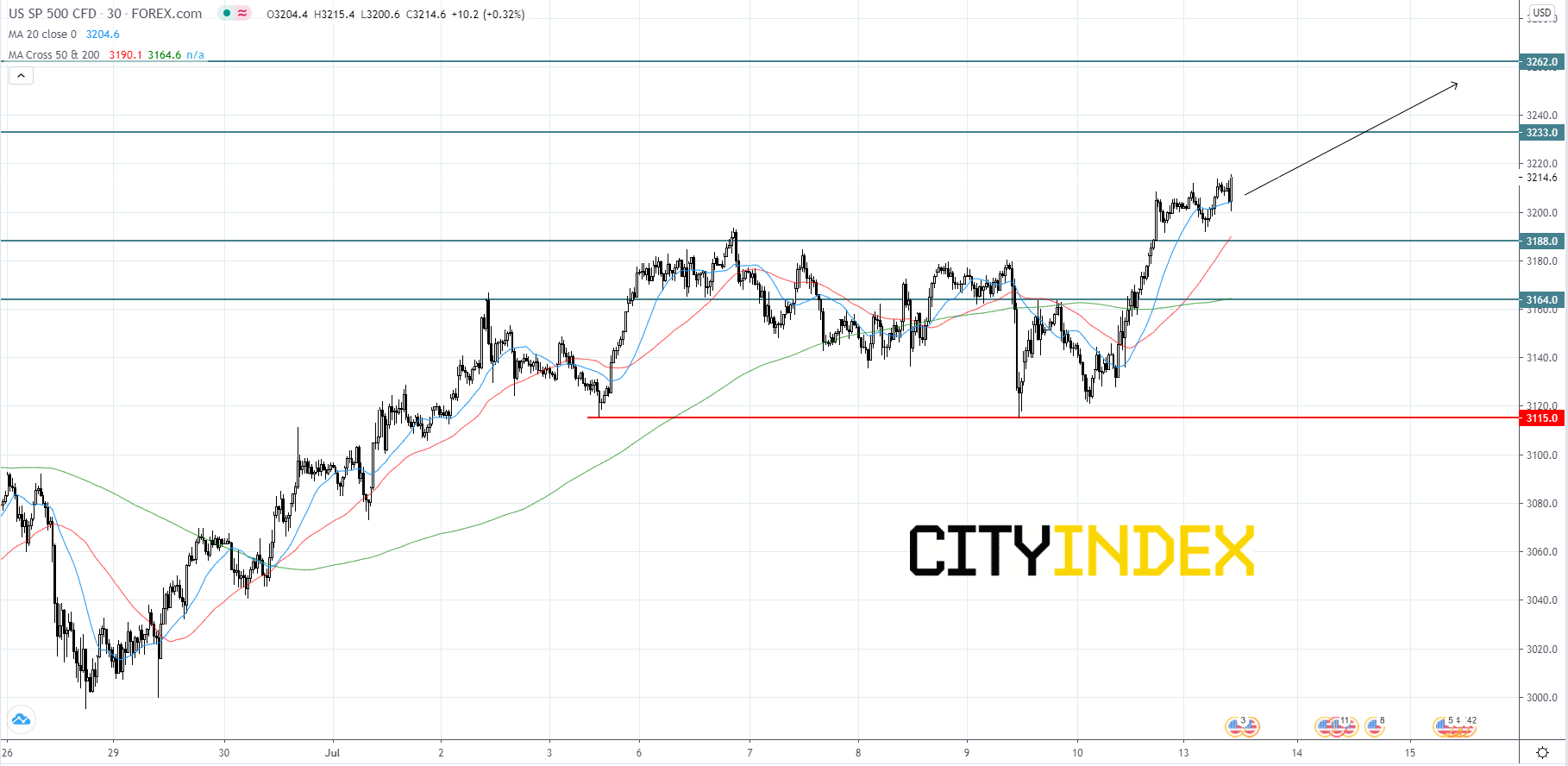

Looking at the S&P 500 CFD, the index has been steadily rising since the end of June. During the end of last week prices slipped a bit before finding support at 3115. The Index appears to be headed to retest its last peak of 3,233, made on June 8th. If price can break above 3,233, the advance will likely continue to 3,262. With earnings seasons starting this week we should prepare for the possibility of exaggerated price movements. If the index falls below the 3188 level we could witness price retrace back to 3164, around the 200-period moving average. Since we are still in a bull market the bias will remain bullish in the short-term unless market conditions change.

Source: GAIN Capital, TradingView

On Wednesday, Unitedhealth Group (UNH) is expected to announce 2Q EPS of $4.91 vs. $3.60 the prior year on revenue of $63.4B compared to $60.6B in the year before. The Co is a private health insurance provider and on June 24th, the Co's Dental division announced the launch of its teledentistry services, which will improve access to oral care while reducing unnecessary visits to the emergency room. From a technical point of view, the RSI is below 50. The MACD is below its signal line and positive. The MACD must penetrate its zero line to expect further downside. Moreover, the stock is trading under both its 20 and 50 day MA (respectively at $292.83 and $293.27). We are looking at the final target of $258.20 with a stop-loss set at $306.60.

On Thursday, Netflix (NFLX) is anticipated to release 2Q EPS of $1.81 vs. $0.60 the prior year on revenue of $6.1B compared to $4.9B last year. The Co operates a video streaming service and on June 17th, company Chief Executive Officer Reed Hastings and his wife pledged to donate 120 million dollars to fund scholarships at historically Black colleges and universities. On a different note, the Co's current analyst consensus rating is 29 buys, 9 holds and 6 sells, according to Bloomberg. From a chartist's point of view, the RSI is above 70. It could mean either that the stock is in a lasting uptrend or just overbought and therefore bound to correct (look for bearish divergence in this case). The MACD is positive and above its signal line. The configuration is positive. Moreover, the stock is above its 20 and 50 day MA (respectively at $467.04 and $444.99). We are looking at the final target of $614.00 with a stop-loss set at $485.00.

On Friday, Kansas City Southern (KSU) is awaited to post 2Q EPS of $1.21 vs. $1.64 the prior year on revenue of $573.1M compared to $714.0M last year. The Co operates a commercial railroad system and on July 1st, the Co reported that President, General Manager and Executive Representative of Kansas City Southern de Mexico, Dr. Jose Guillermo Zozaya Delano will retire as of August 1st, he will be succeeded by Vice President and Director General Oscar Augusto Del Cueto Cuevas. Technically speaking, the RSI is below 50. The MACD is below its signal line and negative. The configuration is negative. Moreover, the stock is below its 20 day MA ($146.30) but above its 50 day MA ($144.32). We are looking at the final target of $126.30 with a stop-loss set at $151.90.

Looking at the S&P 500 CFD, the index has been steadily rising since the end of June. During the end of last week prices slipped a bit before finding support at 3115. The Index appears to be headed to retest its last peak of 3,233, made on June 8th. If price can break above 3,233, the advance will likely continue to 3,262. With earnings seasons starting this week we should prepare for the possibility of exaggerated price movements. If the index falls below the 3188 level we could witness price retrace back to 3164, around the 200-period moving average. Since we are still in a bull market the bias will remain bullish in the short-term unless market conditions change.

Source: GAIN Capital, TradingView

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM