As of Tuesday 1st October:

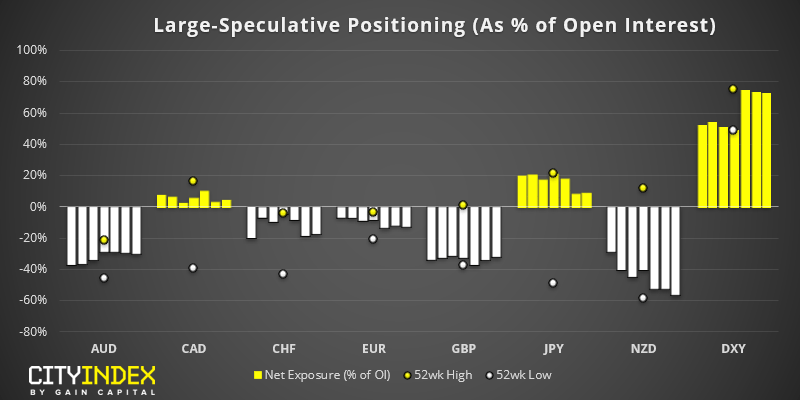

- Bullish exposure on the USD was at $17.5 billion ($20.5 billion against G10 FX)

- Overall, only minor adjustments were made to FX majors on a weekly basis

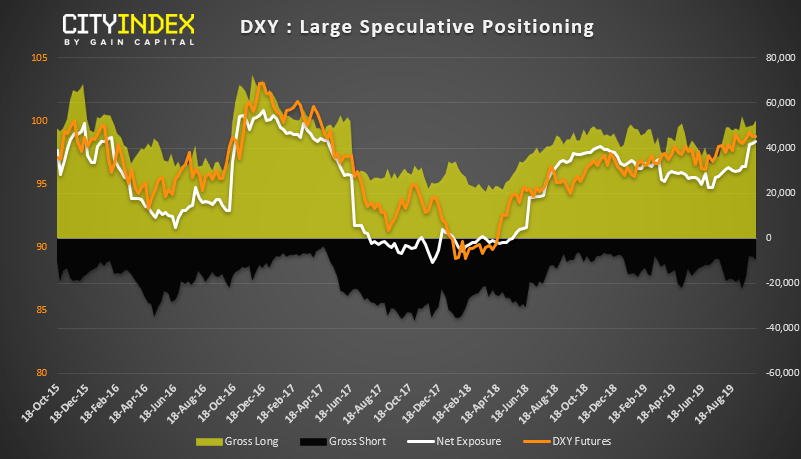

- Net-long exposure to the USD index (DXY) hit a 2.5 year high

- Net-short exposure nudged its way to a fresh record high, although fuelled by a close of longs and shorts

DXY: By Tuesday’s close, net-long exposure to DXY was its highest in 2.5 years. It’s 1-year Z-score was over +2 standard deviations foe the first time in 12 months. There were also 5.5 long contracts to every short, although this ratio actually peaked at 6.3 two weeks prior. However, this marketed the swing high and DXY has since retraced from its peak, so these metrics will be a little less stretched. From a price action perspective, DXY remain within a bullish channel and the its structure remains bullish above 98.6 so whilst this level holds, we favour a break to new highs.

As of Tuesday 1st October:

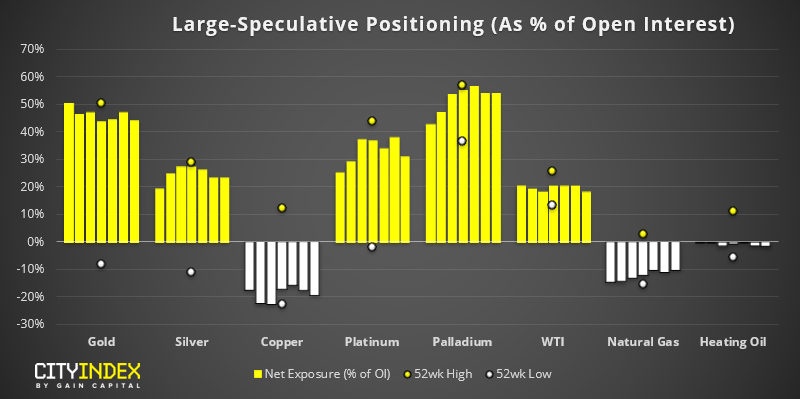

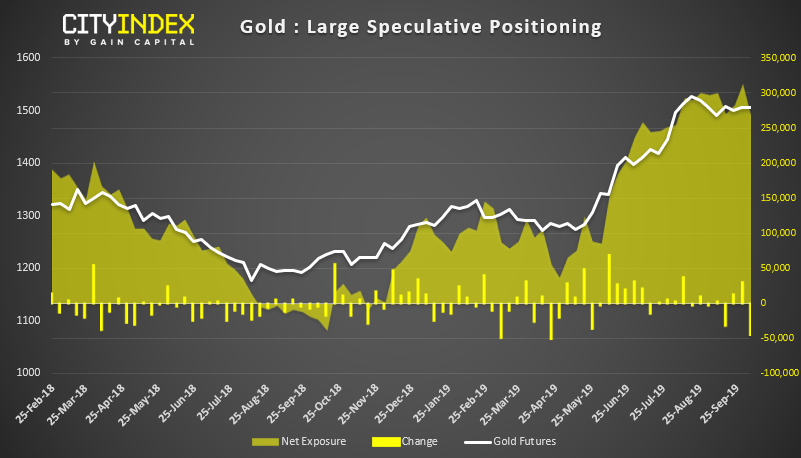

- Net-long exposure to gold was reduced by -11.6%

- Platinum traders reduced net-long exposure by 10.5%

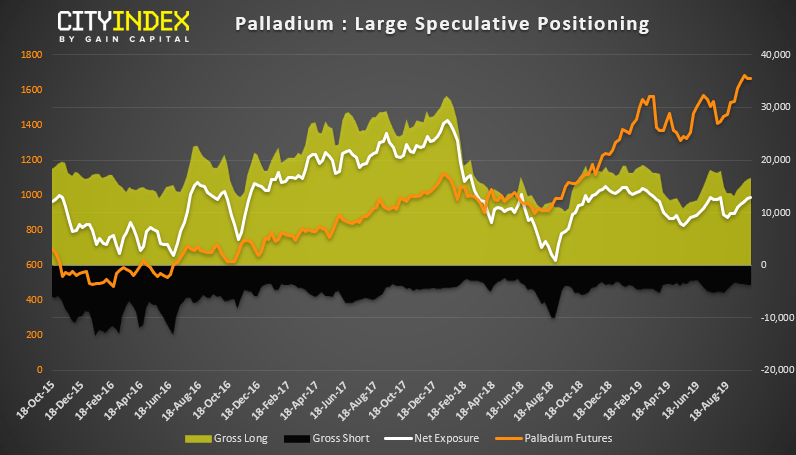

- Bullish exposure to palladium hit a 3-month high

Gold: Gold bulls closed 47.6k long contracts last week, their largest weekly reduction since December 2017. This saw net-long exposure drop by 11.6%. Incidentally, the report (which was compiled on 1st October) marked the swing low on Gold. It’s also worth noting that net-long exposure was near record highs ahead of the bullish reduction. (The record high was in 2016). Whilst we’ve observed stretched positioning and warned of a potential inflection point, geopolitical tensions and weak economic data has proven too difficult to build a bear case for the yellow metal. But if those supportive features were to be removed, it then opens up the potential for a deeper correction. For now, gold could remain stubbornly near its highs and trade within a range.

Palladium: Traders have remained net-long on palladium since 2003. However, whilst prices remain at record highs, net-long exposure isn’t flagging a sentiment extreme with 1 and 3-year Z-score at +1.3 and -0.2 standard deviations respectively. Until price action suggests otherwise, palladium appears favourable to trend traders (or those seeking to buy dips).