Vodafone: continuation of the rebound?

Vodafone posted a full-year pretax profit of 795 million euros that beat consensus estimates, compared with a loss of 2.61 billion euros a year earlier. Group revenue grew by 3.0% to 45.0 billion euros, supported by improving commercial momentum in Europe.

The company added: “The economic impact of the COVID-19 pandemic in our markets, whilst uncertain, is likely to be significant. Whilst our business model is more resilient than many others, we are not immune to the challenges. We are experiencing a direct impact on our roaming revenues from lower international travel and we also expect economic pressures to impact our customer revenues over time."

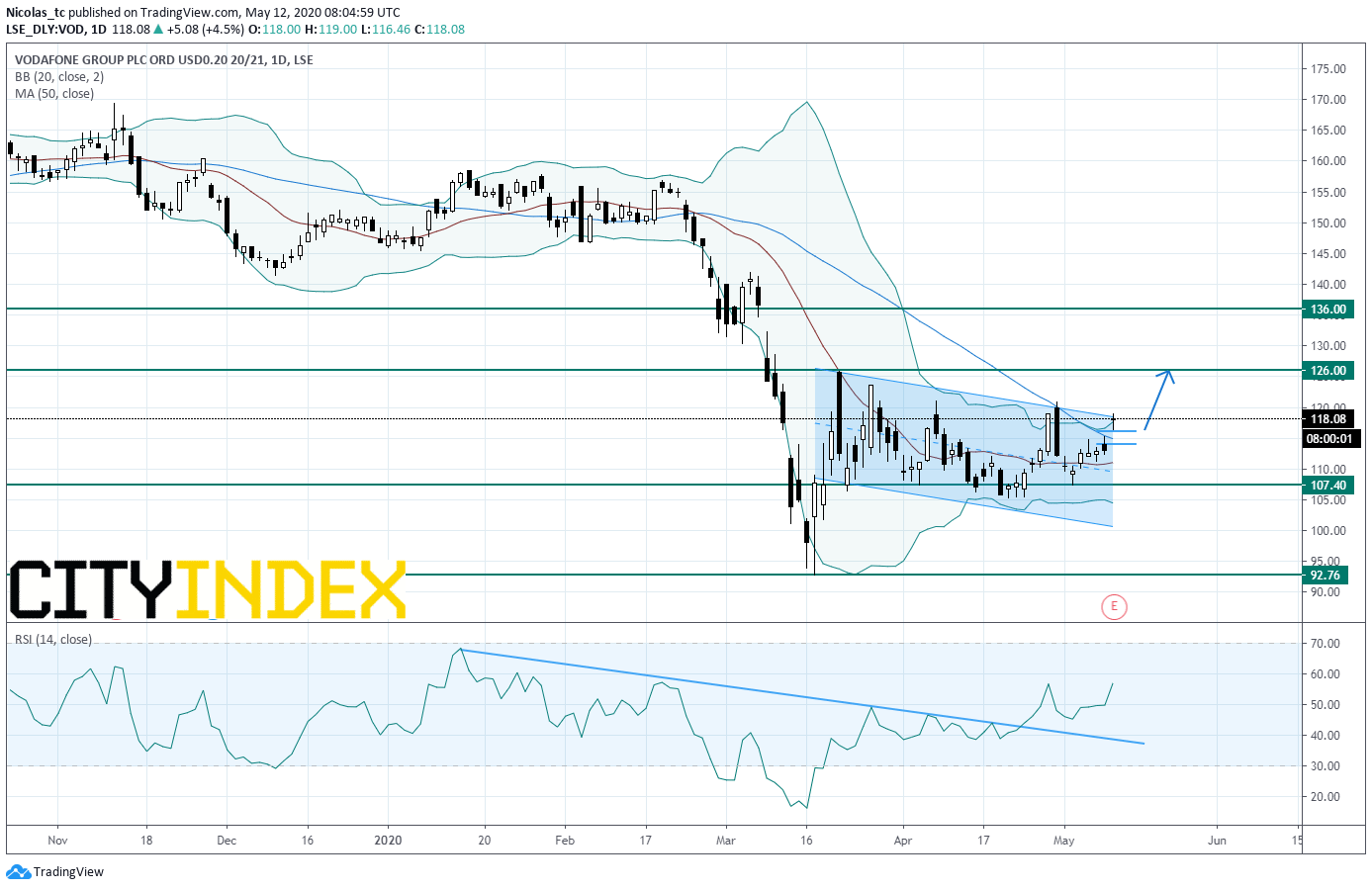

From a technical perspective, the bullish gap opened this morning is going to help the stock price to escape from its short term consolidation channel. Prices pushed above the 50-day simple moving average for the first time since February.

From a technical perspective, the bullish gap opened this morning is going to help the stock price to escape from its short term consolidation channel. Prices pushed above the 50-day simple moving average for the first time since February.

A breakout confirmation of the channel would trigger a bullish acceleration towards the next resistance at 126p.

Alternatively, a break below 107.4p would call for a new down leg towards March 17th bottom at 92.75p.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM