Despite the weaker dollar, signs of stability are surfacing so we’re closely tracking DXY and EUR/USD for a near-term inflection point. And with the dollar index trading within two bullish channels, we don’t believe the dollar has topped out just yet.

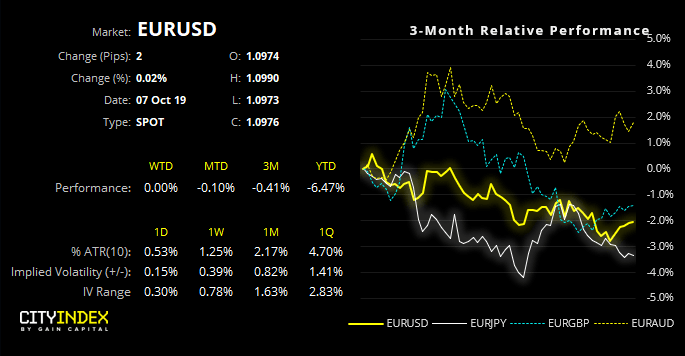

This brings EUR/USD into focus as it struggles to break above a zone of resistance around 1.10. So if sentiment or data allows, we’re closely watching to see if Euro will roll over once more or invalidate its bearish channel to signal a move towards the 1.1100 high.

This week we have a couple of speeches from Jerome Powell at the National Association for Business Economics meeting. Given markets are pricing in an 83.9% of a Fed cut this month, the dollar could end up being supported if there’s no sign of a dovish tone. Besides, even if the Fed are to cut rates, it may not necessarily be a bearish case for USD as prior analysis has sown that the greenback tends to appreciate in the weeks following a cut (although it may provoke a bearish reaction initially). At this stage, we’d need to see a dovish cut and the majority of Fed members making dovish comments publicly to expect a sizable move lower for the USD, which is the vital ingredient lacking at present.