After a turbulent start to 2020 with a sharp escalation in US-Iran tensions, things calmed down from the middle of the week. Oil prices, which had spiked sharply higher, fell even more sharply as investors remembered increasing non-OPEC oil output - and not to forget the willingness from other OPEC members to step up - would more than offset any potential supply disruptions in Iran or Iraq. Gold, silver and yen also gave back some of their gains as demand for safe haven assets fell, which helped to fuel the ongoing rally on Wall Street where the major indices hit fresh record highs.

Going into the weekend, some market participants will be wondering whether more Middle East drama will unfold over the next couple of days, and if so, what might that mean for their open positions. Thus, it is reasonable to expect some profit-taking of risky positions such as stocks later on today - and possibly the opening of few opportunistic long positions in crude oil and gold, in case you-know-what hits the fan again.

If tensions escalate again over the weekend, then expect the markets to again open with big gaps - especially for crude oil and gold. Otherwise, the start of next week could be a continuation of this: risk ON. If that’s the case then expect things like copper and the FTSE 100 to rally, for the reasons we have discussed HERE and HERE.

Meanwhile, next week’s data highlights include U.S. CPI and a handful of U.K. macro numbers. Overall, there won’t be too many market-moving macro numbers to look forward to. So, the focus will continue to remain on Middle East tensions, ongoing US-China trade situation and Brexit. Still, some of next week’s data releases should move currencies. So, here are the data highlights for next week:

Monday

- A handful of UK economic data including monthly GDP – expected flat; manufacturing production, expected to print -0.3% m/m; construction output, +0.6% expected following a 2.3% drop the month before, and the NIESR’s GDP estimate, among a few other things.

Tuesday

- China’s latest trade figures

- US CPI – with headline expected at 0.2% vs. +0.3% last time, while core is seen at +0.2%, similar to the previous month.

Wednesday

- UK CPI – both headline and core expected unchanged at 1.5% and 1.7% y/y respectively

- Eurozone industrial production seen at +0.3% expected vs. -0.2% last

- Crude oil inventories

Thursday

- ECB’s Monetary Policy Meeting Account

- US retail sales – headline expected at +0.3% vs. +0.2% last and core seen at +0.5% vs. +0.1% last. In addition to retail sales, there will be a number of other second-tier US macro pointers that will be published on Thursday.

Friday

- China’s GDP – expected unchanged at 6.0% q/y; Industrial output is also expected to have remained flat at 6.2%, while retail sales are seen easing to 7.9% y/y growth from 8.0% in the month before.

- UK retail sales – expected to print +0.8% m/m vs. -0.6% the month before.

- More second-tier US data, including Building Permits, Housing Permits, Industrial Production and Prelim UoM Consumer Sentiment.

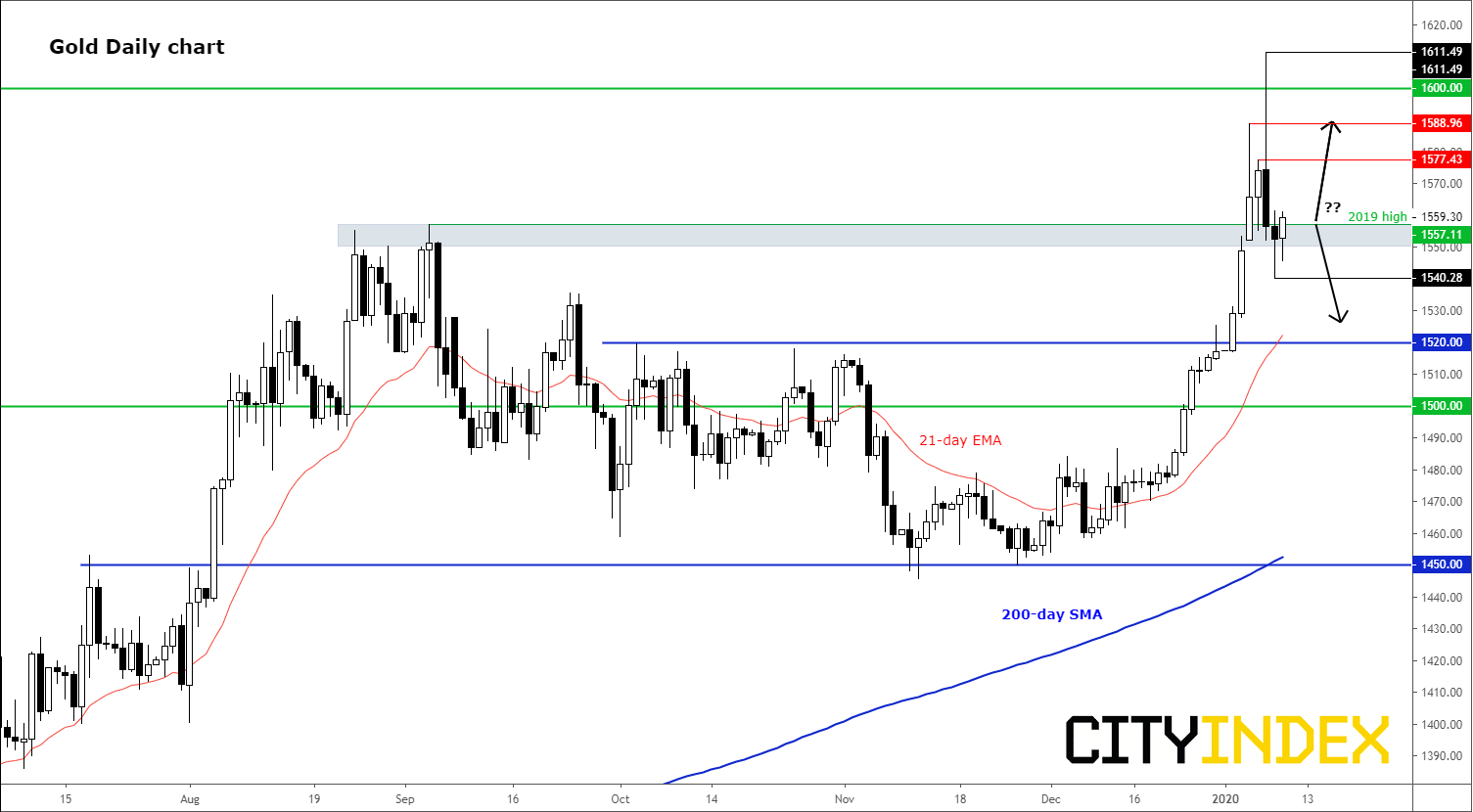

Chart to watch: gold

Source: Trading View and City Index.

Our featured chart to watch for the week ahead is that of gold. The yellow metal broke last year’s high and key resistance at $1555/57, and investors will be looking to see what happens next. If the precious metal holds above this area then more gains should be expected, especially in light of Friday’s disappointing US jobs report and ongoing central bank support with interest rates and yields being depressed. However, a clean break back below this level would be bearish in the near-term outlook.