As of Tuesday 17th September:

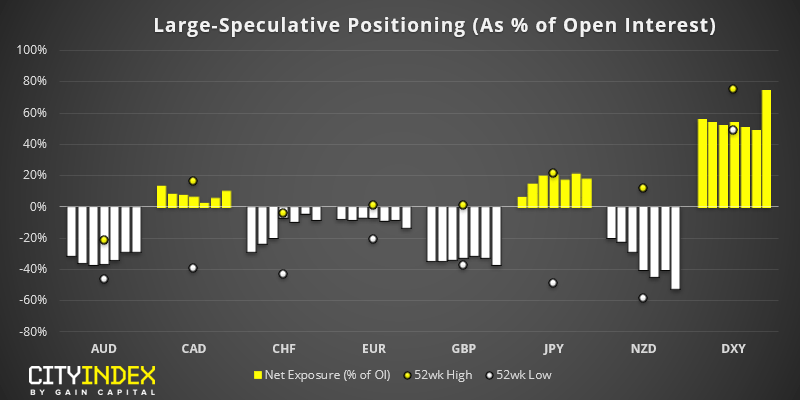

- Traders increased net-long exposure to the USD by $2.2 billion, taking bullish exposure to a 3-month high of $15.4 billion

- Bullish exposure to the USD index (DXY) was at a 29-month high

- Traders were the least bearish on AUD in 6-months

- Net-short exposure on NZD hit a record high

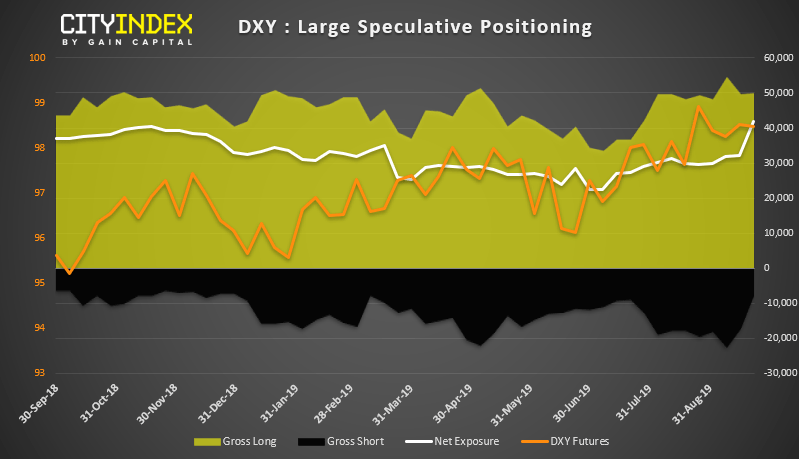

DXY: Traders are their most bullish on the USD index since April 2017. However, its sudden jump to new highs has been fuelled by a sharp decline in short positions, with bears closing -9,599 short contacts. We’re yet to see the index break to new highs, but bears fleeing could be the first steps towards such an event.

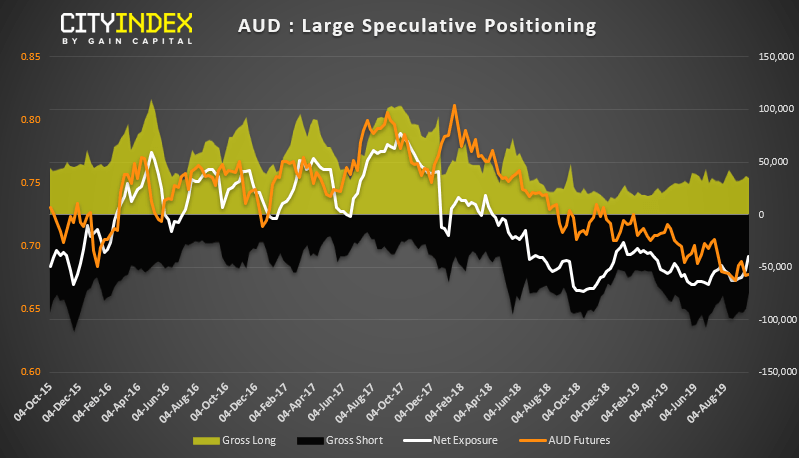

AUD: Traders are their least bearish on the Aussie in 6 months, having reduced gross-short exposure. That we’ve not see an increase of longs suggests it could be corrective behaviour as opposed to a turnaround, but worth noting none the less as prices remain near multi-year lows as bears lose interest. And this was despite that fact that Tuesday’s RBA minutes saw a higher chance of a 25 bps cut next month.

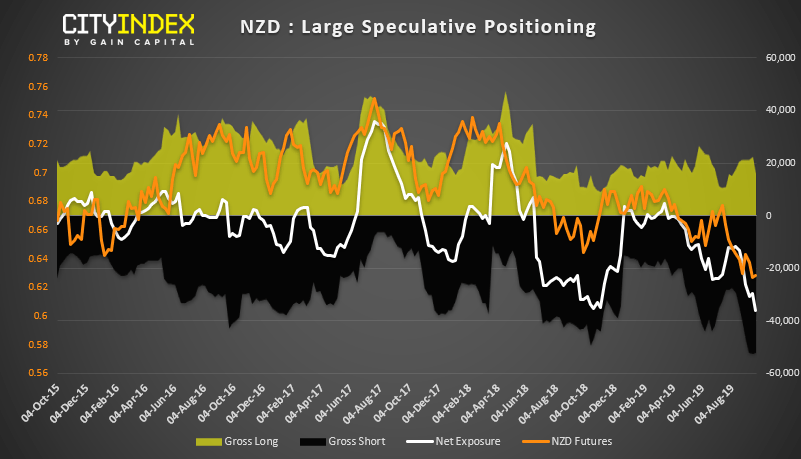

NZD: Net-short exposure hit a record high, although it was achieved on the closer of longs as opposed to initiation of fresh shorts. Still, with net and gross short exposure at record levels, it’s highly possible we’re at or approaching a sentiment extreme. So bears beware.

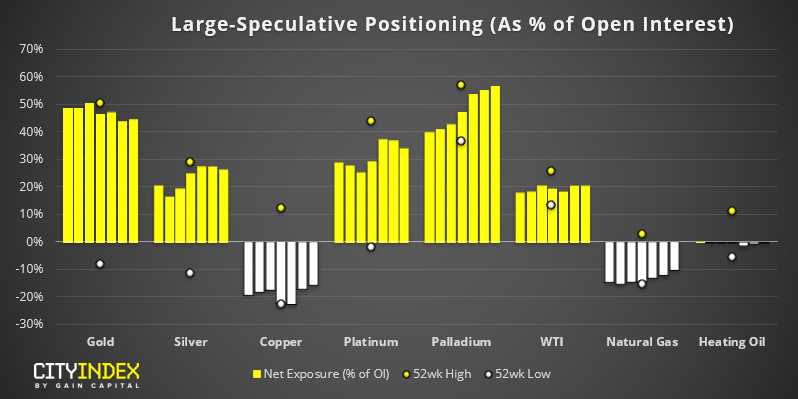

As of Tuesday 17th September:

- Minor changes to gold positioning saw bears remain sidelined

- Bearish exposure on copper hit a 6-week low

- Bullish exposure to palladium hit a 6-week high

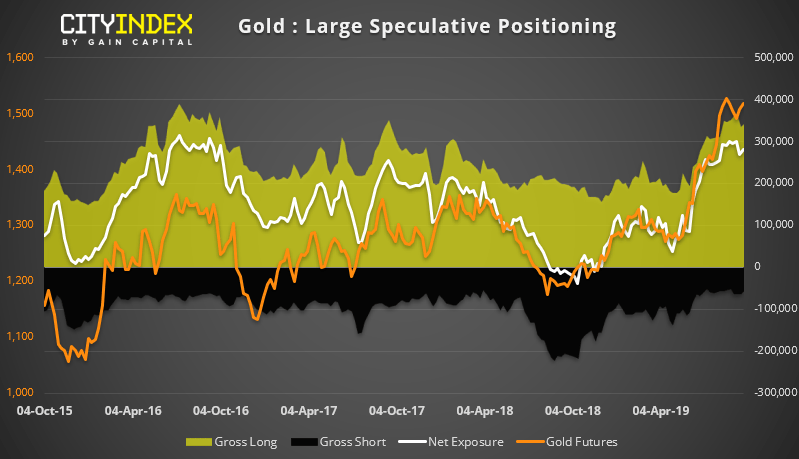

Gold: Despite its epic rally, bears remain hesitant to commit and bulls remain defiant. With prices holding above $1500, it’s possible bulls are carving out a corrective low. So we’ll continue to monitor this key level as it could prove to be the springboard for gold’s next advance, or the trigger for a deeper correction..

Related analysis:

Week Ahead: US-China trade and Brexit back to forefront