As of Tuesday 8th October:

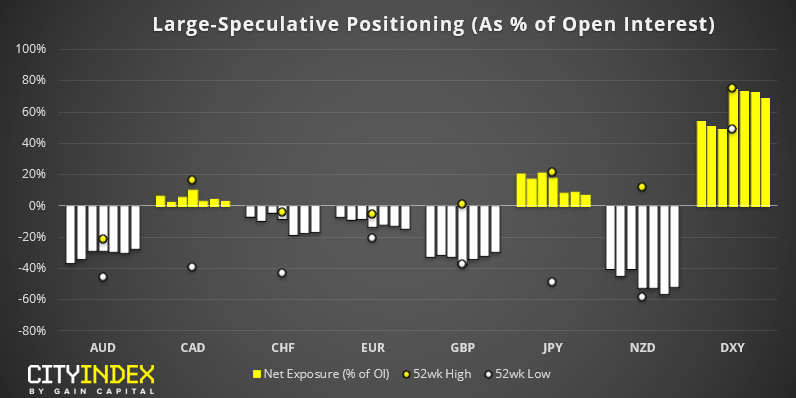

- Traders increased net-long exposure for a 4th consecutive week by $0.8 billion.

- The Euro saw the largest weekly change among FX majors, seeing net-short exposure increase by 9.4k contracts.

- Large speculators were their least bearish on the British pound in 3 months.

- Large speculators were their least bullish on the Japanese yen in 2 months.

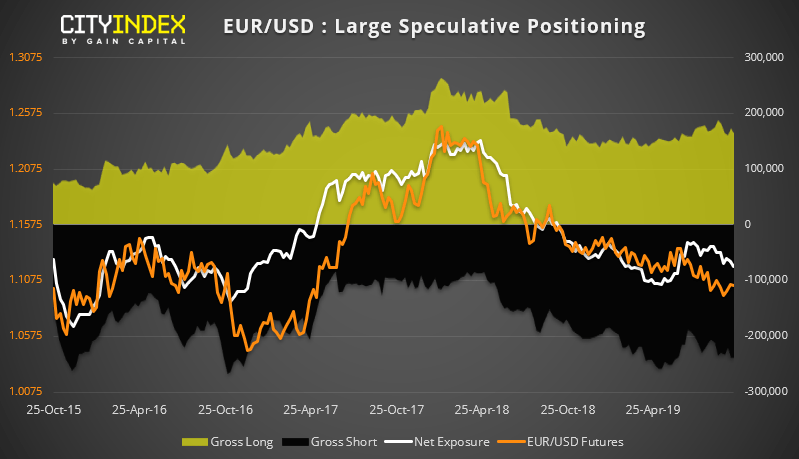

EUR: Net-short exposure dropped to its most bearish level in 4-months. Gross short exposure remains near a 4-month high, although last week’s increase of bearishness was a function of both longs and shorts closing out. Yet, whilst positioning doesn’t scream a sentiment extreme, EUR/USD rallied nearly 1% between Tuesday’s close (when the report was compiled) and Friday’s high on progress with US-China trade talks. So, is the low in? Perhaps, but I’m not currently convinced from this alone. There’s still a long way to go on trade talks and traders remains net-short on the Euro. So until we see a material pick-up with gross longs and closure of shorts, it’s probably better to assume the trend remains bearish.

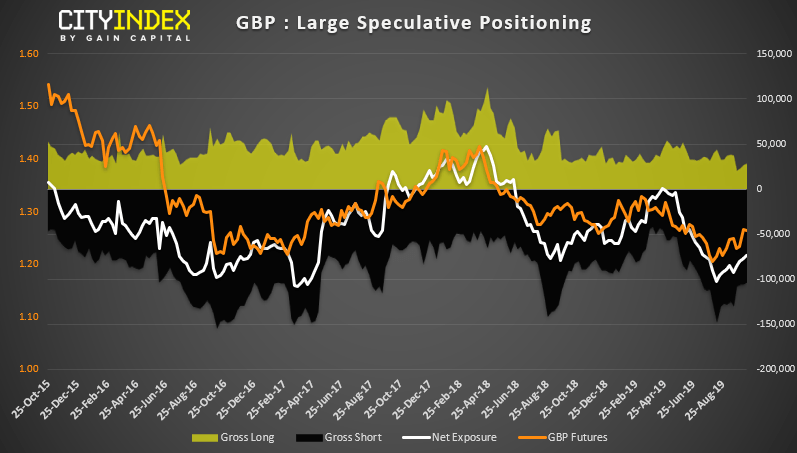

GBP: Over the past three weeks we’ve seen gross longs increase and gross shorts decreased; albeit by a small amount but it has allowed net-short exposure to fall to a 3-month low. Given the 4% rally on cable over Thursday and Friday on Brexit developments, we’d expect net-short exposure to fall notably, assuming traders still think there’s chance of a deal before 31st of October. And looking at the cycles of net-short exposure, it’s plausible that the low was in around mid-August.

As of Tuesday 8th October:

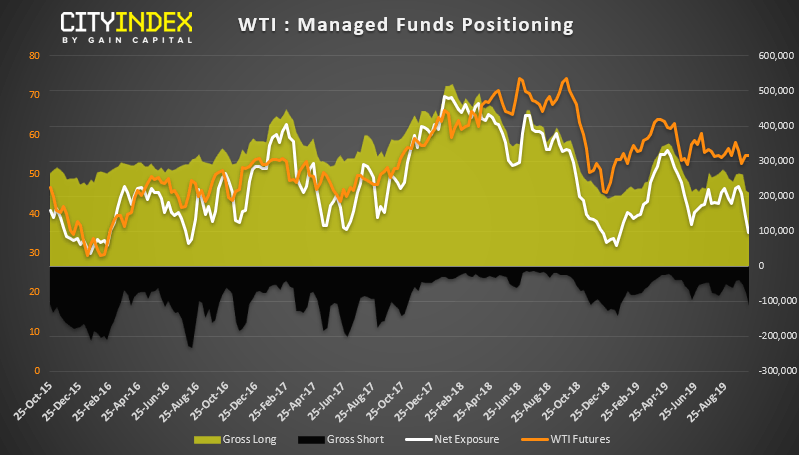

- WTI Traders reduced net-long exposure to a 4-month low.

- Bullish positioning on Palladium was at its highest level in 8-months.

- Net-short exposure to copper was at its most bearish level in 8-weeks.

- Only minor adjustments to gold positioning sees net-long exposure remain stubbornly high.

WTI: Net-long exposure declined for a fourth consecutive week, taking bullish exposure for large speculators to their least bullish in 4-months. However, managed funds (pictured above) saw bullish net-long exposure fall to a 9-month low. Gross shorts are at their most bearish level since January, adding +36.9k contracts last week alone (or over +75k over the past three weeks) so some funds may have been squeezed following the missile attack on an Iranian oil tanker on Friday. Yet with volatility remaining relatively low following the attack, some funds may see the bounce as a reason to add to shorts unless geopolitical tensions rise, or we see another supply shock to make prices truly rally.

Related analysis:

Commencing Phase One of US-China Trade Deal

Week Ahead: US-China Trade and Brexit Optimism Aftermath

WTI Breaks Above 54 Following Missile Attack On Iranian Oil Vessel