- Global macro Overview

- Look Ahead indices

- Look Ahead stocks

- Look ahead commodities

- FX technical analysis

Global Macro Overview

US: The Presidential polls start to narrow

Although the polls suggest that Clinton and the Democrats could still take the White House, the polls have narrowed in recent days, which must be worrying for the Clinton camp. ABC News predicts that Clinton will win by 6 points, while a poll released on Thursday by the LA Times, put the election at a tie, with both candidates attracting 45%.

This is being reflected in the financial markets, where the stock markets have been stuck in a directionless range (see more below), and Treasury yields have broken back above the key 1.8% level. We have mentioned that a post relief rally if Trump loses the campaign could be cut short if investors start to worry about what a Clinton Presidency means for sectors such as healthcare and the economy. The markets also have to contend with a potential rate hike from the Fed in amongst this election risk. Right now the market is expecting an approx. 70% chance of a rate hike next month, so the markets still see a hefty 30% chance that the hike won’t happen. If this week’s economic data, including the ISMs and NFP report for October, surprise to the upside then we could see a rapid pricing in of a rate hike, with Treasury yields moving sharply higher. If this happens then it may trigger another leg higher in the USD, but US stocks could come under pressure, (see more below).

UK and Europe: Will the BOE deliver a killer blow for UK asset prices?

The highlight next week is the BOE Inflation Report, which will give the Bank’s latest projections for interest rates, GDP and CPI. The Bank has already slashed its growth forecast for next year, it will be interesting to see if its forecast for a 0.8% GDP rate next year is slashed further, even after better than expected GDP data for Q3. If it does revise down its growth figures for the UK economy then we could see a sharp drop in the pound and in the FTSE, as UK stocks start to feel the pressure from heightened economic uncertainty surrounding the UK’s post Brexit economic environment. The market will also be looking for direction on the future of monetary policy. Since the market has virtually priced out the prospect of a further rate cut from the BOE, any sign that this is the wrong perception could weigh on sterling, in particular. We think it is more likely that the Bank will confirm it has no near-term plans to cut rates, which would support GBPUSD trading in a range between 1.22-1.24 in the coming days.

In Europe, CPI and GDP data will be in focus. The ECB has not committed to extending its current QE programme when it expires in March next year, but if CPI (released on Monday) remains stubbornly low for October then it will be hard to see the ECB avoiding an extension to its QE programme at some stage. Thus, a weak CPI figure could be enough to drive down the EUR, which staged a mini recovery last week, and broke back above 1.09. It is also worth looking out for the ECB’s latest Economic Bulletin, released on Friday, to get a detailed view on the ECB’s economic assessment.

Asia: BOJ and RBA steal the limelight

Central banks will also dominate in Asia this week, with both the BOJ and RBA announcing their latest decisions on monetary policy. The BOJ will announce its decision on Nov 1st, with no change expected. The Bank has distanced itself from further expansion of its QE programme of late, and we would expect Governor Kuroda to throw more light on the prospect of an expansion to its asset purchase programme during his press conference. The yen could also be in focus, even though the USD has started to recover versus the yen, there remains a lot of election risk that could keep upward pressure on the Japanese currency in the coming weeks. A surprise US Presidential win for Donald Trump, for example, could see the yen and other safe havens surge. Due to this, we would expect the BOJ to keep its powder dry at this meeting, in case it needs ammunition to dampen a stronger yen down the line.

The RBA also announces its latest rate decision on 1st November, with the market expecting interest rates to remain steady at 1.5%. However, we could see a change in the RBA’s tone, after a larger than expected CPI reading for Q3. Prices rose by 0.7% in the quarter, 0.5% was expected, which triggered volatility in the Aussie. While the RBA won’t want to ignore the rising inflation pressures, with annual inflation at 1.3%, we think that the Bank will play down any speculation of a rate hike in the pipeline. Instead, we think that the RBA may voice concerns over a rising Aussie, especially since the AUD/CNH rate reached a 2-year high last week. Overall, if the RBA tries to talk down the AUD without any action, we think its attempts will be futile. Instead we would look for the AUD to remain steady in its recent range, with a bias towards further strength particularly against the GBP and Renminbi.

Look Ahead: Indices

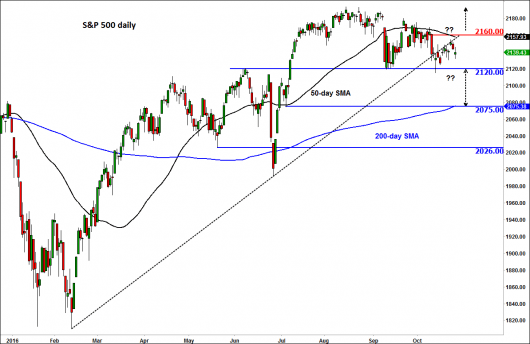

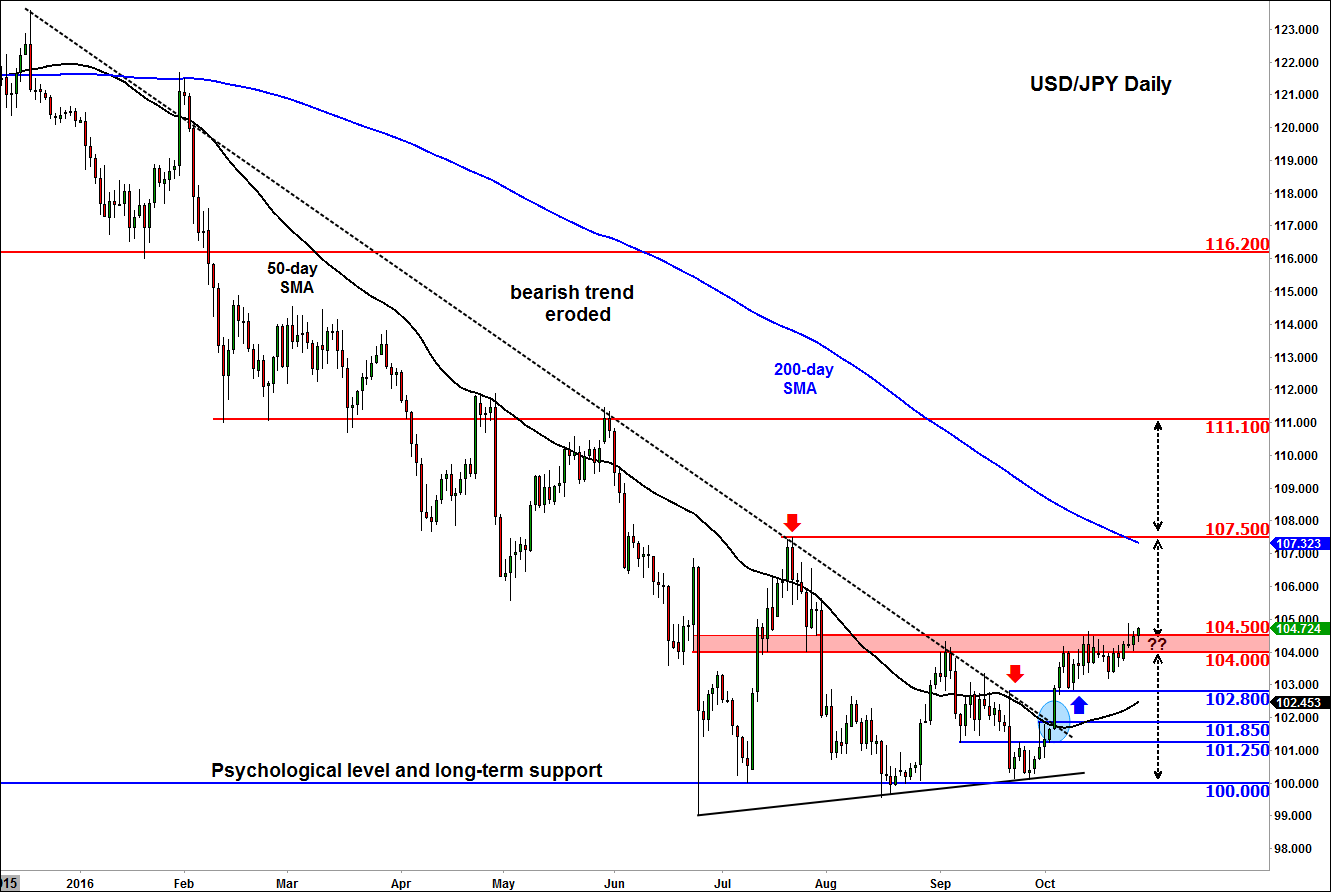

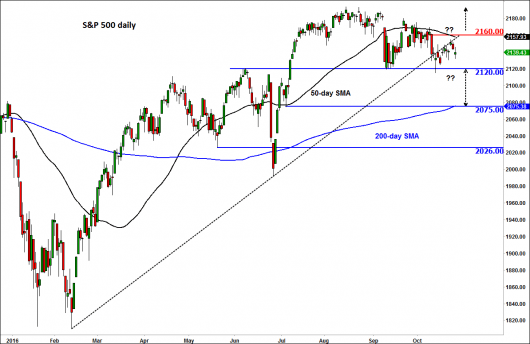

S&P 500:

The US index has been exceptionally boring to trade this month, as it has been stuck in a relatively tight range. While there are trading opportunities in individual sectors and stocks, the actual indices are extremely quiet, which has been reflected in a drop in volatility back to some of the lowest levels in a year.

The S&P 500 has mostly been range trading between 2,120 and 2,160. Not even earnings season can drag this index out of its malaise. We think a couple of things could be making investors sit on their hands rather than get stuck in: firstly, US election risks alongside the prospect of a Fed rate hike in December. Whoever wins the US election, the impact on stocks could be negative, make sure you read our US election special out next week for more detail. We also think that the market may be too complacent about a US rate hike in December, with the Federal Funds Futures market only pricing in a 72% chance of a rate hike. If this moves up to the 90-95% mark once the Presidential election risk is out of the way, then we could see volatility start to rise and stocks come under some downward pressure, as the prospect of higher interest rates starts to bite.

Overall, we believe that a break of the 2,120 mark could trigger a move back towards the 200-day moving average, a key level of support, at 2,075.

Figure 1:

Source: City Index and eSignal

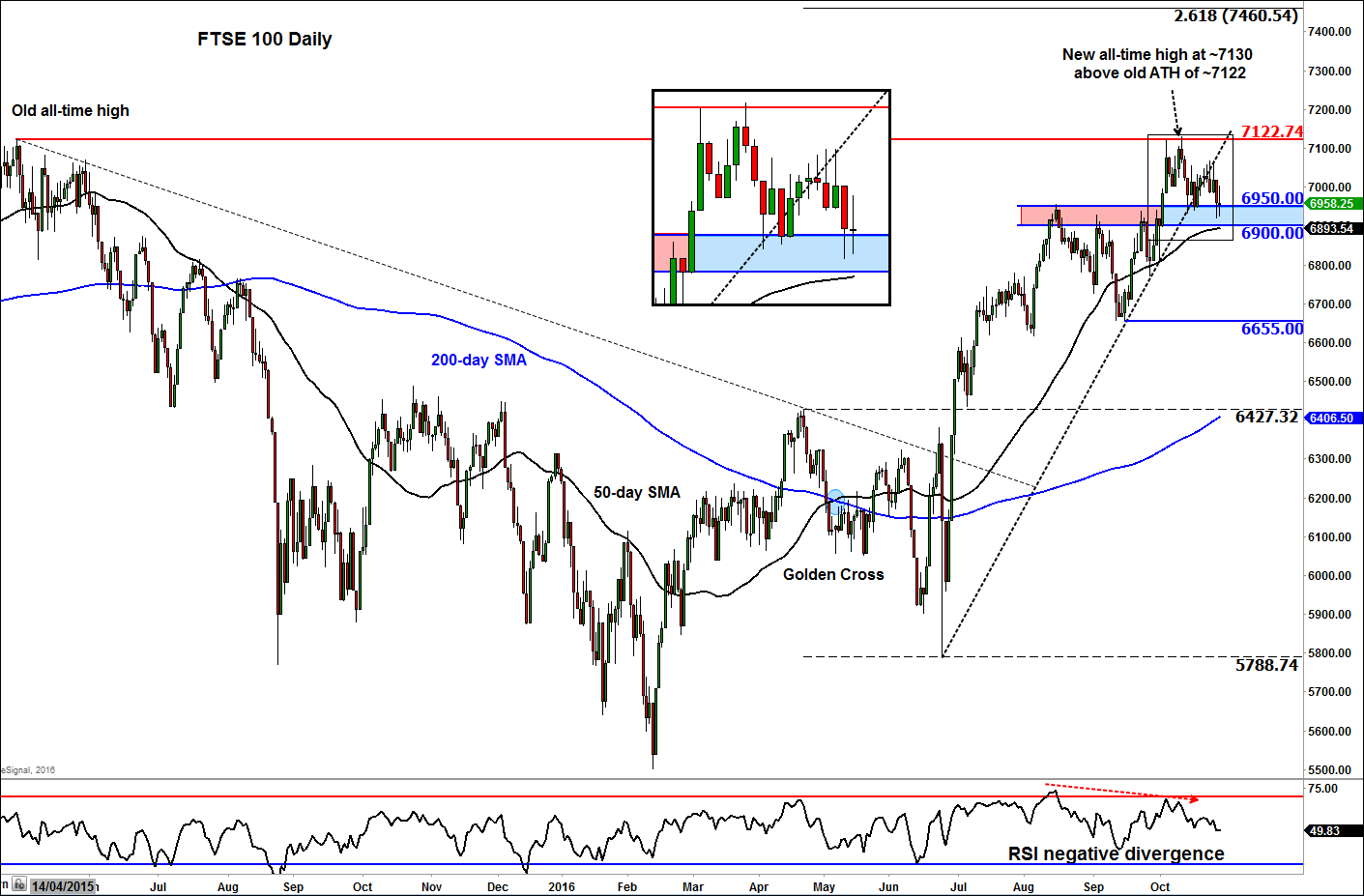

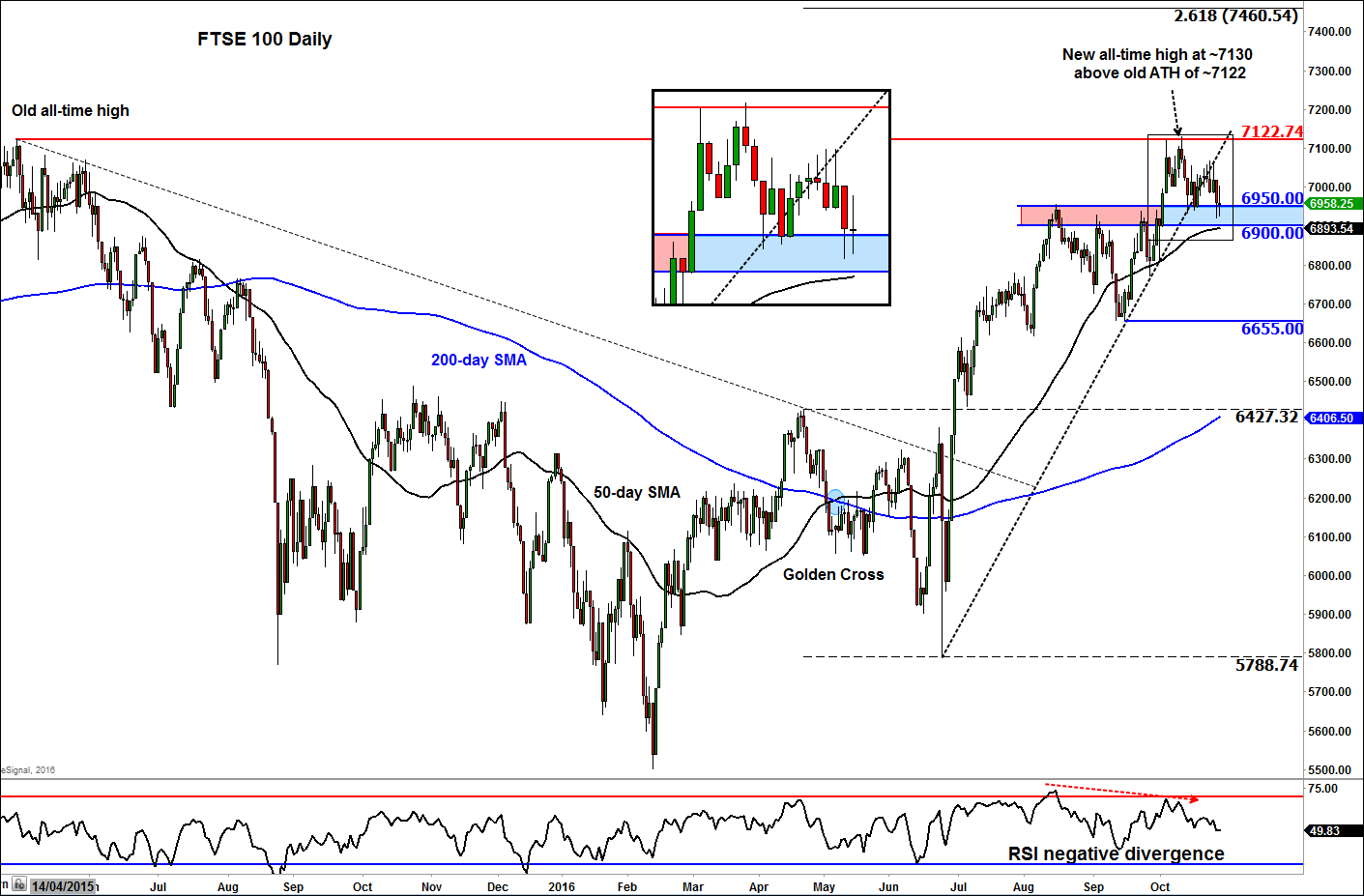

FTSE 100:

The FTSE 100 has been soggy in recent days, and not even a better than expected GDP report for Q3, or news that Nissan is defying Brexit fears to build its new Qashqai model at its UK plant, was enough to drive this index back above 7,000.

We think a few things are weighing on the UK index, firstly, Brexit fears. The UK stock market has been remarkably resilient post the vote to leave the EU, and rallied as the pound sold off. However, as fears about the challenging economic environment the UK economy may face next year may finally start to burden the UK stock index. The energy sector, which makes up nearly 15% of the index, has also struggled of late as investors wait for earnings from the major oil companies next week, and prospects of a production cut from Opec next month get scaled back as some countries such as Russia say they will not take part. The prospects of a rate cut by the BOE have virtually evaporated, which could also weigh on this index, as lower rates tend to be good news for stocks.

Overall, momentum appears to be on the downside for the FTSE 100, with 6,900 the key level of support to watch. We have managed to stay above this level as we backed away from record highs, however a break of 6,900 could signal further losses back towards 6,650, the lows from September.

Figure 2:

Source: City Index and eSignal

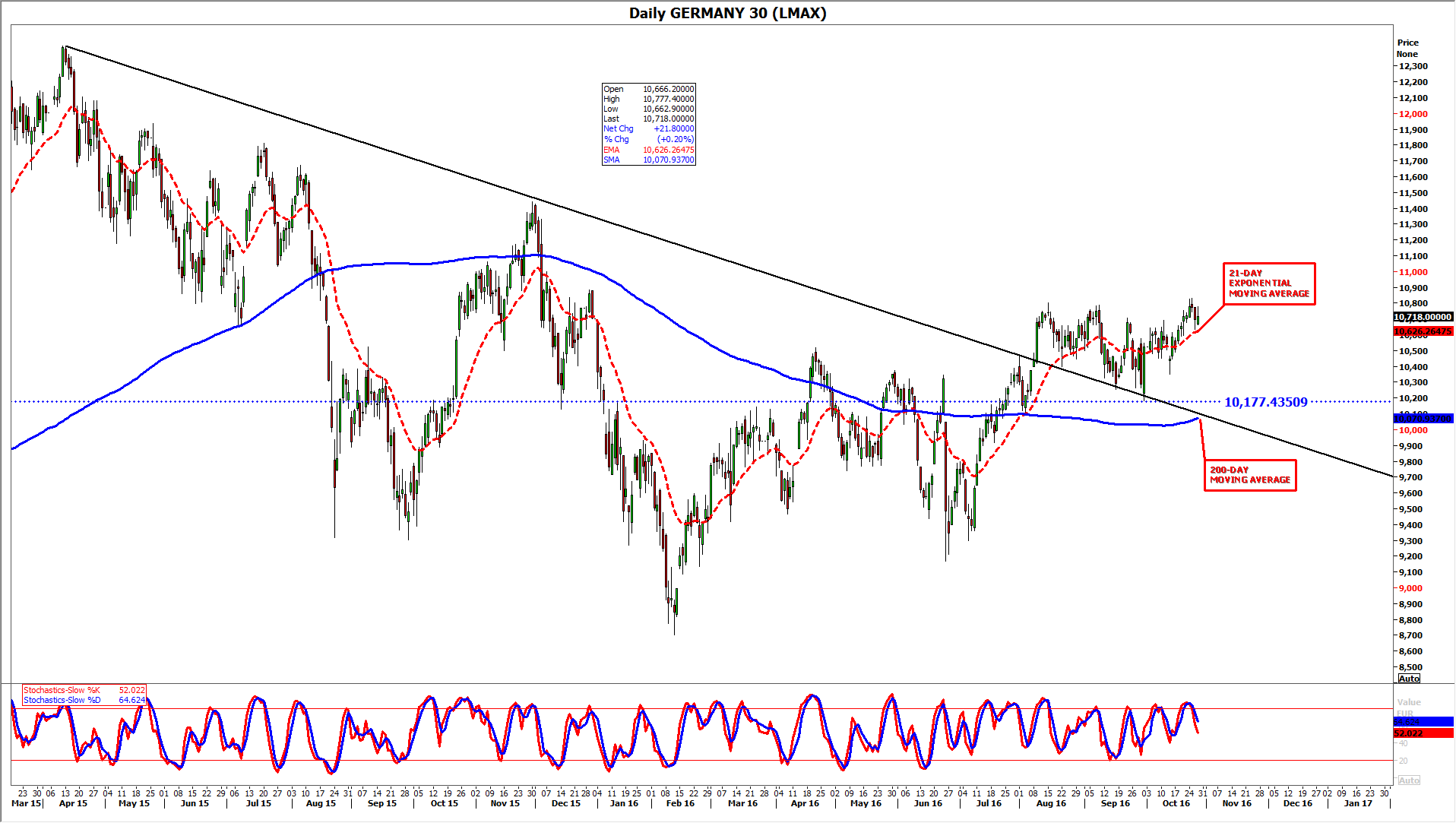

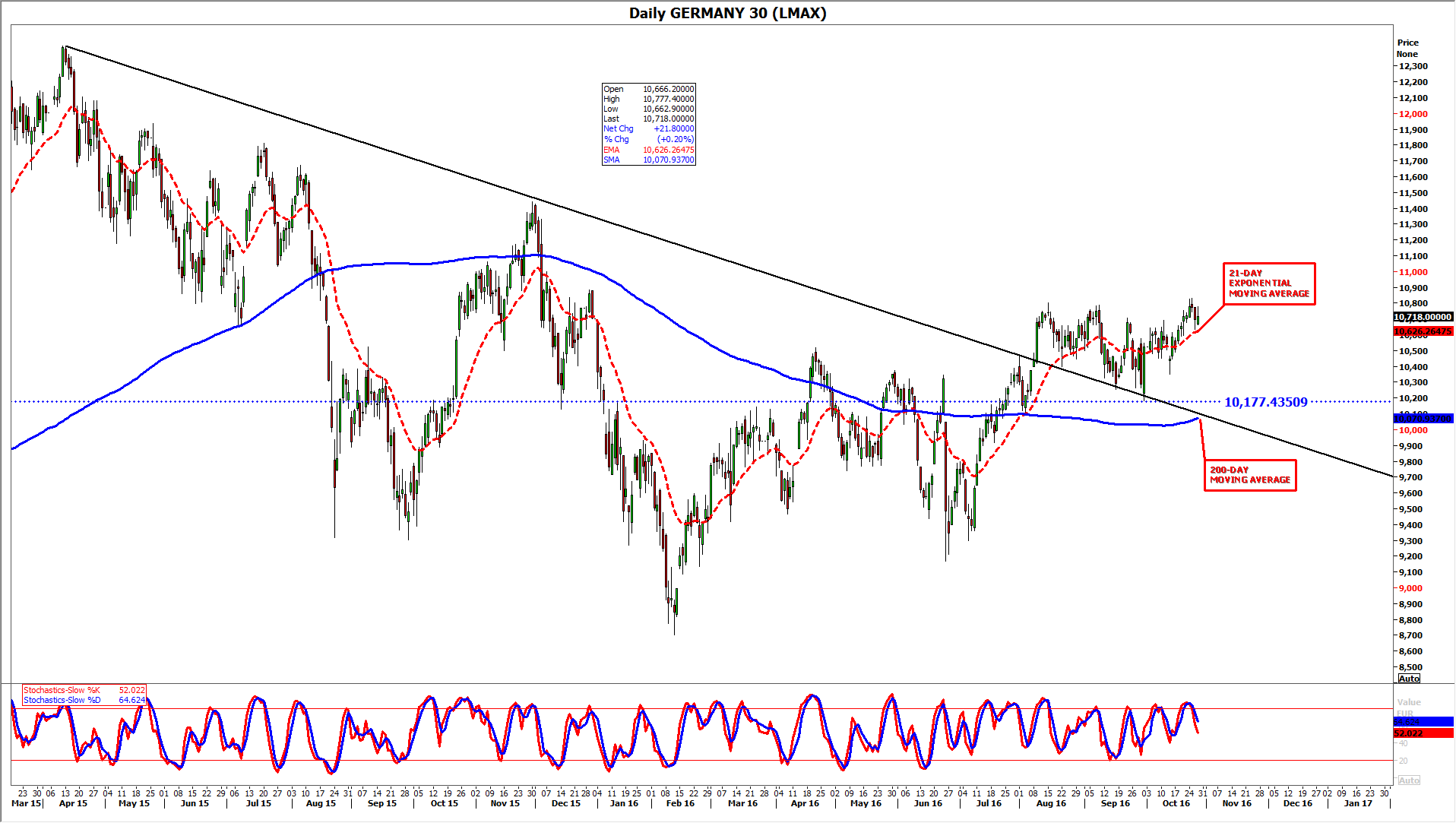

The DAX:

For global equity index investors during the uncertain few weeks ahead, we think the risk/reward balance favours Germany’s DAX 30 more than its benchmark peers in the US and UK.

For one thing, we have been somewhat more optimistic for some time than consensus about the ongoing quarterly reporting season in Europe, particularly for large German groups.

We find average earnings forecasts from Thomson Reuters I/B/E/S’s consensus service to be too pessimistic. We expected an aggregate earnings decline of 5%-8% for STOXX 600 companies in the third quarter, compared to the -14% I/B/E/S average published earlier in the month. With the reporting season now in full swing, we’re even inclined to suspect our forecasts were a little too conservative.

Results from a handful of household names—at least in Germany—have beaten expectations. Among the most notable earnings, Bayer on Wednesday reported better-than-expected third-quarter earnings from robust pharmaceutical and farming pesticides operations. Then on Thursday, Deutsche Bank, reported a surprise profit despite legal and operational turmoil over the last few months, whilst saying it would double down on restructuring and make only a relatively modest addition to settlement provisions.

Lufthansa was another unexpected highlight. One of the largest and most beleaguered carriers in Europe’s hamstrung airline sector released a surprise trading statement on 20th October saying it now expected profits for the year to match those from the year before due to a jump in business bookings and its decision to go against the European trend by reducing seat capacity. The group had previously forecast lower profit after attacks in Europe deterred leisure travellers and weighed on bookings, especially on long-haul routes to Europe.

Visible relief by shareholders in reaction to these and other upside surprises from German corporates has admittedly been moderate.

Still, we think many such results show that the top-tier of Deutschland AG has retained more than a few pockets of strength in what was widely expected to be a taxing quarter. It’s a plus for the DAX before the US presidential elections. We believe S&P 500 share prices as a whole have been suppressed amid persistent investor caution on both candidates.

We also suspect some shareholders are becoming tardy ahead of a probable December Federal Reserve interest hike and renewed worries that the resurgent US dollar may damp demand and eventually, again crimp corporate profits. These are the main reasons why we think US stock indices are idling close to recent new all-time highs. At the same time, the UK’s FTSE 100 falters after its own new historic intraday high. The UK’s earnings season is gathering pace and shares are largely in a holding pattern ahead of disclosure from some of the index’s heaviest weights–BP, Shell and others—next week.

Either way, technical charts show both the FTSE and the S&P 500 recently broke down beneath the rising trends comprised of their upswings that commenced in the summer. Their medium-term rallies must surely now be in question, even if prospects for the indices to bounce, following the US election risk event seem reasonable.

The DAX benchmark on the other hand, despite a severe test of inarguable support around 10177 at the end of last month, has managed to remain above a closely watched descending trend that it breached late in the summer, having been capped by the line since March 2015.

Overall, this picture offers, in our view, far more opportunities on the upside over the next couple of weeks, and perhaps beyond, than we can currently see in the FTSE 100 and the largest markets across the Atlantic.

There’s certainly still plenty of room for continued caution over big German companies, particularly banks, where some investor optimism regarding the European Central Bank’s intentions might be premature. On balance though, we think the DAX’s technical outlook offers a fairer chance of more upside on the near horizon.

Figure 3.

Source: City Index and Thomson Reuters

Look Ahead Stocks:

BP and Shell

On Tuesday both BP and Shell will announce their Q3 earnings figures at 0700 GMT. BP is expected to announce another weak quarter of results after the oil recovery stalled last quarter, and BP’s lower Q3 production volumes due to seasonal maintenance and an outage at its Gulf of Mexico plant. The market is expecting earnings per share (EPS) of $0.04, which is unchanged on Q2. The market will also be looking for news on oil production volumes, its net debt position, which could start to look high due to weak cash generation. Due to this, the market will also look for plans to cut costs further, and also to plans on capital spending and further divestments to bring down BP’s high debt load. There is unlikely to be any change to the dividend. Overall, BP has beaten analyst estimates half of the time in the last 8 quarters, but if earnings and guidance disappoint investors then we could see a decline in BP’s share price, which has been hovering around 2 year highs of late at 488p, 450p, the 50-day moving average, is key support.

Shell is expecting to announce weak, but improving results in Q3, which could be viewed more favourably by the market compared to BP’s release. Although the stalled oil price recovery is likely to point to more losses in its oil production unit, the heavy loss the company faced in Q2 is unlikely to be repeated. Its North American gas business could be a bright spot in this earnings release, as it benefits from stronger production last quarter and fewer outages. Net debt is near the company’s ceiling level, thus, we may hear about future divestments to bring down this debt load. The market is looking for EPS of $0.25. Shell, like BP, has experienced a strong rally in its share price of late, if its EPS is better than expected then we could see further upside back to 2,140 – the high from 11th October.

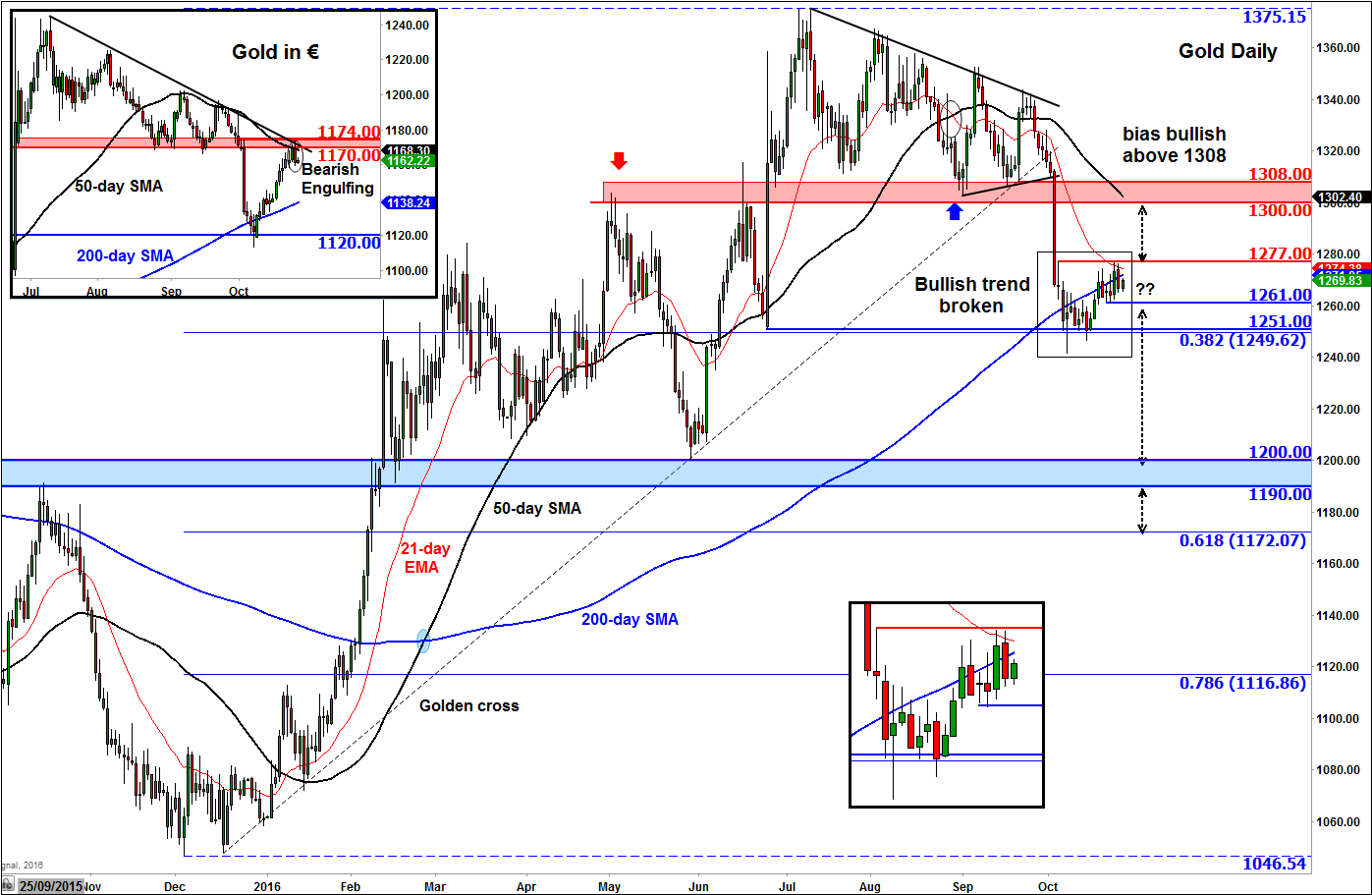

Look Ahead Commodities:

It has been an interesting week in the commodity markets. After falling sharply earlier this week, both crude contracts jumped for a time back above the $50 handle on news of a surprise inventory reduction in the US. However, oil prices have since given up a big chuck of their gains, partly because of growing scepticism over a freeze/production deal between the OPEC and Russia. With several important OPEC members asking to be exempt from a production freeze, it leaves just Saudi, Qatar and a few other Gulf states to shoulder the responsibility, which clearly is not in their interest. Still, hopes that a production cut or freeze will still be agreed upon are not completely dashed. Thus, should the OPEC and Russia reach an agreement next month then this should lend support to oil prices in the short-term. Consequently we expect oil prices to remain range-bound next week, though we are moderately bullish as prices do look oversold in the short-term.

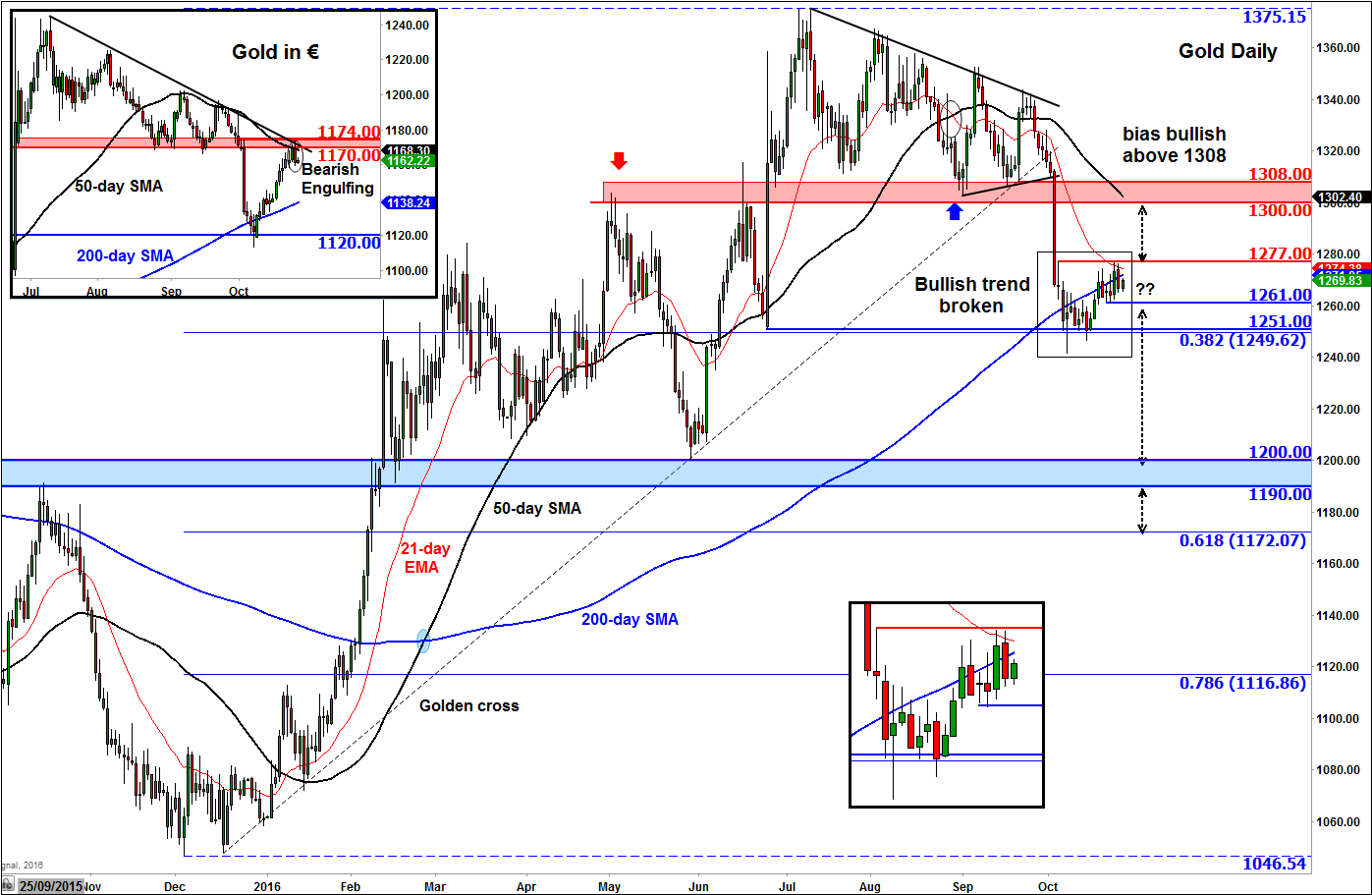

As far as precious metals are concerned, they had been showing relative strength in recent days with gold, silver, platinum and palladium all shrugging off the dollar’s advance while the euro-denominated gold stretched its winning streak to eight days by Tuesday before pulling back. It is not unheard of for gold and dollar to go in the same direction of course and there is an element of safe-haven flows propping up precious metals, especially ahead of US elections. That being said, we are not convinced about the prospects of a more noticeable rally because ultimately the rising US bond yields reduce the appeal of gold and other noninterest-bearing precious metals. In fact, precious metals could be on the verge of another big drop, especially if the Fed delivers a hawkish statement next week.

Indeed, gold in euro terms turned sharply lower on Wednesday from the key €1170-74 old support area after filling the void that it had left behind following its collapse on October 4. This bodes ill for gold in regular US dollar terms. The latter fell back below its technically-important 200-day moving average on Wednesday and at the time of this writing on Thursday it was still holding below it. Gold’s advance from earlier in the week was rejected at previous resistance level of $1277. But even if gold were to climb decisively above here, and therefore its 200-day moving average around $1272, it will still face further, probably stronger, resistance around the $1300/10 area, which was a key reference point prior to that breakdown. So, we will remain sceptical for as long as $1300/10 holds as resistance. In the short-term, a potential break below $1260/1 support area, which is likely in our opinion, could pave the way for a re-test of the $1250/1 support level and if the latter also gives way then we could see the onset of a much larger correction towards $1200 or even lower.

Figure 4.

Source: City Index and eSignal

FX technical Analysis

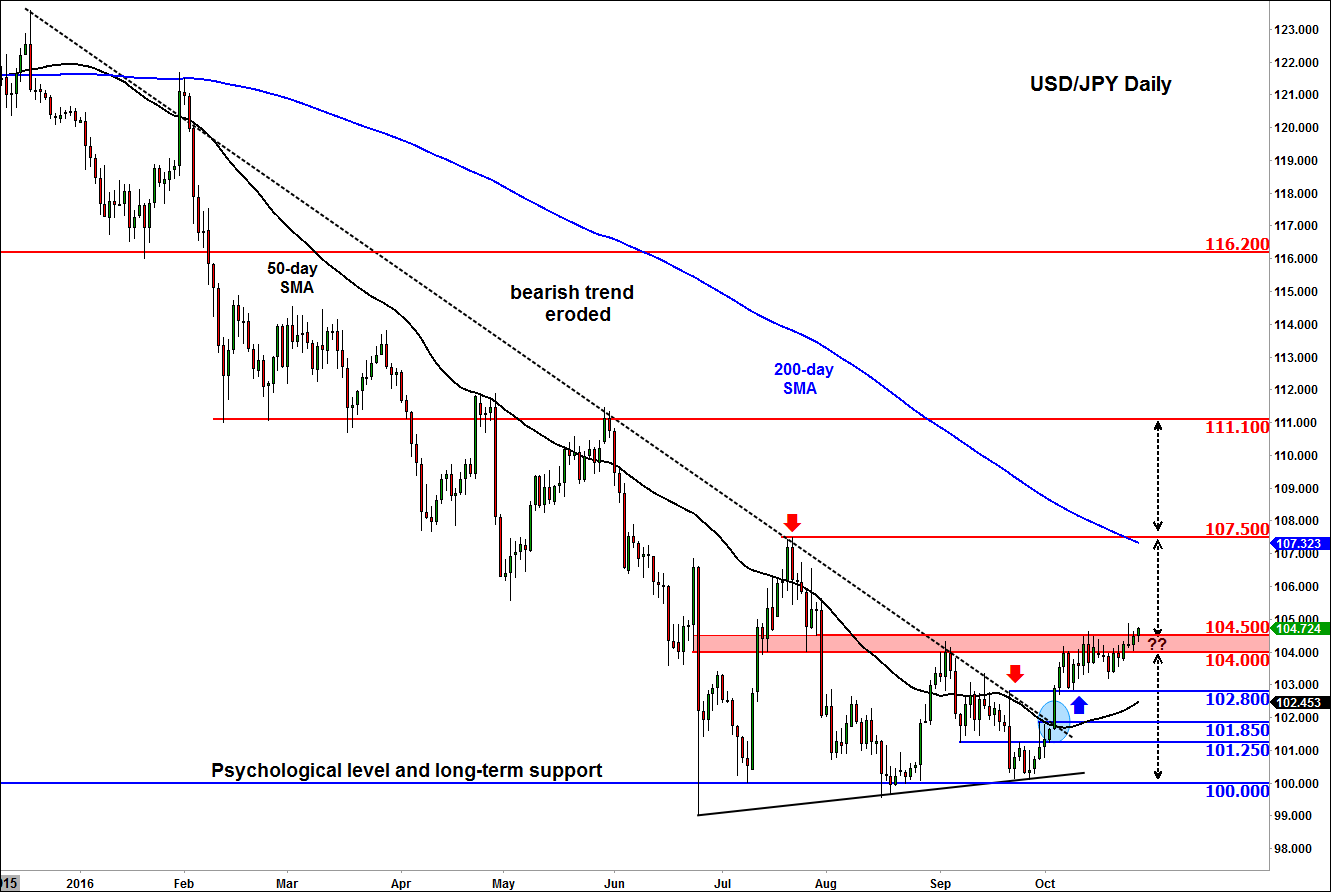

USD/JPY

With both the US Federal Reserve and Bank of Japan scheduled to announce their monetary policy decisions next week, we cannot ignore the USD/JPY. Technically, the trend is still looking strong for this pair following its breakout above the bearish trend line and the subsequent rally and consolidation near the next resistance area between 104.00 and 104.50. With the 50-day moving average also pointing higher now, we favour further bullish than bearish price action, possibly towards the next swing high at 107.50, which comes in just above the 200-day moving average at 107.30/5 area. However, if the USD/JPY moves back below the 104.00 support level then the sellers may aim for the next support at 102.80 next, followed by the levels shown on the chart in blue. But expect to see a big range expansion next week as the two central banks announce their policy decisions and as we have some very important economic data coming up from the US, namely the October jobs report, which could influence the Fed’s decision at its next meeting in December, when it is widely expected to raise rates again.

Figure 5.

