-

Fed watch: here comes Santa Claus

-

Stock Index: FTSE

-

Stock spotlight: Barclays

1, Fed Watch: hear comes Santa Claus…

by Kathleen Brooks

A child goes to bed on Christmas Eve certain that they have been put on the ‘good’ list and Santa will come and deliver gifts to open the next morning, so too does the market believe that the they have been ‘good’ enough for Janet Yellen to deliver the much-expected rate hike on Wednesday 14th December.

Very rarely is the market so sure that the Fed will deliver a policy change that it is priced in 100%. But that is what has happened. There is now a 100% chance, according to activity in the Fed Funds futures market, that the Fed will hike interest rates at this week’s meeting. A mere 8 weeks ago, this was only at 60%. Considering that the market feels confident that a 25 basis point rate hike is a done deal this week, why bother showing up for the Fed meeting at all?

The trouble is, it’s not about this week’s rate hike, it is about what Janet Yellen has to say about future rate hikes and the pace of any potential rate-hiking cycle. This meeting is critical, not for what is said and done, but for what the Fed may not say and do. The key things to look out for include:

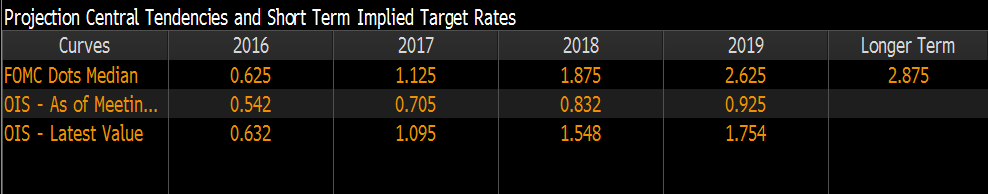

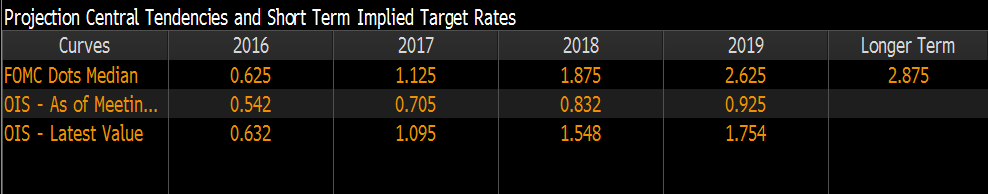

- Any change to the ‘dot plot’ – the Fed’s expectations for interest rates. Back in September, the average of Fed members’ expectations for 2016 was 0.65%, for 2017 it was 1.30%, for 2018 it was 2.1%, 2019 it was 2.64%, and further out it was 2.9%. Will these forecasts be revised higher, and could the Fed actually plan to raise rates at a faster pace for 2017 and 2018 considering President elect Trump’s big push for fiscal largesse?

- Any change to the Fed’s growth expectations. The last time it released its GDP forecasts, it revised down the growth outlook for 2016 to 1.7% to 1.9%, while keeping the 2017 estimate at 1.7% to 2.2%. Could this be revised upward if the Fed, like the stock market, thinks that Donald Trump will lead to a boost in US growth?

- If the Fed is going to hike rates, will it try to dilute the tightening impact by maintaining its huge balance sheet?

All of this will impact the depth of market reaction to the announcement. The question of President Trump is a pertinent one, considering how vocal he has been about the economy. We expect the artful Janet Yellen to dodge directly referring to Trump in her post-decision press conference next week. However, Trump is likely to influence the Fed’s decisions at this week’s meeting, and his victory at last month’s election could dramatically shift Fed policy in the future. But will this trigger volatility in the market, or will the impact be all over in about 3 minutes, a bit like the Italian Referendum?

The market impact:

- Volatility, as measured by the Vix, is low. Thus, it may take a stray comment or an upward revision to the pace of policy tightening in the ‘Dot Plot’ to boost volatility and knock stocks from their recent peaks. But low volatility leading up to the Fed meeting also suggests that the market is not expecting a shock from, and instead expects a rate hike, a mild upward trajectory for rates in 2017 and 2018, and a commitment to maintain the balance sheet at its current size for the future.

- The one-month risk reversal in EURUSD is also relatively low, although it has moved off its lows post the ECB meeting. At current levels, it does not suggest that the market is pricing in a major move in EURUSD on the back of the Fed meeting. So, parity in EUR/USD may be off the cards for the foreseeable future.

- USDJPY is also worth watching, the one month risk reversal for USDJPY options, a good barometer of the market’s expectations or volatility in this pair, has fallen back from recent peaks. Volatility had surged in this pair from mid until late November, however, the fact that it has backed away from recent highs, suggests one thing – the market may not see a major dollar rally on the back of this week’s Fed meeting.

Don’t bet on a dollar rally on the back of this week’s Fed meeting:

Janet Yellen and co. would have to pull a Draghi and do something completely unexpected before we will see a sharp move in the dollar this week. Overall, we expect the dollar to continue to move higher, and the contrasting policy stances of the ECB vs. the Fed only makes it more likely that the dollar will continue to gain on its G10 counterparts. However, as we have seen in the past, the dollar can weaken on the back of a Fed policy meeting, so don’t expect Yellen to cast any short term spell over markets this week.

Figure 1: The Fed’s Sept ‘Dot Plot’ and the market’s expectation for future interest rates. The market is underestimating US interest rates beyond 2016, which could be rectified after this week’s meeting.

Source: Federal Reserve and Bloomberg

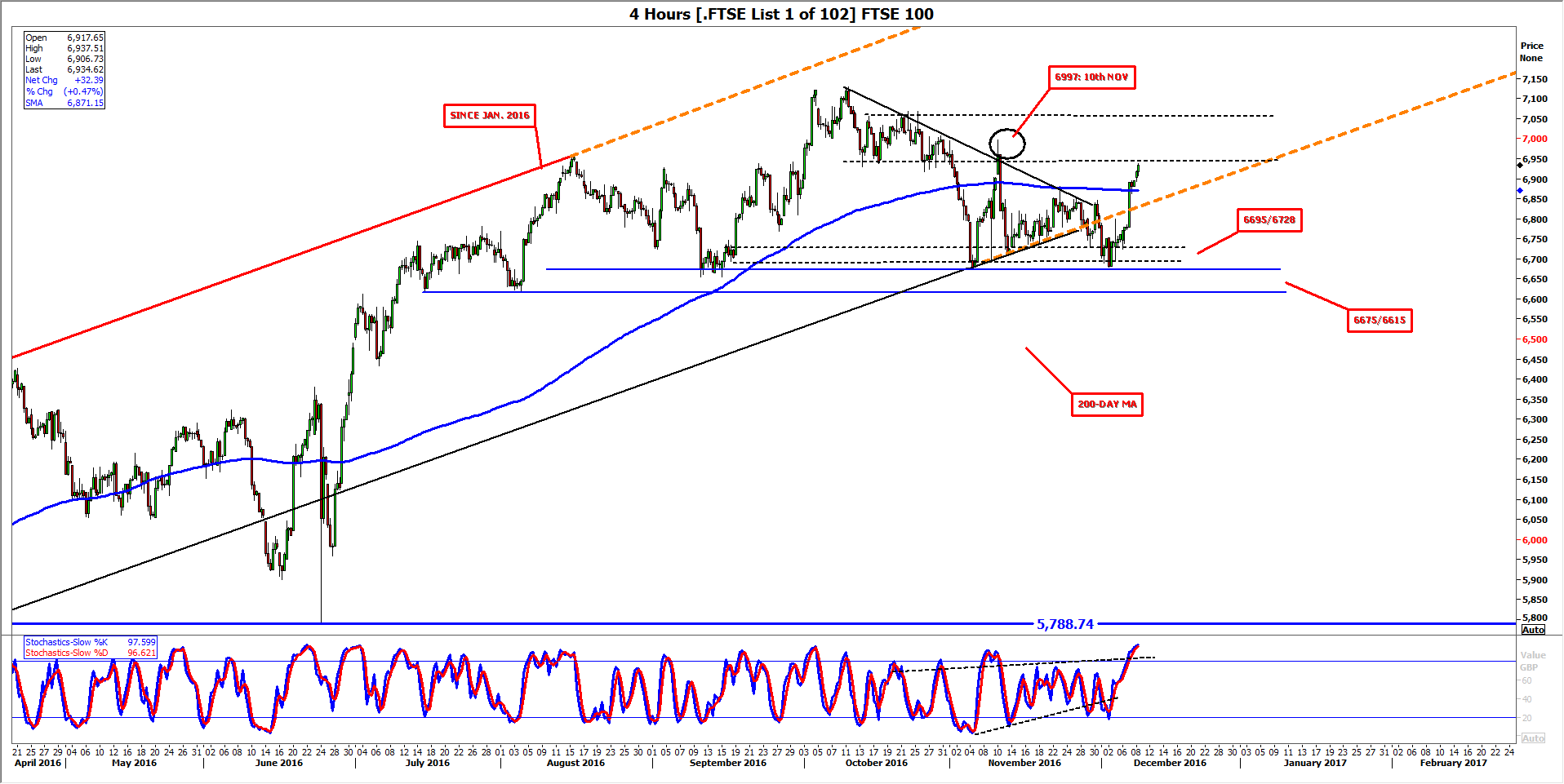

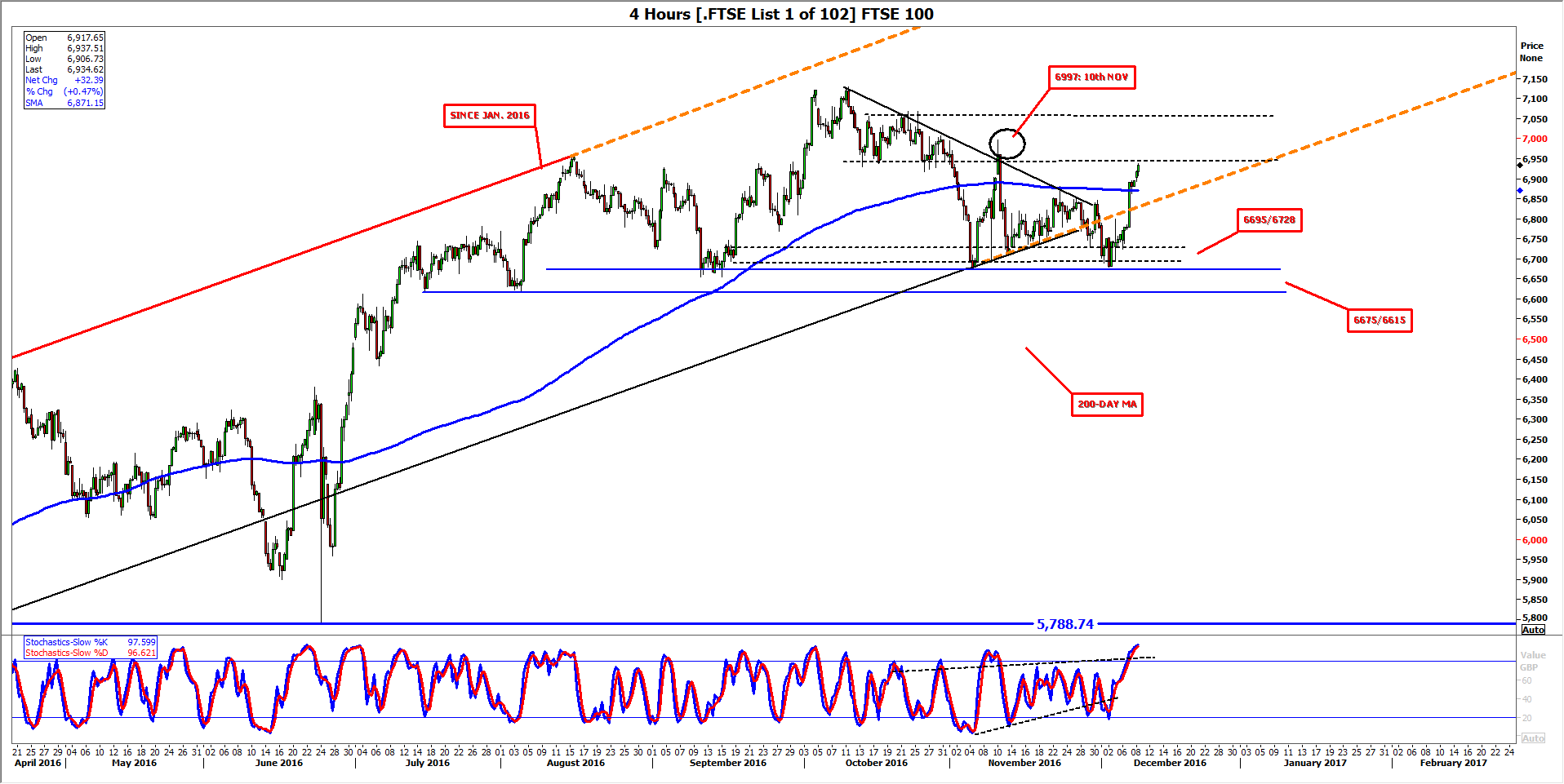

2, FTSE’s Italian whipsaw was painful for some

by Ken Odeluga

The FTSE 100’s uptrend this year is intact. Just. This week brought only the third incursion of any note outside the walls of the benchmark’s channel that was established in February. The whipsaw price action—coinciding with the Monday morning after Italy voted ‘no’ to a closely watched constitutional referendum—did not trigger a sustained decline. But it will have been enough to shake out weak longs that had clung on whilst the index consolidated for almost a month.

Note however, that the FTSE did not breach nearby support that we have highlighted recently—6695/6728, and only skimmed the upper bound of what we expect to be a tougher floor between 6675/6615. Rather, the failure of any bulls to capture the index’s 3.8% (c. 250 point) upswing from Friday 2nd December to date would be a failure of risk management or margins (not to mention luck). That is not the end of the story for the uptrend though. We expect resilient bulls will see more chances in the nearest term than lurking bears.

That said remaining upside needs to be handled with enhanced care, particularly if we agree that momentum indicators are informing us that a pull-back of some extent is due. For traders, the next watch point will be the high on 10th November at 6997. Given that the index subsequently kicked lower from that top, it makes sense to think a fresh run-up if to the mark would be preferable for it to be surpassed.

It should be clear by now that in our view, it would take a failure of the FTSE 100’s rising channel to increase chances of a significant decline below the supports mentioned above. We think the prospects of a sustained breach remain distant.

Figure 1: FTSE 100

Source: Thomson Reuters, City Index

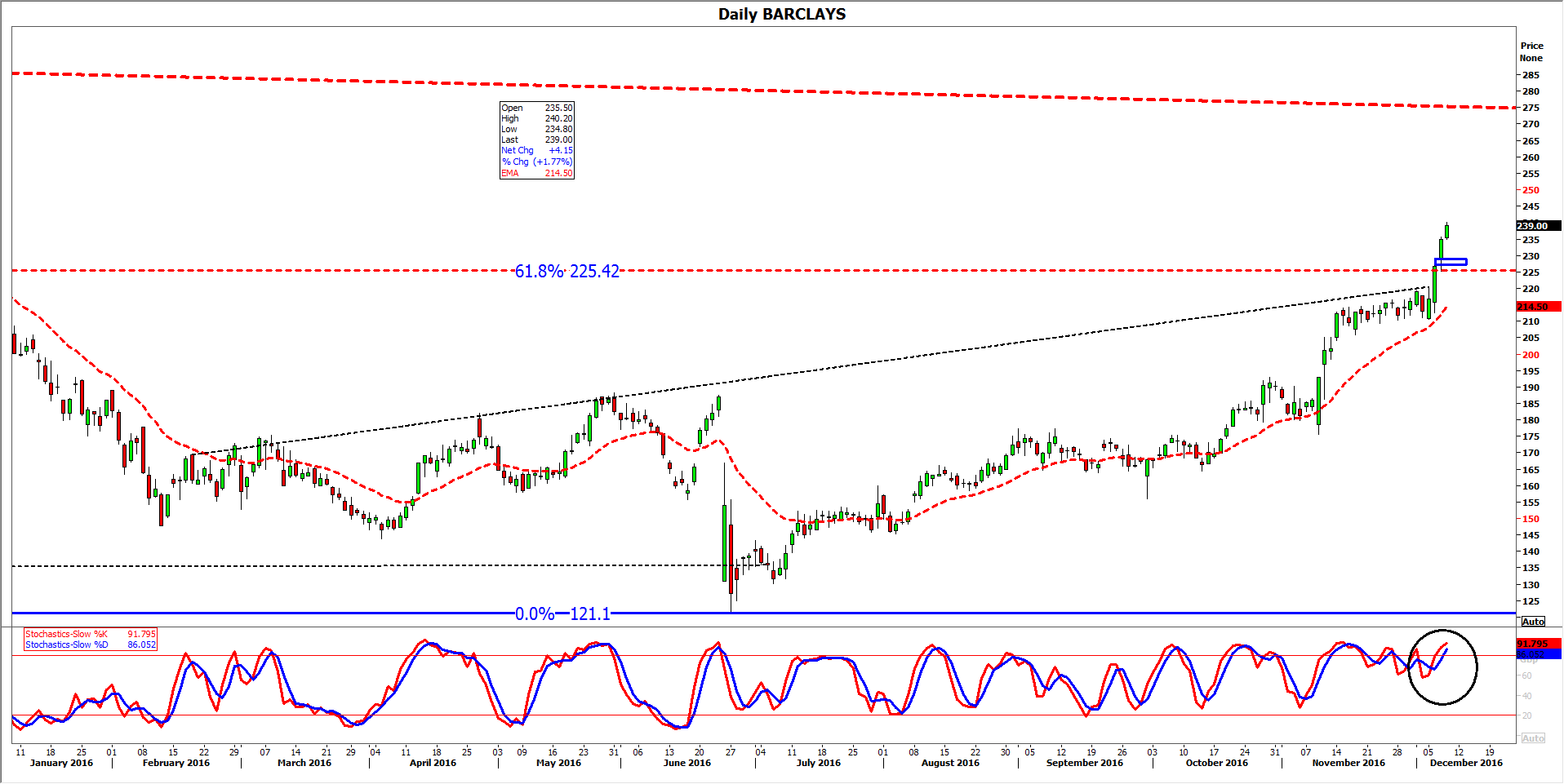

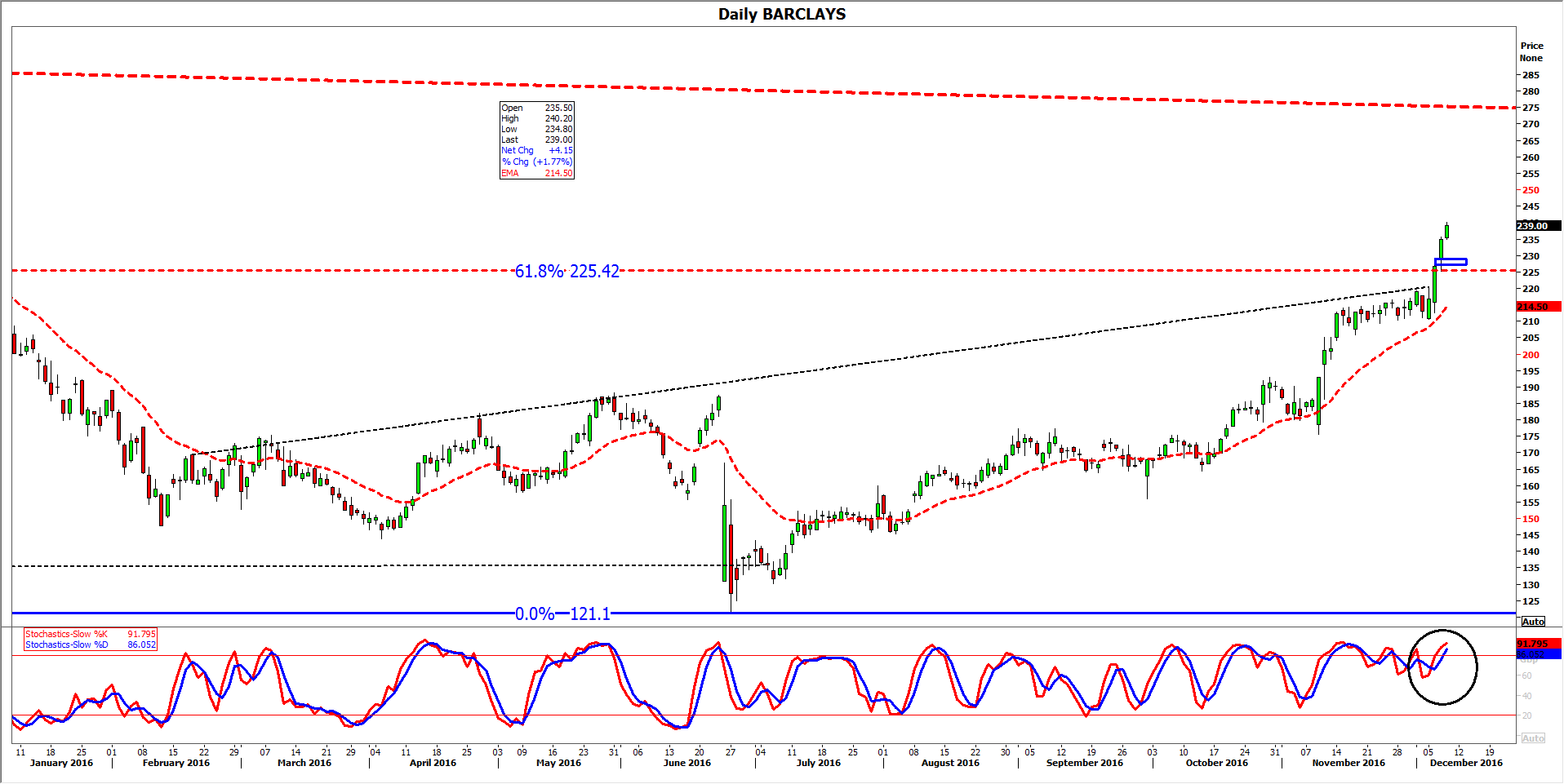

3, Barclays bounce baffles, a bit

While Tuscany totters, Canary Wharf continues to confound.

At least famous banks associated with those locations—Monte dei Paschi di Siena, and Barclays have recently accelerated on their divergent paths in ways that keep surprising.

For Barclays, it is not its recovery that is surprising rather it’s the speed at which investors’ confidence is returning. For sure, the group’s diversified global presence and decision to stick with investment banking in the face of a seemingly unending barrage of regulatory flak has quickly given it an edge against British and European rivals.

It gained market share in trading in the third quarter, and it expects the £600m it set aside for mis-sold UK loan insurance will last until a regulator-imposed deadline for claims in mid-2019. Amortising that charge over three years would lift the group’s underlying returns to around 8%, well above the negative trailing return on equity it’s been burdened with for years.

That suggests deeper underlying strength than the group’s official numbers, but still nothing to write home about. Furthermore, the ECB announced on Thursday that it was leaving negative interest rates as is “for an extended period”. That means no early boost for net interest margins at even the strongest banks, like Barclays.

From a technical perspective Barclays shares certainly reflect a more robust recent performance than we expected. This week the shares have breached the rising trend line that capped the stock following the Brexit vote sell-off. With the closely watched 61.8% retracement barrier (derived from Barclays’ July 2015-June 2016 decline) also broken, there is little significant resistance in the way before that July ’15 peak at 289.

In the immediate term however, the shares are struggling to maintain the momentum of the current up leg. (See slow stochastic sub-chart). We would expect bulls—who clearly have control right now—to wait for consolidation closer to 225p, before any look at 290p. We also expect the ‘liquidity gap’ between closes on the 6th/7th December—note the long-tailed candle with a blue rectangle underneath—will act like an outright price gap. Once momentum truly reverses, prices will aim to fill it nonetheless.

Figure 2: Barclays

Source: Thomson Reuters, City Index