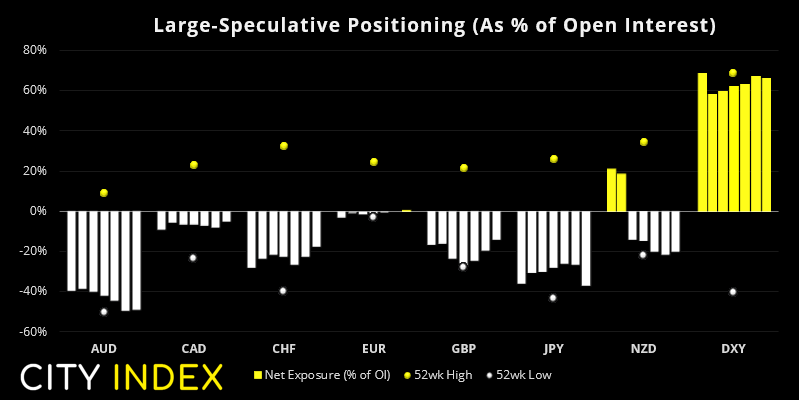

- Traders increased bullish exposure to USD by $0.42 billion, according to IMM

- Traders flipped to net-long exposure to euro futures

- Net-short exposure to AUD futures hit a new record

- Large speculators increased net-short exposure to yen futures to a 6-week high

Read our guide on how to interpret the weekly COT report

Read our guide on how to interpret the weekly COT report

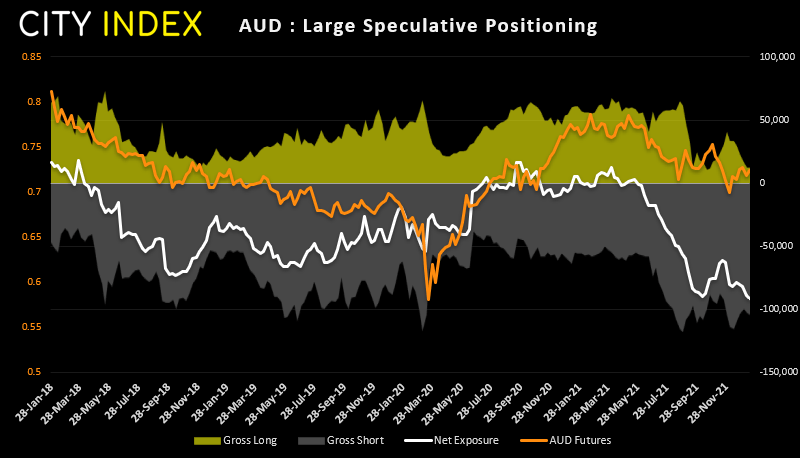

AUD futures:

Traders sold short 1.8k contracts against the Australian dollar and trimmed longs by -249 contracts, which takes the net-sort exposure to a new record of -91.5k contracts. Whilst shorts rose a little last week, the increase of short exposure has mainly been a function of longs being closed out since the end of November. Yet despite the bearish exposure to AUD prices continue to hold up well overall, which means we need to see prices roll over or bears will be forced to close and potentially spark a short-covering rally (like we’ve seen on GBP futures recently).

Read our guide on the Australian Dollar

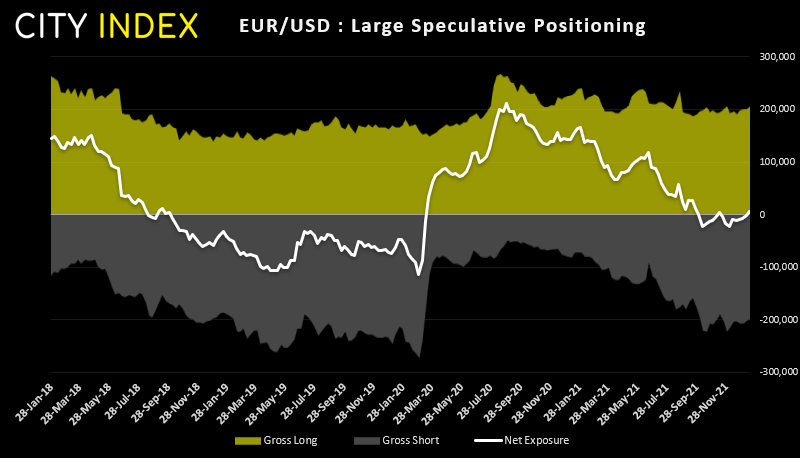

EUR futures:

Traders flipped to net-long exposure on euro futures by 6 contracts. Yet we note there is a lot of trading activity in both directions, with longs and shorts sitting around 200k contracts each, so it appears investors are hedging their bets. So for a sustainable move to materialise we’d need to see a significant reduction in longs or shorts, as opposed to newly initiated activity.

Euro explained – a guide to the euro

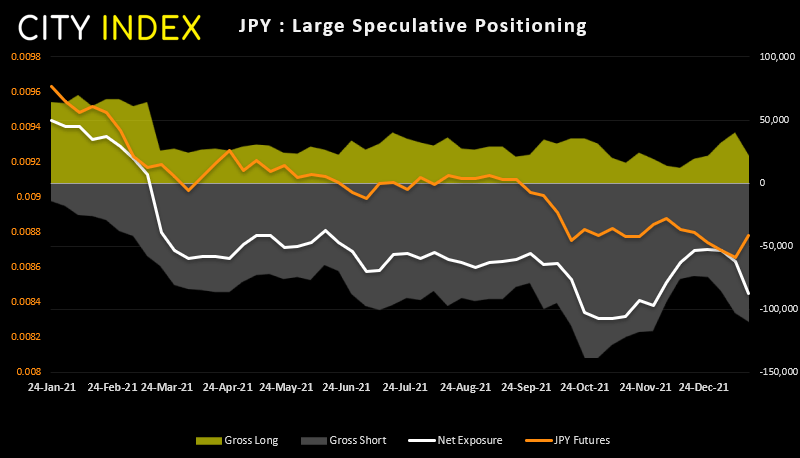

JPY futures:

Last week traders closed 18.4k long contracts on yen futures and added 6.8k short contracts, which saw net-short exposure increase by 25.3k contracts. Yet prices went on to rally 1.48%, most of which was seen on Wednesday – a day after the report was compiled. So we have to assume some of those shorts have since been closed.

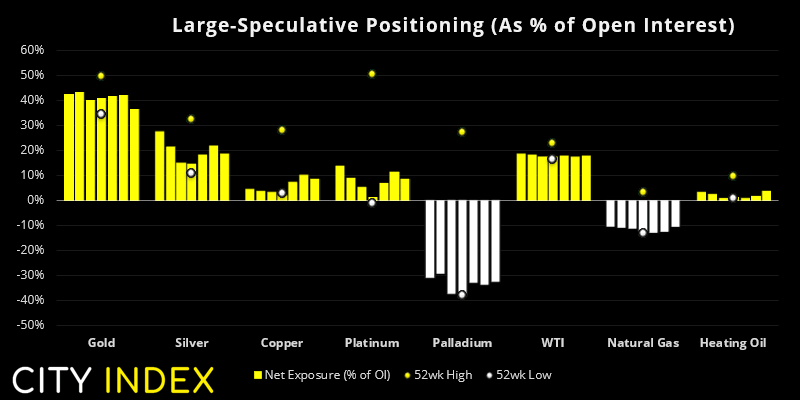

As of Tuesday 11th January 2022:

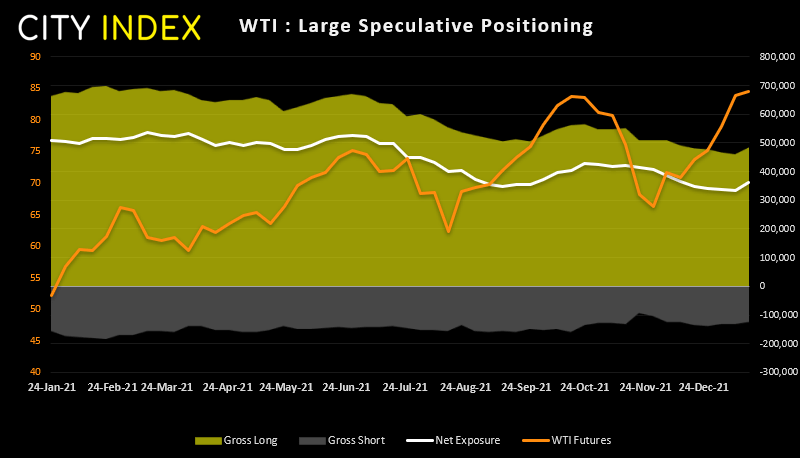

- Traders increased net-long exposure to WTI futures by 27.7k contracts

- Large speculators trimmed net-long exposure to gold futures by -11.6k contracts

WTI futures:

Traders increased their net-long exposure to WTI futures by 27.7k contracts last week, which is the most bullish weekly increase in 13-months. As gross logs have been trending lower for about a year it raises the odds that net-long positioning has seen a trough, and oil prices could potentially rally from here.

How to start oil trading

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade