As of Tuesday 8th February 2022:

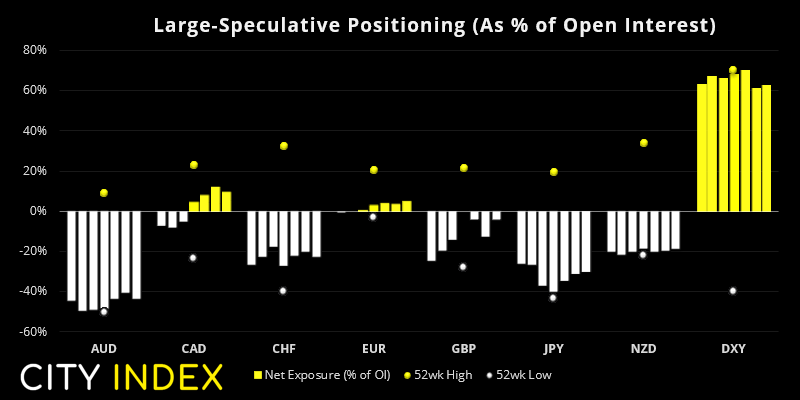

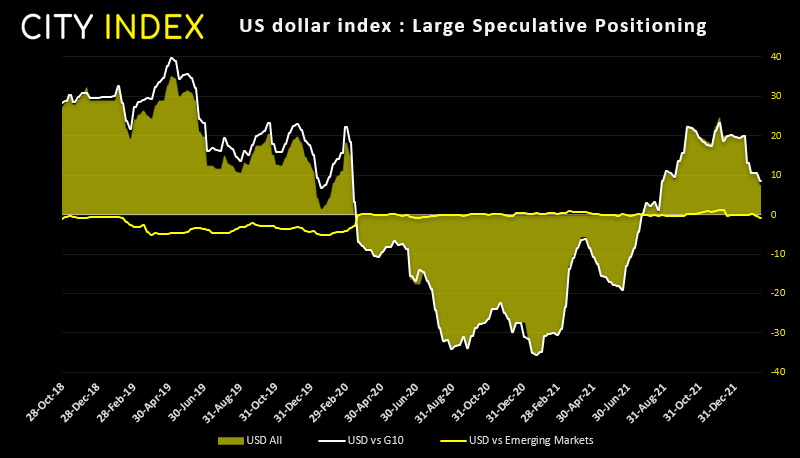

- According to data compiled by IMM, traders were net-long the USD by $7.5 billion, which was -$2.7 billion less than the previous week.

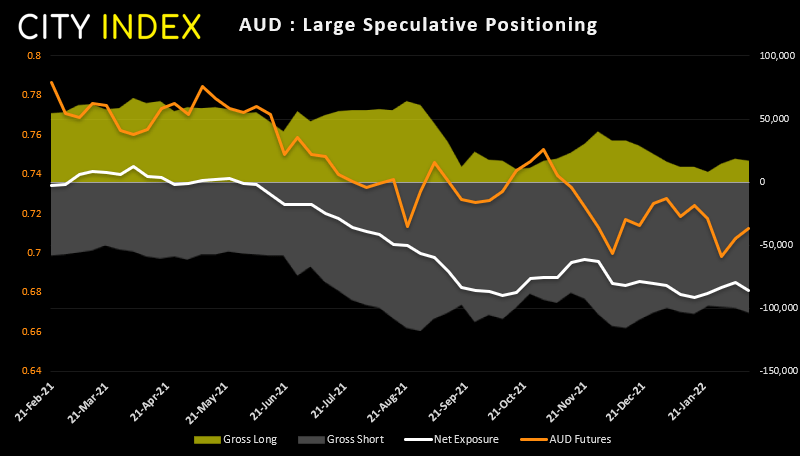

- Traders increased net-short exposure to AUD by 5.9k contracts

- Net-long exposure to euro futures rose to a 25-week high

USD positioning:

Aggregate net-long exposure to the US dollar fell to a 6-month low last week and fell for a fourth consecutive week. Moreover, it was down -26% from the prior week. This is at odds with the fact the Fed are soon to embark upon an aggressive rate-hike path, although it does play along nicely with our view in the 2022 outlook that commodity currencies could perform well from Q2 after a weak start to the year.

AUD futures:

Bears are returning to the Australian dollar, with gross shorts rising 4.4k contracts and gross longs falling -1.5k contracts from the previous week. And despite a hawkish Fed the RBA remain defiantly dovish after saying in their quarterly SOMP that they were “prepared to be patient”, so there is seemingly little reason to expect those bears to close out any time soon.

As of Tuesday 8th February 2022:

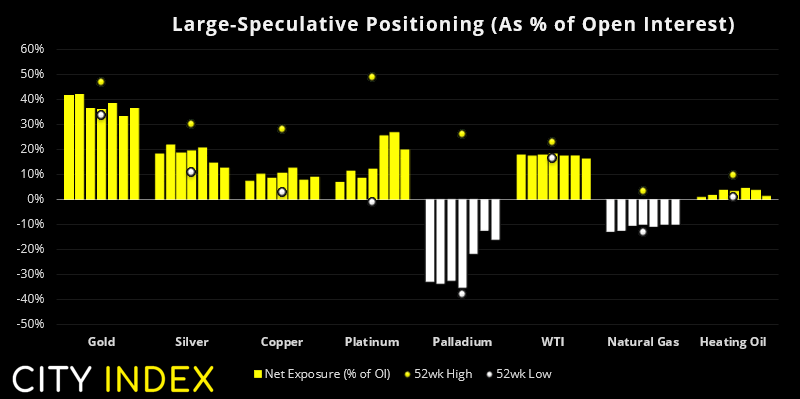

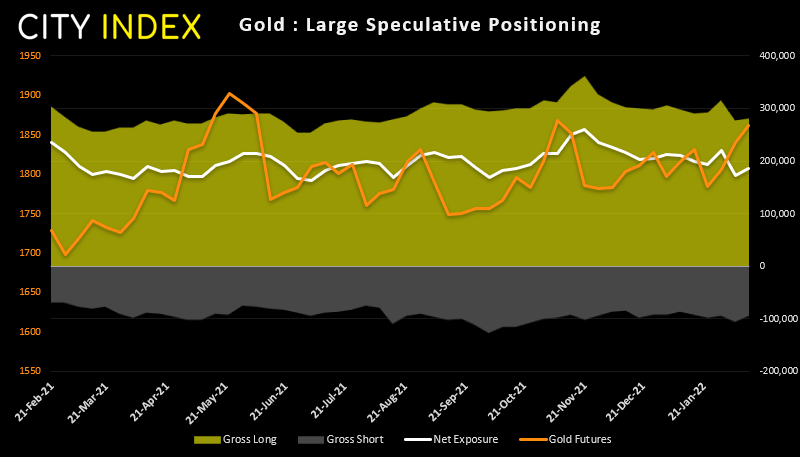

- Gold bears removed -11k short contracts ahead of last week’s bullish breakout

- Traders trimmed gross longs of silver futures for a third week which pushed net-long exposure to a 17-week low

- Net-long exposure to platinum futures fell by -2.8k contracts, fuelled mostly by an increase of gross shorts.

Gold futures:

The closure of 11k contracts effectively reversed the new bearish bets from the previous week. 3.6k net-long contracts were added which saw net-long interest increase by 15.6k contracts. And that we have since seen gold rally above yet resistance levels and breakout of a multi-month triangle strongly points towards the potential that we’ve seen the corrective low and bulls are to remain dominant.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade