Medium-term technical outlook on Visa (V)

click to enlarge charts

Key Levels (1 to 3 weeks)

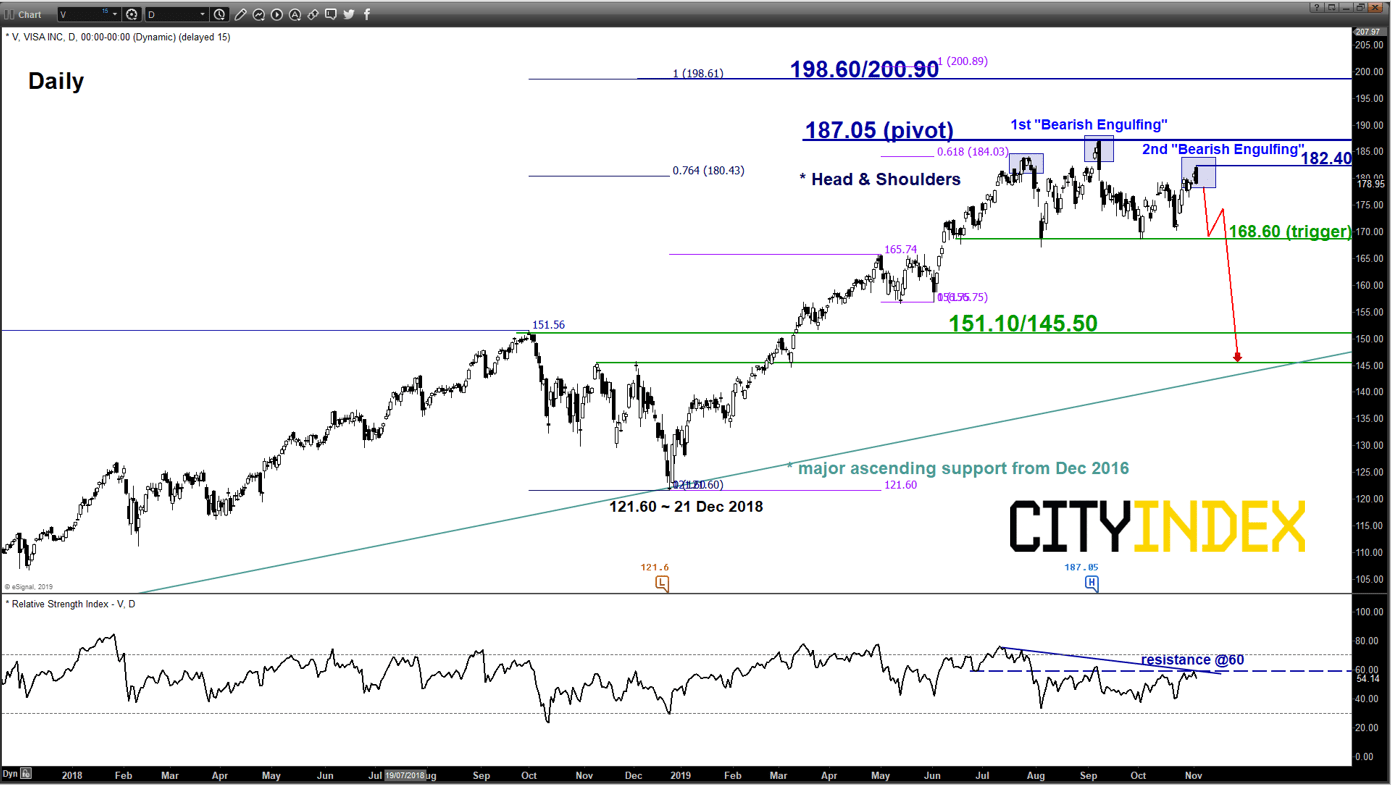

Intermediate resistance: 182.40

Pivot (key resistance): 187.05

Supports: 168.60 & 151.10/145.50

Next resistance: 198.60/200.90

Directional Bias (1 to 3 weeks)

A potential major 3-month toppish configuration in place since 29 Jul 2019, bearish bias below 187.05 pivotal resistance and a break below 168.60 is likely to reinforce the start of a potential corrective decline to target the next medium-term support zone at 151.10/145.50.

On the other hand, a clearance with a daily close above 187.05 sees an extension of the impulsive upleg sequence towards 198.60/200.90 next (Fibonacci expansion cluster).

Key elements

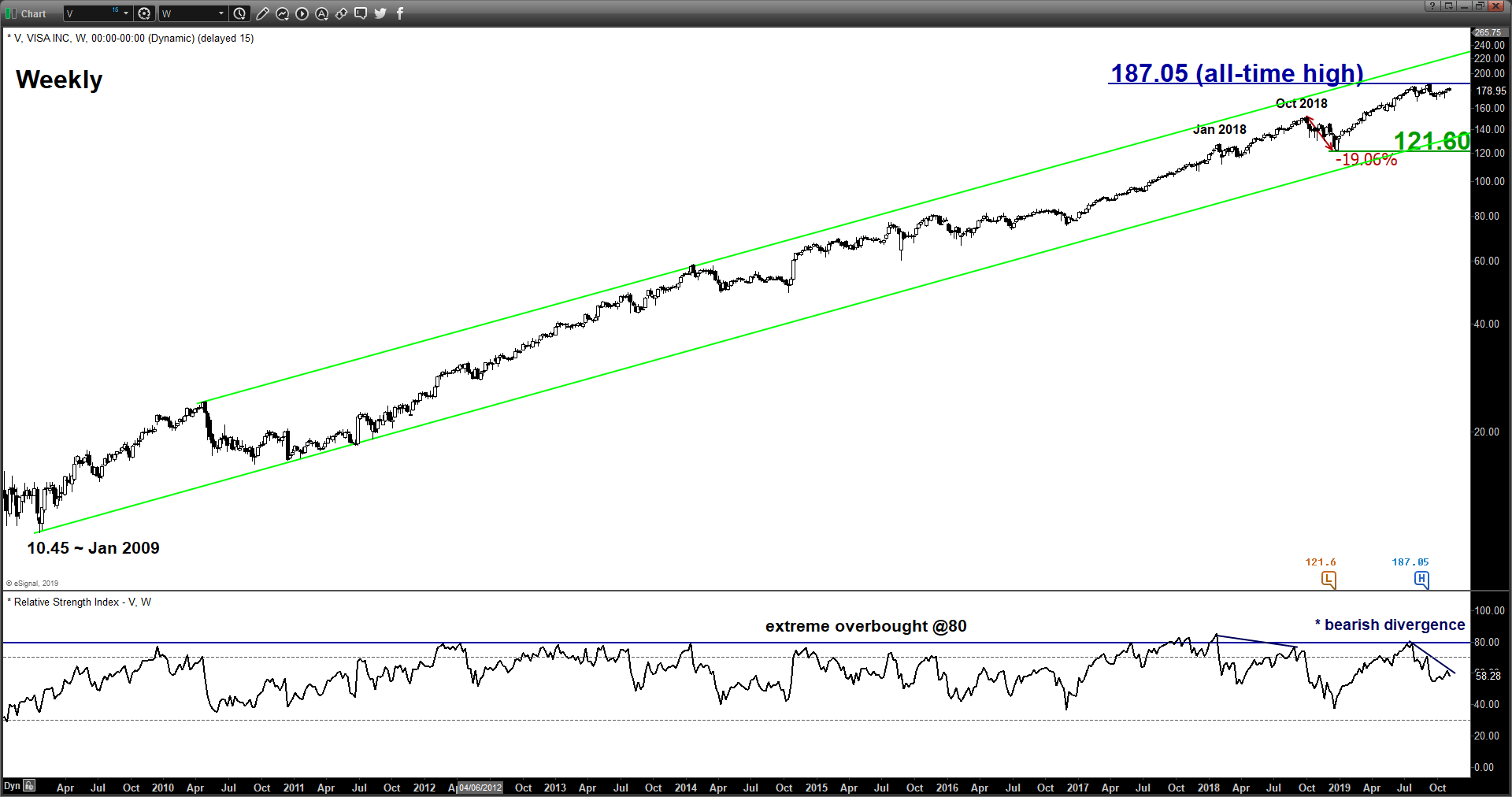

- The weekly RSI oscillator has continued to trace out a bearish divergence signal in place since its all-time high of 187.05 printed in Sep 2019 which indicates a slow- down in upside momentum of the major uptrend from 21 Dec 2018 low.

- A potential major bearish reversal “Head & Shoulders” configuration has started to take form since 29 Jul 2019 with its neckline support at 168.60.

- At the close of yesterday, 04 Nov U.S. session, the price action has formed a 2nd “Bearish Engulfing” candlestick pattern where the 1st Bearish Engulfing” has taken shaped at the 187.05 all-time high level. These observations suggest that sentiment has turned negative where a potential downside reversal in price action is imminent. Interestingly, the 2nd Bearish Engulfing candlestick pattern has formed at the “right shoulder” of the potential “Head & Shoulders” configuration with 1st Bearish Engulfing that has coincided with the “head”.

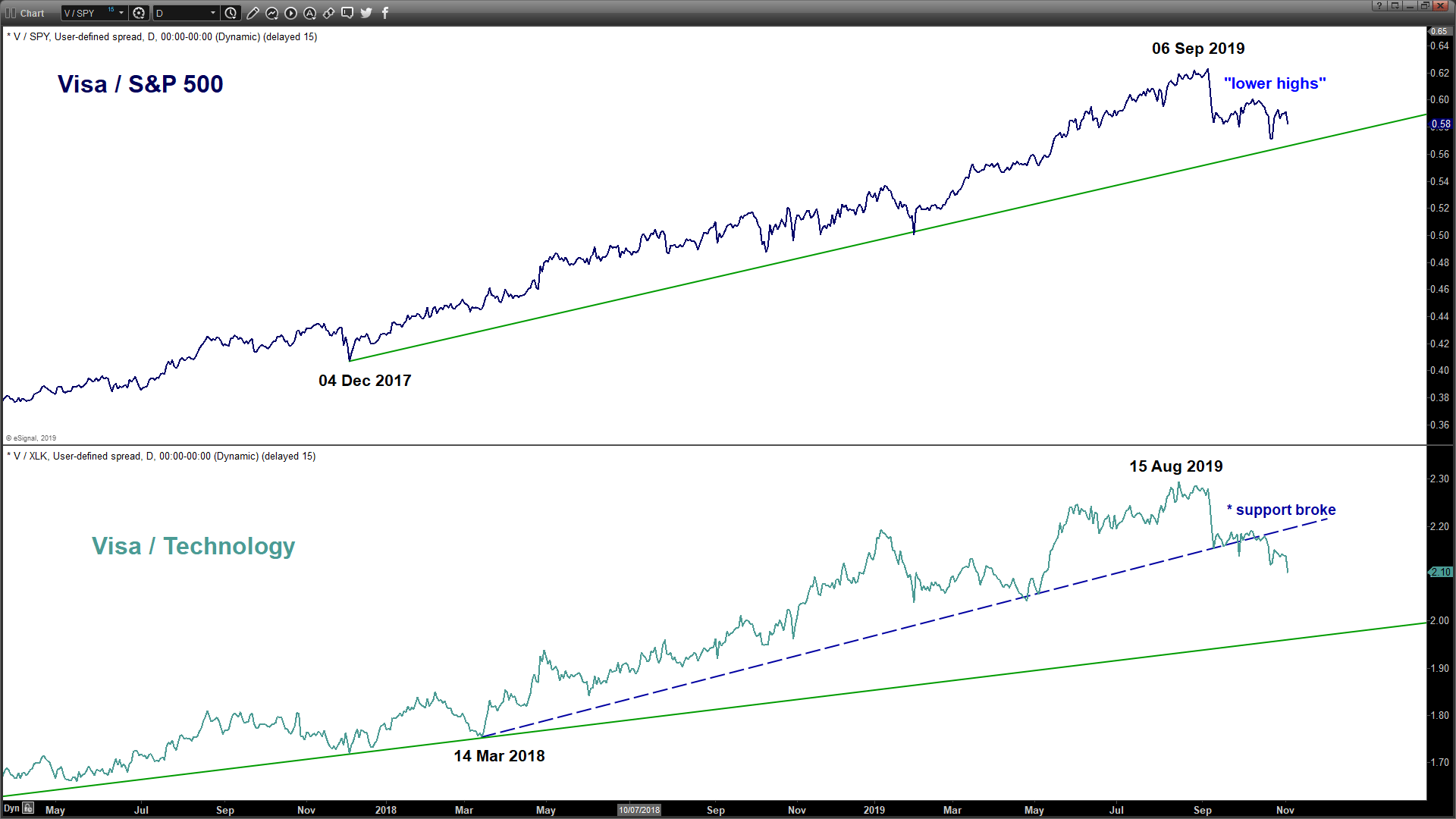

- Relative strength analysis as seen from the ratio charts of Visa against the market (S&P 500) and its sector (Technology) has indicated on-going underperformance of Visa.

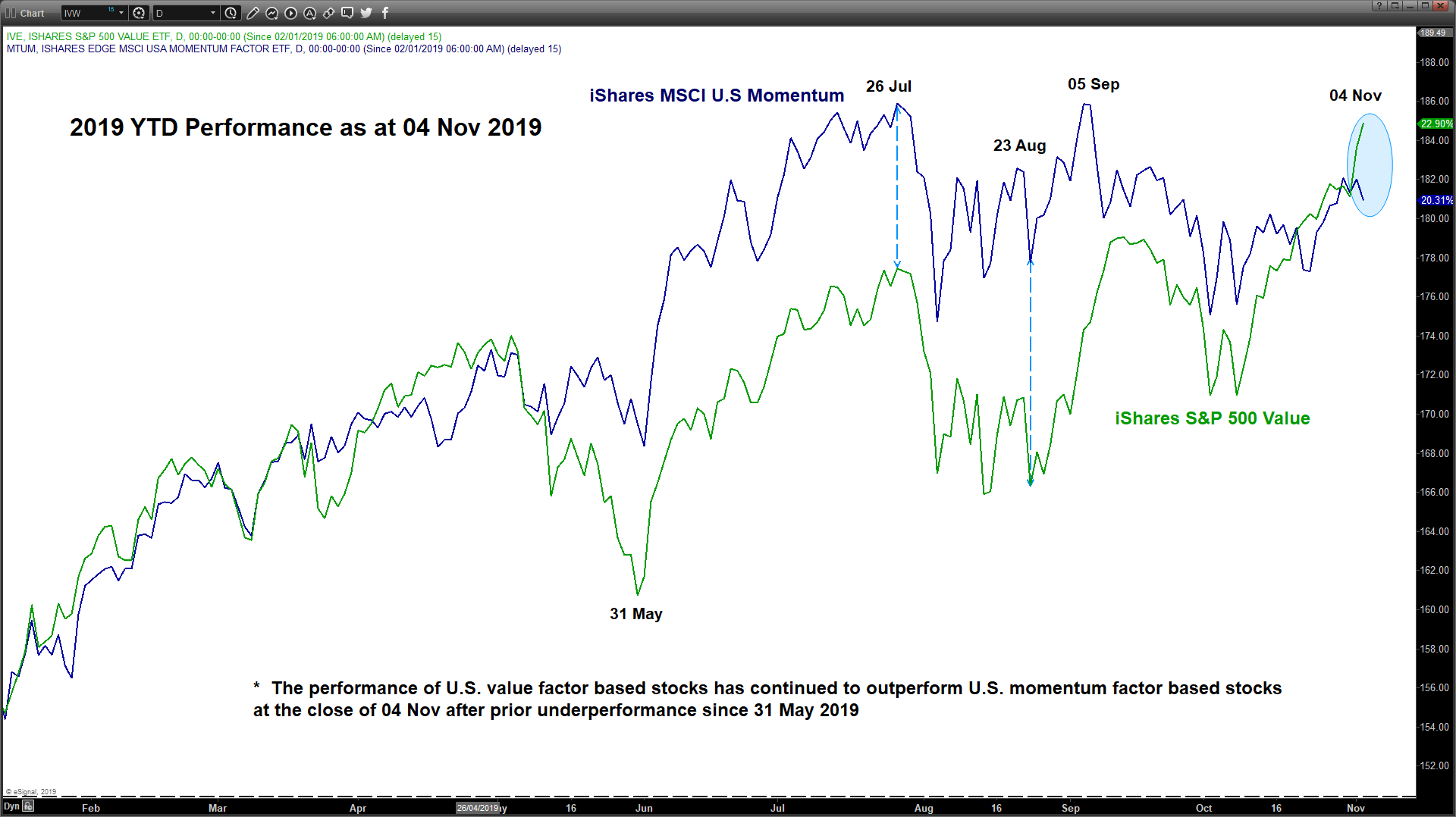

- Also, Visa is classified as a momentum factor-based stock where it is a significant component stock (4th largest) in the iShares USA Momentum Factor ETF that has underperformed against a basket of value factor-based stocks (iShares S&P 500 Value Factor ETF).

Charts are from eSignal

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM