Read our guide on how to interpret the weekly COT report

As of Tuesday 29th of October

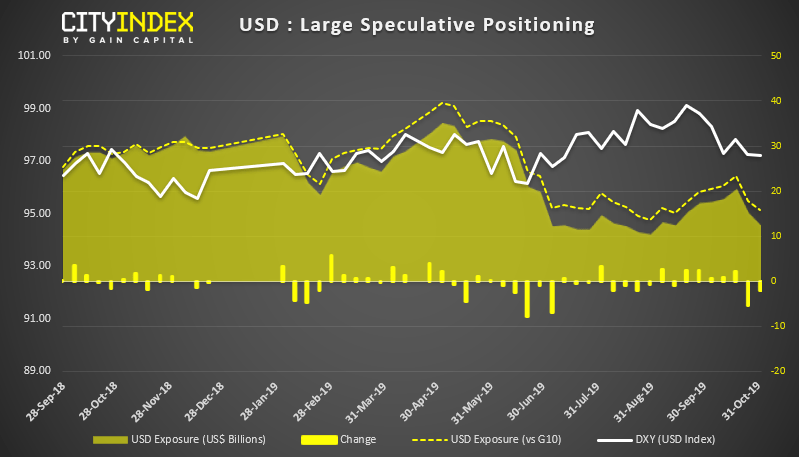

- Bullish exposure on the USD was $12.6 billion ($15.9 against G10)

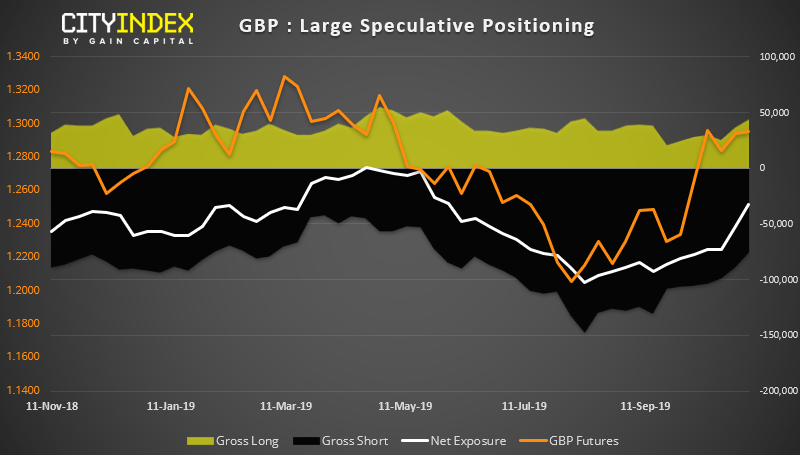

- Traders are their least bearish on GBP futures since early June

- GBP saw the largest weekly change among FX majors, with net-short exposure being reduced by 20k contracts

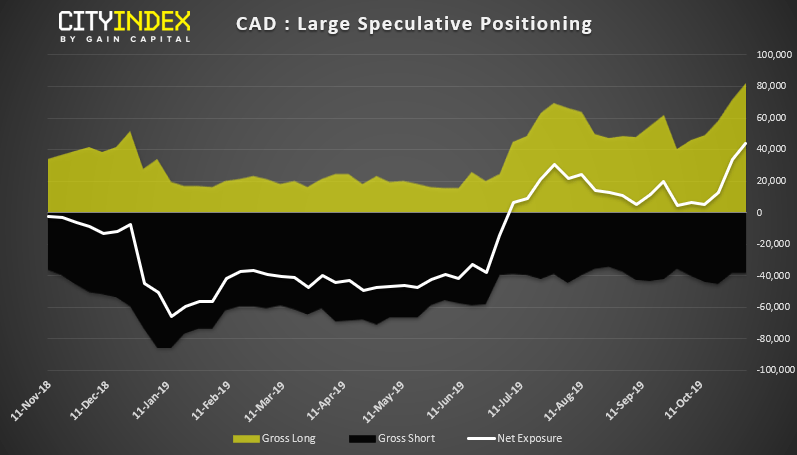

- Traders increased net-long exposure to CAD ahead of the dovish BOC meeting

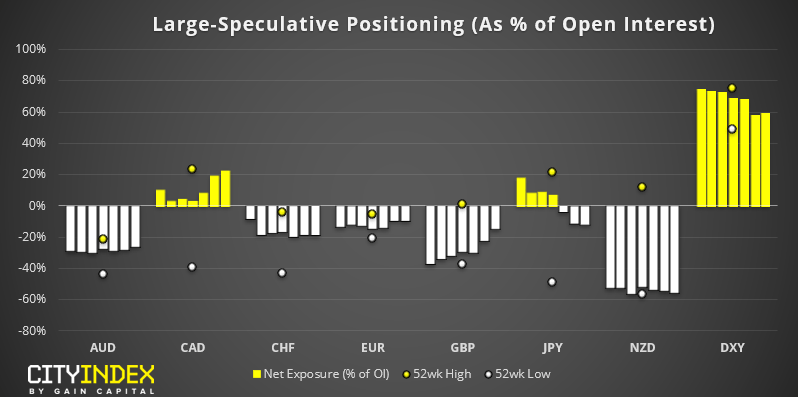

USD: Bullish exposure on the USD continues to dwindle. At $12.6 billion net-long, it’s the least bullish traders have been since late August and has remained under pressure since the Fed embarked on ‘not QE’ to help with the repo market. Technically, the decline on DXY (USD index) has stalled around 97 and above the lower bounds of its bullish channel. Its plausible to expect a technical ounce from current levels but whist prices remain below 98, a test (or even a break of) the lower trendline is looks feasible.

GBP: Traders are their least bearish on GBP futures since early June. It’s also the 7th consecutive week that net-short exposure and gross shorts have been reduced. Moreover, bulls have increased long bets for 5 weeks over the past 6. Technically cable remains firmly bullish yet there are risks of over extension to the upside. Yet whilst the UK avoids a hard Brexit, it’s becoming difficult to build a bearish case, so GBP may remain in ‘buy the dip’ category over the foreseeable future.

CAD: Large speculators were their most bullish on CAD futures since December 2017. Yet the dovish BOC meeting has thrown a spanner into the works. With the BOC lowering growth projections and the Fed lowering rates, Canada aren’t going to want to have a higher interest rate then the US so, despite the economy doing well relatively, there are growing risks they could cut rates. And this risk intensifies if economic data begins to weaken. So we’ll look for contrarian opportunities on CAD as there could be quite a few bulls on the wrong side of the bet.

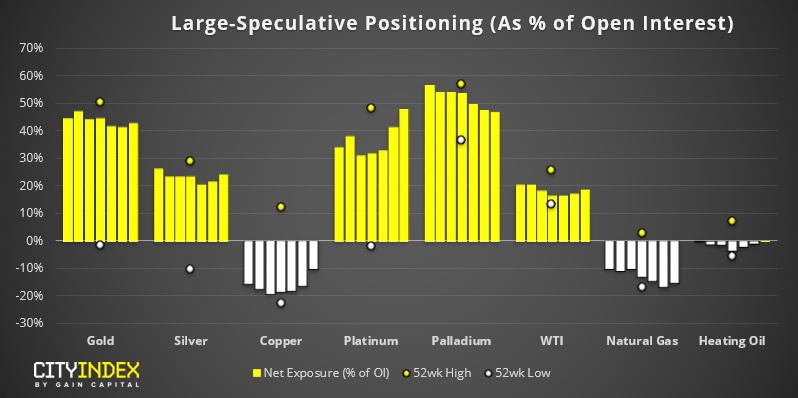

As of Tuesday 29th of October

- Large speculators are their least bearish on Copper since late August

- Bears remain side-lined on gold

- Traders are their most bullish on platinum since February 2018

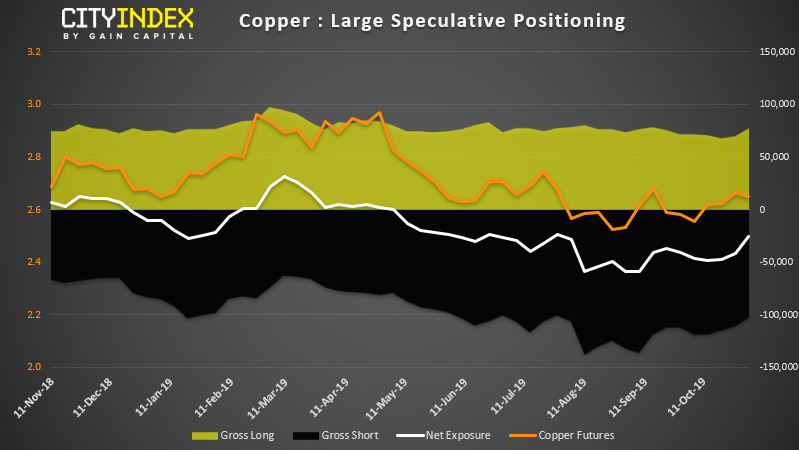

Copper: Traders are their least bearish on copper since late July. Long bets have increased the past two weeks and shorts have been reduced the past four. Technically copper prices are yet to provide a compellingly bullish cue, but shorts may want to take notice of recent changes to positioning, as its hard to provide a bearish case. So we may find price action to remain copy and uncommitted to either direction for the foreseeable future.

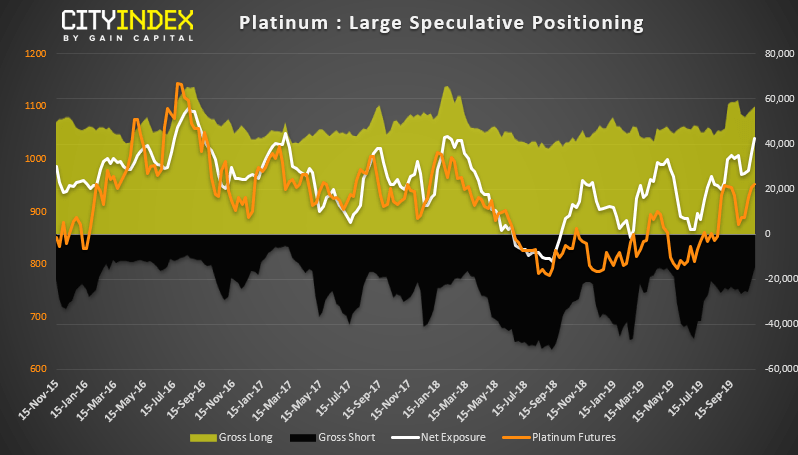

Platinum: Net-long exposure is its highest since February 2015, although near levels which have historically led to an inflection point. That said, short interest has fallen for two consecutive weeks and price action doesn’t appear exhausted, so whilst there’s potential for an inflection point, it’s not being signalled by price action yet.