Source: City Index and eSignal

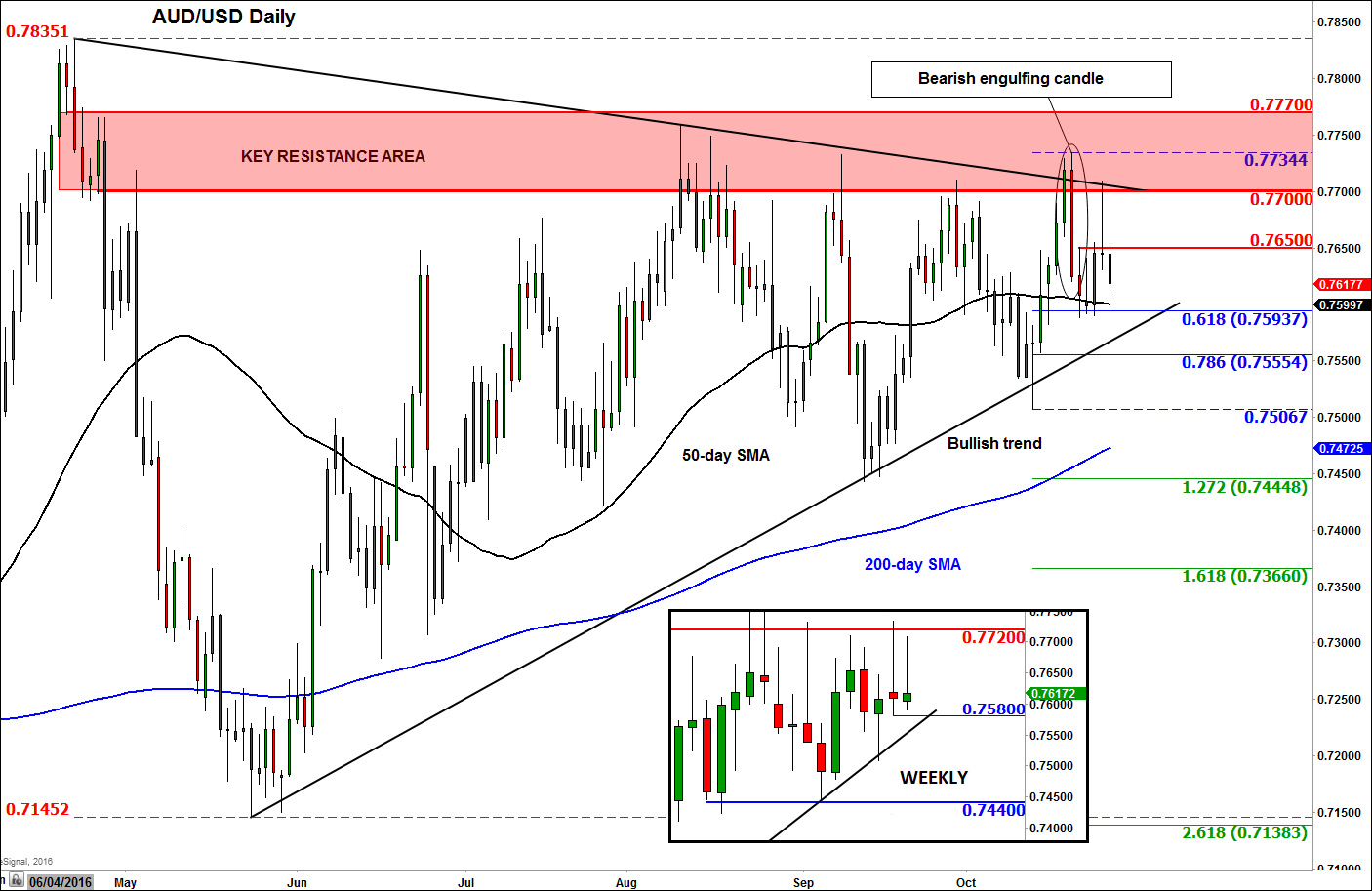

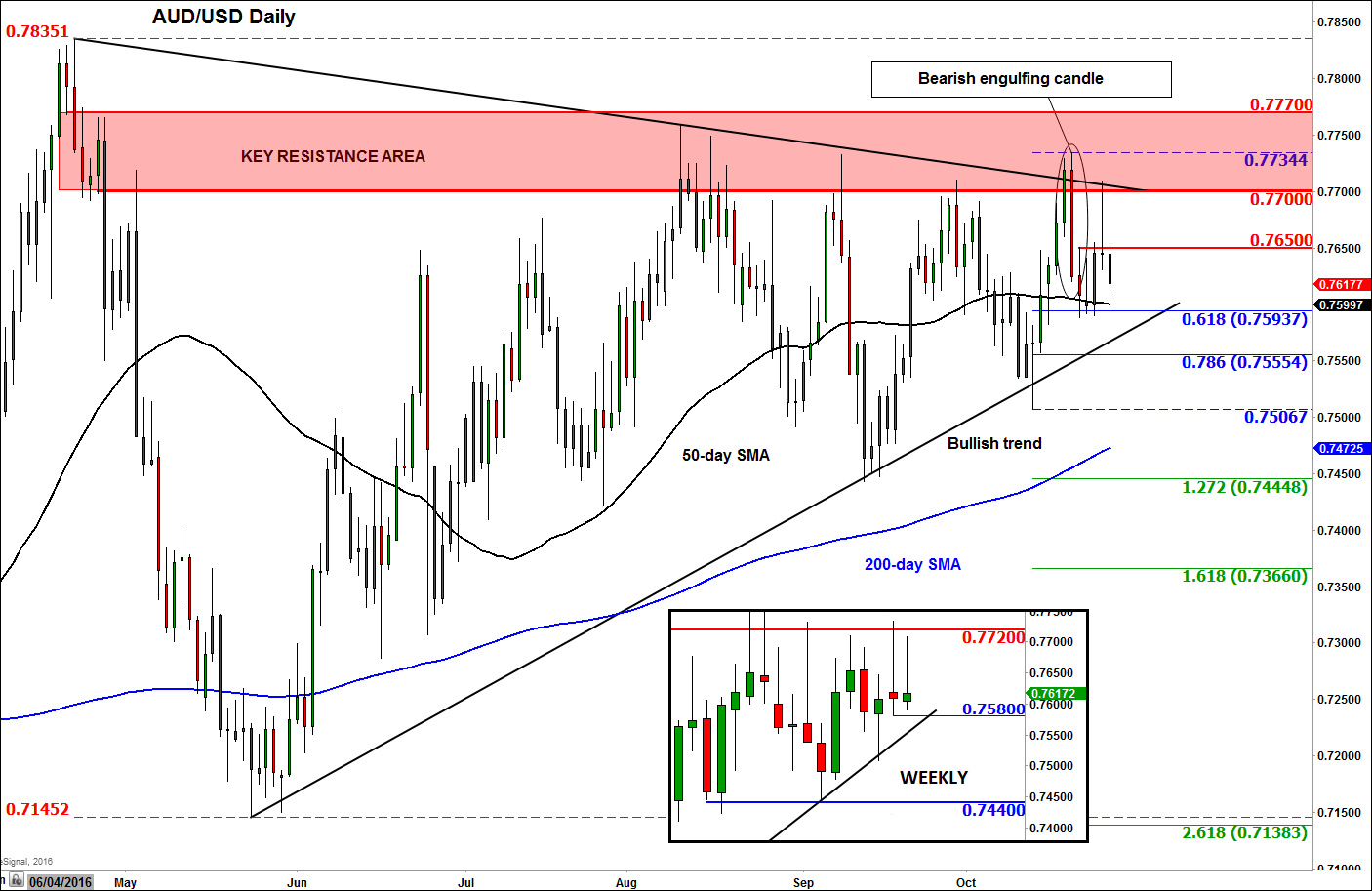

AUD/USD

The Australian dollar’s bounce on the back of news that domestic consumer inflation data was stronger than expected ended once again at the key 0.7700 resistance area on Wednesday. Inflation was boosted by temporary factors which means the Reserve Bank of Australia may ignore the rise in CPI and deliver a more dovish policy statement next week than expected, especially given the fact that the Aussie employment figures that were released last week were anything but strong. The Federal Reserve is also meeting next week and there is a risk that it may send out the strongest signal yet about a December rate hike. If so, this should send the US dollar further higher, potentially causing AUD/USD to slump.

As we have noted previously, the Aussie continues to find resistance at or around the 0.7700-0.7770 area, so it could be at a turning point even though the 200-day moving average is still pointing higher and a bullish trend line is still intact. Several attempts to break above this area failed recently, which resulted in the formation of some bearish-looking price candlestick patterns. On the weekly chart for example (see the inset) a long-legged doji candle was created following last week’s price action and another one is in the process of being formed this week, barring an unexpected rally at the end of this week. Similarly, a large bearish engulfing candle can be observed on the main daily chart from last week, and on Wednesday we had a doji candlestick pattern, too. Thus, price action looks bearish. That being said, the low from last week at around 0.7580/90 area remains intact, which also happens to be the 61.8% Fibonacci retracement against the most recent upswing. So, while the AUD/USD may well drift further lower, for the selling pressure to accelerate the 0.7580/90 support area will need to break down soon. However, if the abovementioned resistance area at 0.7700-0.7770 gives way first then all bets are off. In this potential scenario the prior swing high at 0.7835 could be the initial bullish target ahead of the 0.8000 psychological level next.

Figure 6.

Source: City Index and eSignal