The signal from Vodafone’s most key financial performance metric—organic service revenue—remains strong, the world’s second-largest mobile operator said on Friday.

The benefits of its £5bn acquisition of Germany’s biggest cable TV firm, Kabel Deutschland, about two years ago, continued to boost Vodafone’s top line in the first quarter, it said.

Q1 organic service revenues edged 0.8% higher on the year, a faster pace of growth than the 0.1% uptick seen in the quarter before, the latter being the first time this refined version of sales—which excludes handset sales and currency movements—had grown for three years.

It was also a second-consecutive quarter of enterprise organic service revenue growth which rose 1.8%, though it was down from the 2.1% rise over the whole of the last full year.

One potential area of disappointment for investors was that CEO Vittorio Colao declined to give an update on discussions with Liberty Global.

Still, judging by the stock price extending early session gains by a further 2%, bringing the rise by mid-morning on Friday to as high as 4%, investors appeared to interpret Vodafone’s reluctance to address the subject of a tie-up as a sign that the talks were at a promising, albeit sensitive, stage.

Vodafone opened discussions about a potential ‘exchange of assets’ several weeks ago, but there’s no guarantee of a deal.

Synergies from the potential deal, which Liberty and Vodafone first disclosed in May, have been estimated as high as £13bn, but one of the main uncertainties shareholders have worried about is that the acquisitive owner of Virgin Media, which is by no means afraid of extensive leverage, may have a number of piecemeal options to expand in Europe.

Would John Malone, who exercises tight control of the Liberty companies, many of which he chairs, agree to a pro forma figure for VOD’s European assets based on 7.05 times 2017 Enterprise Value/Ebitda?

That’s what the group trades at, and, in theory, it implies a takeout figure for the German businesses alone that could be at least £7.7bn.

It’s questionable whether the UK group would accept less for the entire European operations.

The major question mark over Vodafone’s corporate structure going forward will need to be resolved fairly quickly.

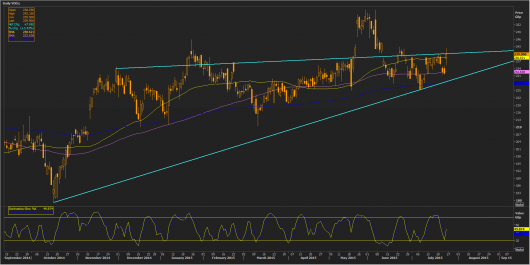

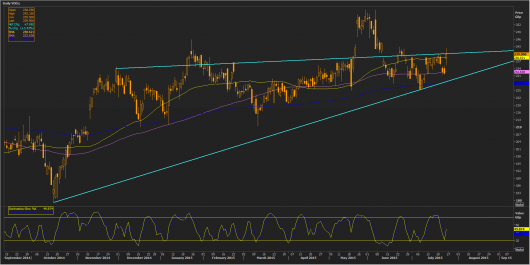

That’s if its shares are to hold on to the 35% gain from mid-October lows.

With the stock having declined 9% since early June, the unresolved potential consolidation appears to be at the forefront of the minds of many investors.

The approaching confluence of ascending and descending trends and a relatively short-term moving average (the 50-day) are challenging the stock right now.

Please click image to enlarge