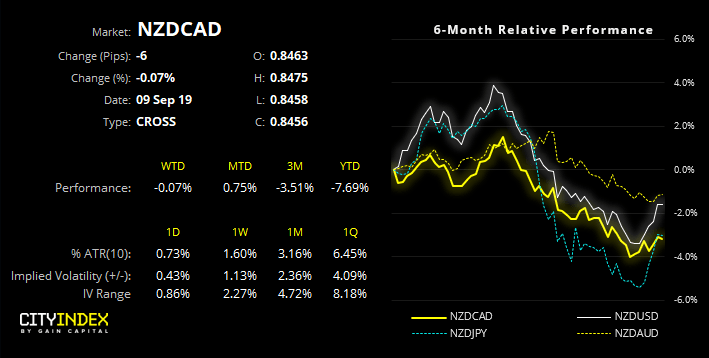

NZDCAD has been a trend that has kept on giving. We’ve been following its demise closely, since identifying its test of a long-term bearish trendline back in March, it’s double-top in April and potential 300-pip slide in June.

After breaking below the 0.8500 target, the cross remains in an established bearish channel and shows the potential for a bear-flag on lower timeframes. Whilst the channel allows potential for a deeper correction against the dominant trend, we’d consider short setups if prices remain below 0.8500.

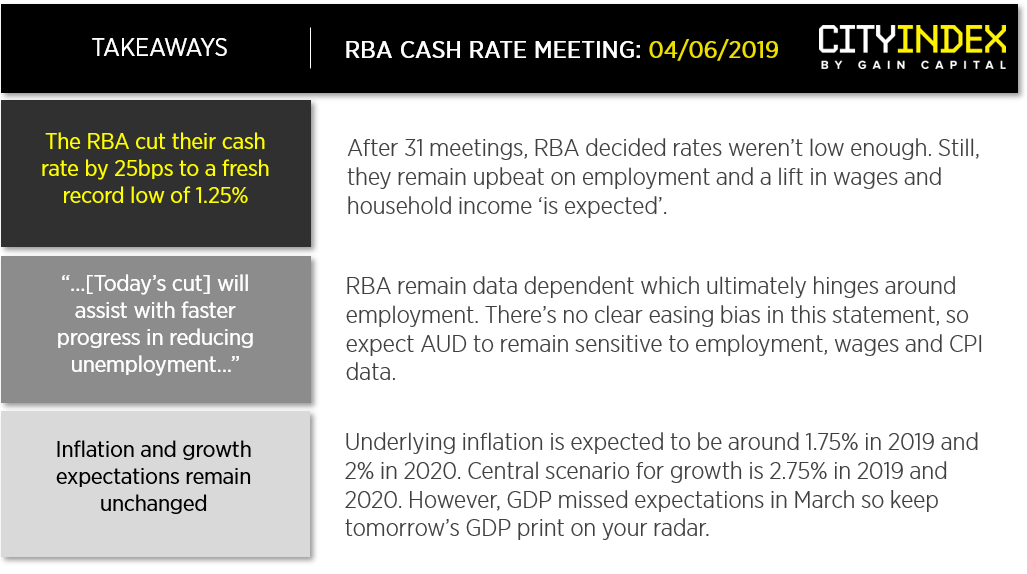

The daily trend structure remains firmly bearish, the CA-NZ 2yr yield differential has broken to new lows (ahead of price action) and, of course, Canadian dollar have the yield advantage with BOC’s base rate at 1.75% versus RBNZ’s 1%. Put together we suspect upside could be limited for NZD/CAD. Furthermore, we can see that Canada’s data is outperforming New Zealand’s, using the spread between NZ and CA CESI (City Economic Surprise Index).

For now, we’re watching to see how prices react around 0.8500, and the potential for a bear-flag breakdown.