This week was all about the major central banks as the race to zero and beyond resumed, with the Fed and ECB signalling potential rate cuts while the BoE was slightly less hawkish than had been expected. The RBA’s governor hinted at the prospects of loosening monetary policy even more after the 25 basis point cut earlier in the month, while the BoJ was unsurprisingly dovish as well. With all these banks willing to keep yields depressed, global stocks rallied which saw the S&P 500 hit a fresh record high. Buck-denominated and noninterest-bearing precious metals also rallied with gold soaring above $1400 to reach its best level since September 2013.

Heading into the new week, we are expecting to see further short term gains for stocks amid bullish technical momentum arising from this week’s central bank action, but we are not too sure whether the bulls will go all out buying every single dip given the increased risks to economic growth and ongoing trade tensions. Speaking of which, the focus will slowly turn to the upcoming G20 meetings in Japan towards the end of next week. Donald Trump has already told us that he had a good phone conversation with Chinese Premier Xi and that their teams will be meeting ahead of the G20 summit in preparations. Fresh comments via Trump’s twitter handle on this topic could move the markets, so watch out.

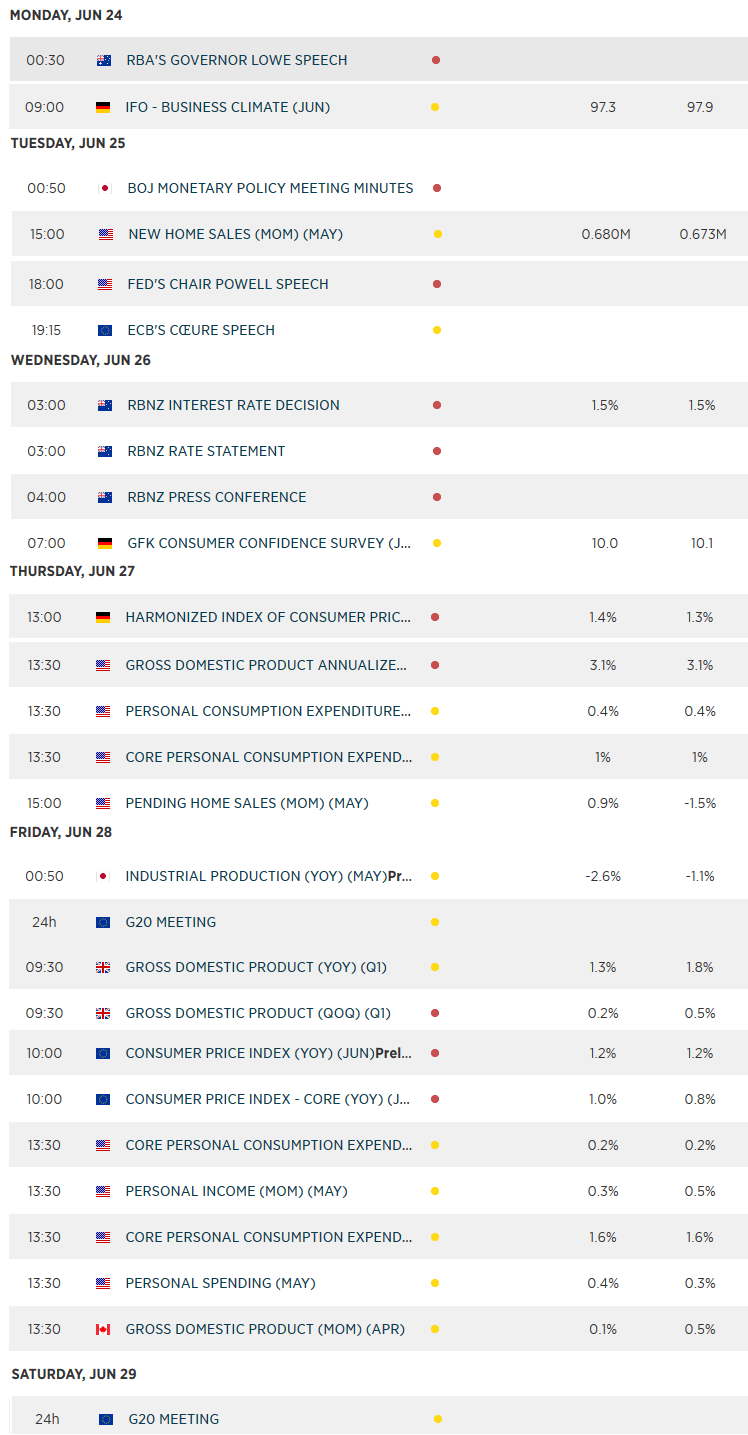

However, before the G20 meetings start, there will be one more major central bank interest rates decision to come: the Reserve Bank of New Zealand, on Wednesday. Given the somewhat unexpected cut last month, the RBNZ is unlikely to trim rates again at this meeting, but it may well give a clear indication about another potential cut at a near future meeting.

Among next week’s other highlights, we will have Eurozone CPI and a few macro pointers from the US towards the end of the week, as shown in the edited-down economic calendar, below. All eyes will be on incoming Eurozone data after the ECB signalled it may cut interest rates soon, and CPI will be key in that regard. However, Friday’s PMI data surprised to the upside, suggesting the Eurozone economy may have bottomed and the EUR/USD spiked above 1.1350 late in the day on Friday. If we see further strength in Eurozone data, then Draghi and co. at the ECB may have to switch back to a neutral stance.