- Net-long exposure to the US increased for the first time in 8-weeks, but by a mere +$0.2 billion according to data from IMM

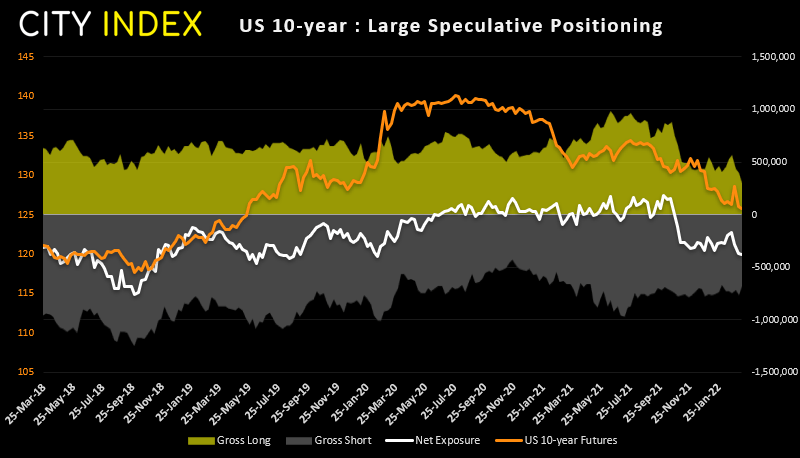

- Net-short exposure to the US 10-year treasury note rose to its highest level since the pandemic

- Yet traders increased net-long exposure to emerging FX against the dollar for a sixth straight week

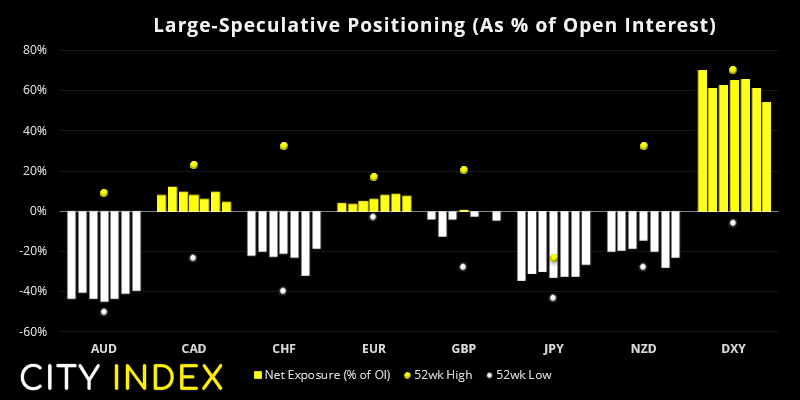

- Traders were their least bearish on JPY futures in 10-weeks

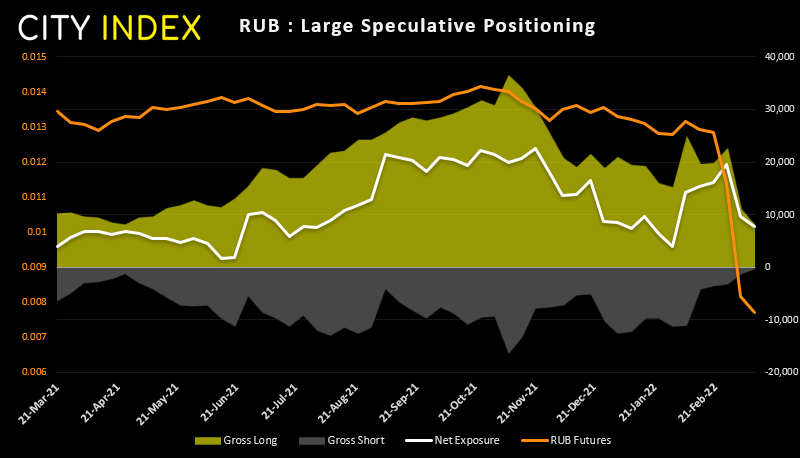

- Traders remained net-long the ruble, but a clear trend of the past two weeks is both gross longs and shorts being culled as traders reduced exposure to the currency

- GBP and JPY futures saw the largest weekly repositioning, with

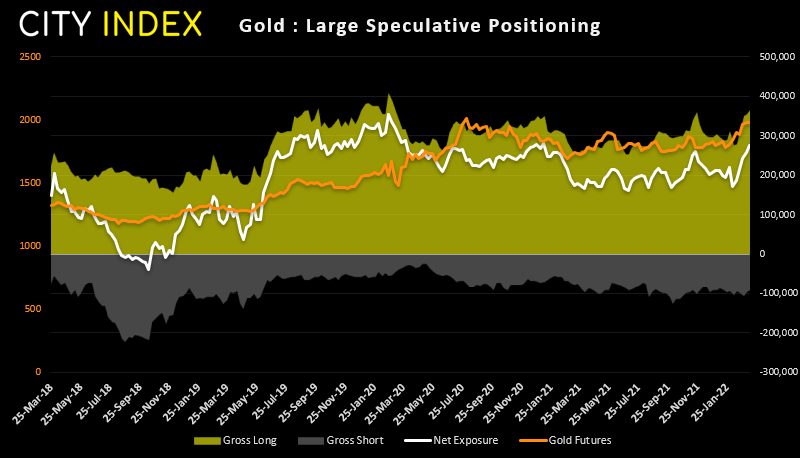

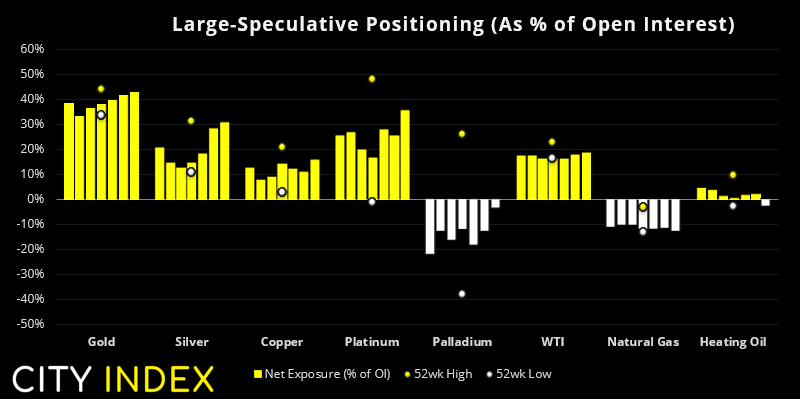

- Large speculators were their most bullish on gold in 13-months

- Net-long exposure of large speculators on silver and platinum futures hit an 11-month high

- Traders were net-long palladium futures for a second consecutive week

Read our guide on how to interpret the weekly COT report

Read our guide on how to interpret the weekly COT report

Ruble futures:

Two key features stand out on this chart; the ruble has been in freefall and large speculators (on the CME exchange) are reducing exposure to it. The currency fell nearly 40% two weeks ago as hard-hitting sanctions on key Russians and the central bank were announced. Since then, we have seen a significant reduction of gross longs and shorts. And who can blame them with a domestic stock market that remains closed and capital controls in place. It may not be an ideal market to trade for many at the moment, but it does at least highlight the sentiment towards Russian markets. And that is to steer clear of them.

US 10-year treasury note futures:

Bond prices move inversely to yields, which means that weaker bond prices send yields move higher. It’s therefore interesting to note large speculators were their most bearish on the 10-year bond since February 2020, just as the pandemic swept its way across the West. And that could effectively be taken as a bet on higher yields, as the trend lower in bond prices is showing no signs of an immediate trough.

Gold futures:

Large speculators increased their net-long exposure to gold futures to their most bullish level since January 2021. Open interest has also confirmed the rally on gold, as volumes have risen to levels not seen since March 2020. Furthermore, traders added 10.4k long contracts last week to take its 5-week total of 88.6k long contracts added, whilst shorts have been trimmed by -6.3k contracts. However, managed funds actually trimmed net-long exposure by -5.6k contracts to suggest some were not ‘buying into’ its potential to break to a new record high, even though it stopped just $5 from it last week. Still, net-long exposure of this sub-set of traders remain near their most bullish level since the pandemic, so many appear to be holding on for a new record high.

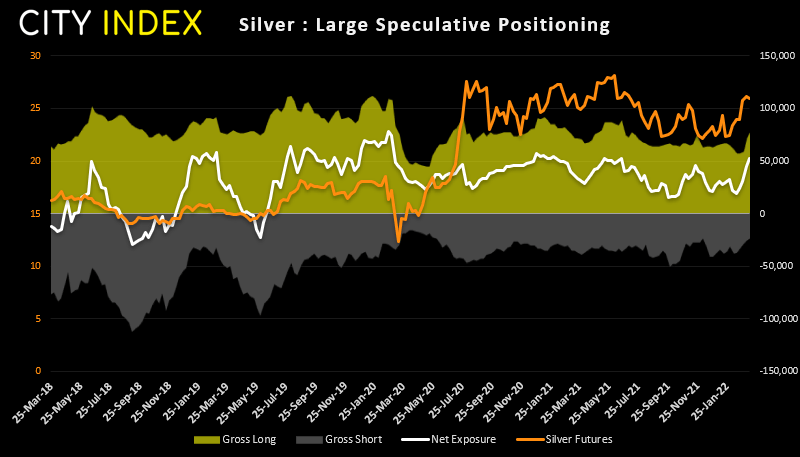

Silver futures:

The pattern on silver futures is very similar to that seen on gold. Traders love it. Large speculators are their most bullish since the pandemic, although unlike gold, managed funds also increased their net-long exposure to silver last week. The price reversals seen on copper, palladium and platinum – seemingly related to the sharp rise in nickel prices and closure of LME trading, is not apparent on gold or silver. And they appear to remain the go-to-bet around geopolitical tensions right now.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade