From the Weekly COT Report (Commitment of Traders)

From Tuesday 19th October2021

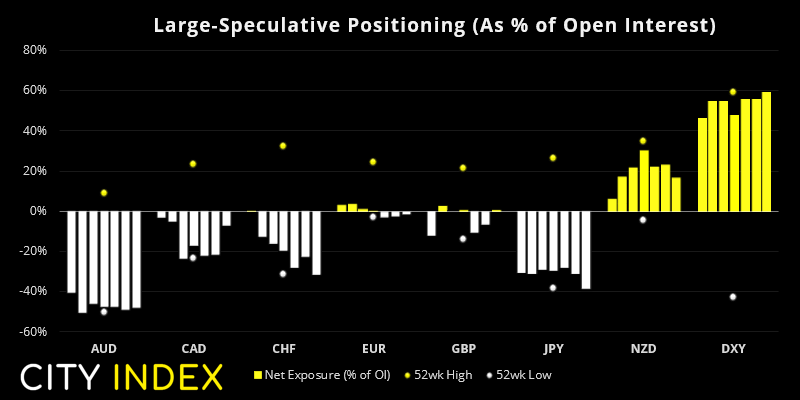

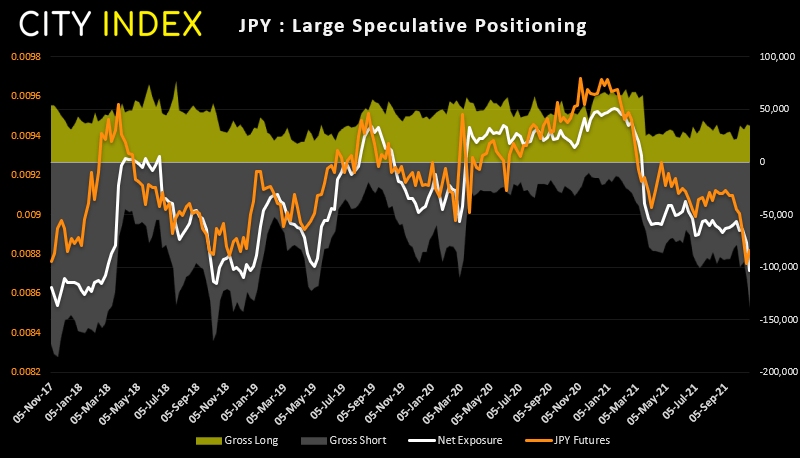

- Net-long exposure to USD were trimmed for a second week, according to calculations from IMM. Traders were net-long USD by $21.52 billion against all other currencies, and around half ($11.2 billion) long against the Japanese yen.

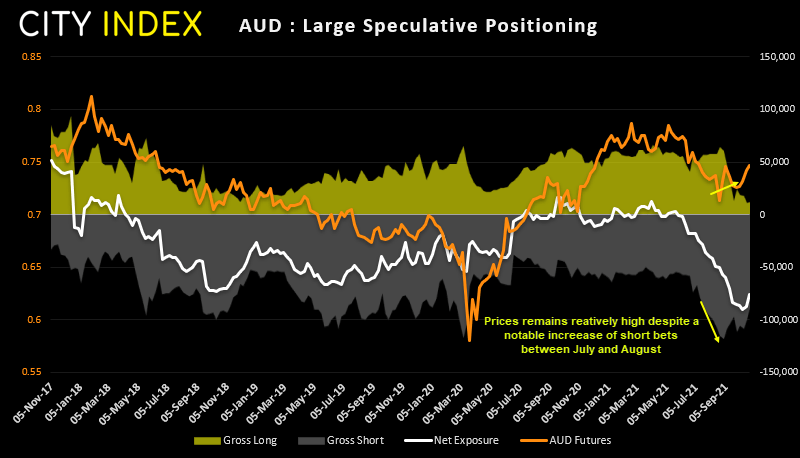

- AUD net-short exposure was trimmed for a second consecutive week, after printing several weeks of net-short exposure.

- Safe-haven currencies CHF and JPY were still being offloaded, with traders being their most bearish on CHF futures since December 2019 and their most short on JPY futures since December 2018.

It seems Aussie dollar bears are finally capitulating, after several months of fruitless short exposure. You can see the rate the gross shorts increased between July and September (grey shaded area) only price action did not entirely follow. Yet over the past few weeks, prices have been rising as gross shorts have been covered, although longs are yet to step in. It has therefore been a classic short-covering rally for the Australian dollar. And for us to see fresh buyer’s step in we need to see the RBA hint that rates may be hiked before 2024 (and nobody really believes they will wait this long).

Net-short exposure to JPY futures are approaching a 3-year high. Bears increased their net-short exposure by another 26.1k last week along which is their most aggressive week since March 2021 (and 2nd most aggressive since March 2020). Gross-short exposure is also nearing levels associated with inflection points / bullish reversals, and the fact that USD/JPY has rolled over from the October 2018 high also suggests we could be approaching a sentiment extreme. But to confirm this we need to see shorts trimmed and, as of yet, there are no signs of that in the data.

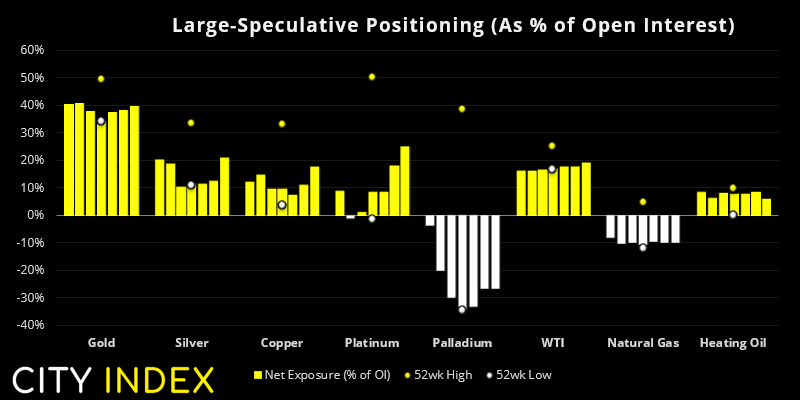

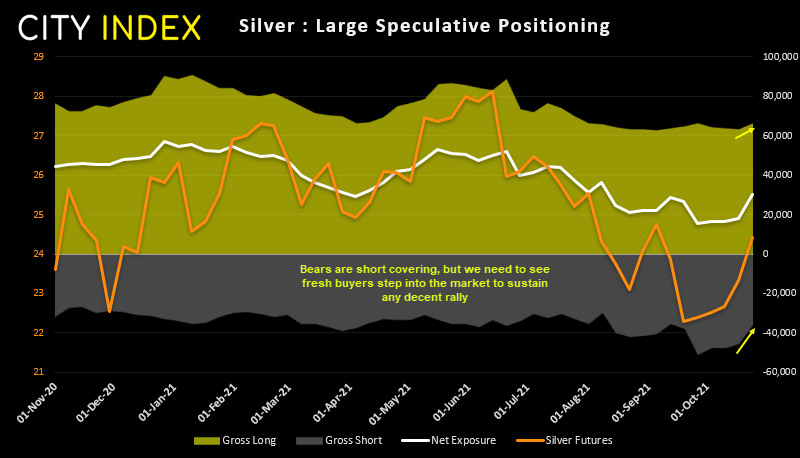

- Net-long exposure to metals was broadly higher. Traders were their most bullish on silver futures in 11-weeks, platinum futures in 3-months, copper futures in nearly 6-months and gold in 5-weeks.

- Gold and silver saw a combination of increased long exposure and reduced short exposure, whilst copper futures saw a notable increase in longs and slight increase of shorts. Platinum saw a decrease of longs and shorts to push up the net-long exposure.

- Traders also increased their net-long exposure to WTI futures, although only 1.7k longs were added whilst -23.1k contracts were closed, meaning its rise was fuelled by short-covering.

Silver (among other metals) could be one to watch for a bullish trend to develop. It reached our bullish target from the inverted head and shoulders breakout although its rally has stalled around the September high and 200-day eMA. Friday’s bearish pinbar warns of a potential retracement, but we will then seek a new level of support to build. Yet from a market positioning perspective we need to see fresh buyers now step into the market for any rally to be sustained, as most of its gains recently have been fuelled by short covering.

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade