Read our guide on how to interpret the weekly COT report

Read our guide on how to interpret the weekly COT report

As of Tuesday 26th October 2021:

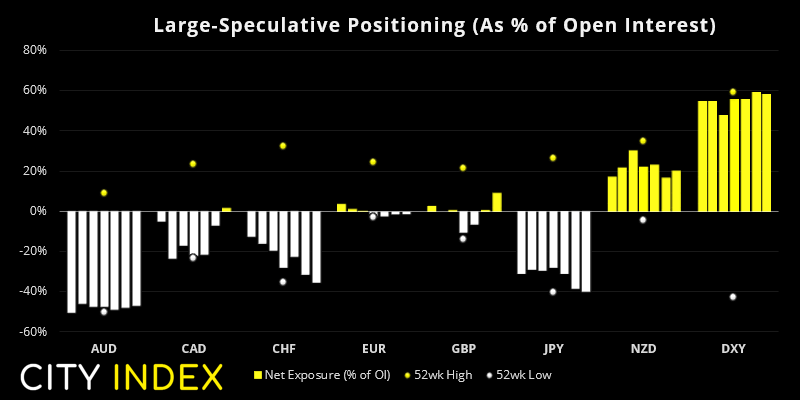

- Net-long exposure to the US dollar was trimmed for a third week, according to data compiled by IMM (International Money Market). Traders are estimated to be net-long USD by $19.75 billion, down -$1.7 billion on the week, $19.4 billion of which is against G10 currencies and just $0.3 billion of net-long exposure against emerging currencies.

- Traders flipped to net-long exposure on Canadian dollar futures, breaking an 8-week streak of bearish net exposure

- Bears continued to increase net exposure to CHF and JPY futures

- Short-covering saw net-long exposure to GBP futures rise to a 3-month high

- Net-short exposure to AUD futures were trimmed by just -12 contracts, which is really not a lot considering the Australian dollar rose to a 16-week high and net-exposure is just off from record highs.

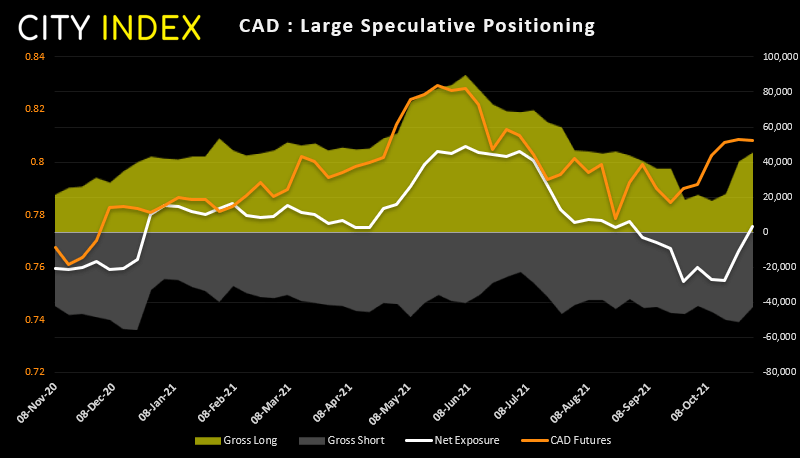

CAD futures flip to net-long exposure

Traders flipped to net-long exposure to CAD futures for the first week in eight. It may only be by 3.3k contracts, but the move was seen with a rise of 5.6k new longs and reduction of -8.6k shorts, which pushed net exposure u by 14.2k contracts to the favour of the bull camp. Given CAD spent around 3-month correcting against its dominant bullish trend, prices do not appear to be stretched to the upside and momentum has now realigned with that bullish trend. So the flip to net-long is simply confirming the trend.

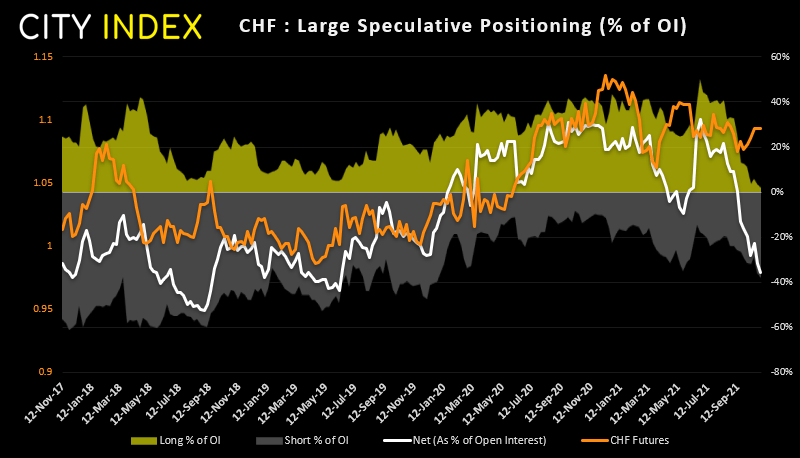

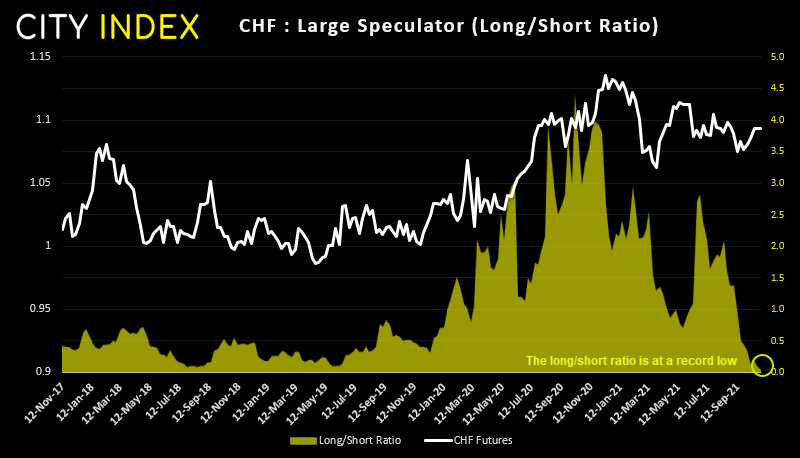

Is the Swiss franc reaching a sentiment extreme?

Traders are their most bearish on Swiss franc futures since December 2019. The net exposure indicator has fallen for 10 of the past 11 weeks and gross longs are near a record low. Yet the futures prices rose to an 11-week high. At some point we will either see shorts covered to send prices higher, or prices need to turn lower to justify the current rate of bearish exposure.

We suspect the former will take place (sentiment extreme to push prices higher) given just 5.7% of traders hold gross long positions, the 1-year Z-score is at -3 standard deviations. But, as always, we need price action to confirm.

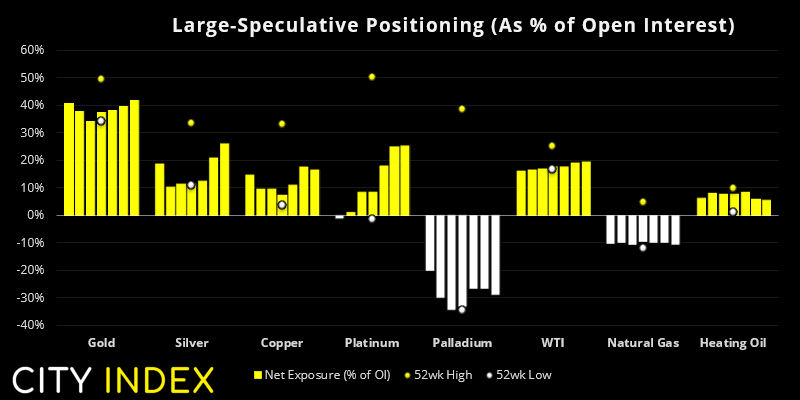

As of Tuesday 26th October 2021:

- Traders increased net-long exposure to gold futures for a fourth week, and are now their most bullish

- Large speculators were their most bullish on silver futures in 14-weeks.

- Traders slightly increased net-long exposure to platinum futures to a 15-week high.

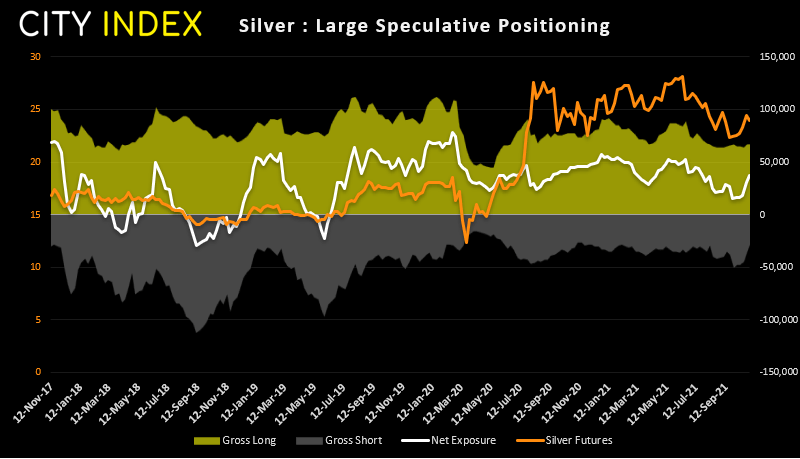

Can silver outperform gold?

It is certainly a scenario to consider, given the rise of bullish interest on silver futures. Traders are now their most bullish on silver in 14-weeks, although as of yet its rally has been a function of short-covering. Therefore, we now want to see fresh longs initiated to provide the rally with some additional strength. However, both gold and silver are retracing against their trends so one way to monitor the relationship is to see which has the shallowest correction to reveal the stronger market for when or if bulls return.

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade