Whilst Tesla (Tesla CFD) appears set to snap a 3-month losing streak, we think its rally from the June low has had its day and prices could revert to its bearish trend.

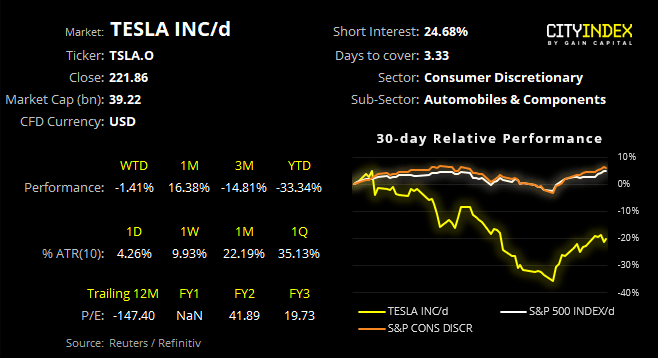

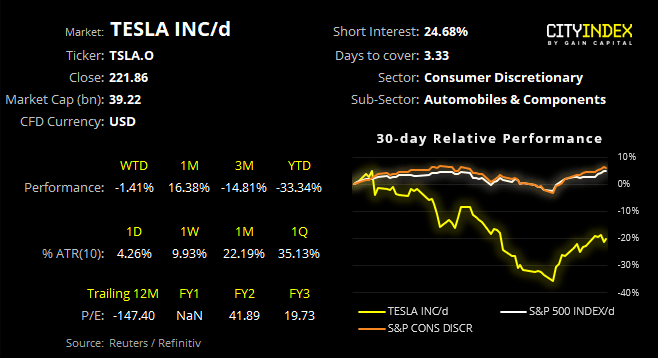

June has been a good month for Tesla so far, currently trading 19.8% higher and, at one-point rallying nearly 33% from its low, it seems very likely to snap a 3-month losing streak. However, with 24.7% of traders net short on Tesla, we question how sustainable its upside is.

- Technically, resistance has been found below the 50 day-averages (both standard and exponential averages), and the rally has failed to retest the June and August 2016 highs.

- If prices remain below last week’s high, the bias remains bearish and we await for bearish momentum to take prices back in line with its dominant downtrend.

Latest market news

Today 05:45 AM

Yesterday 11:09 PM

Yesterday 11:01 PM

Yesterday 04:00 PM

Yesterday 01:15 PM