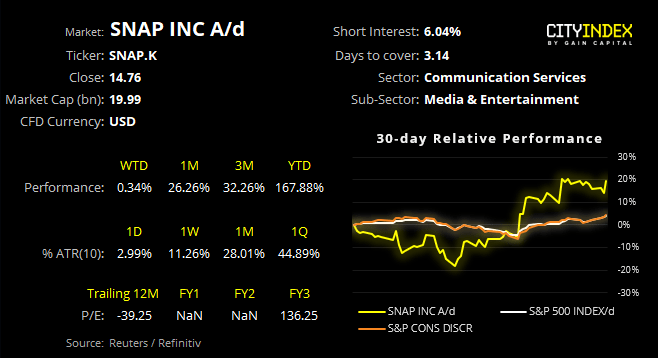

Since finding resistance at $15 last month, Snap has continued to consolidate within a potential bullish flag formation. And, given the strength of the underlying trend, and the fact that forward returns tend to favour the S&P500 once it closes at new highs, we expect this to break higher in due course.

Related analysis:

US Indices Closed At New Highs: Do We Hold Or Fold?

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM