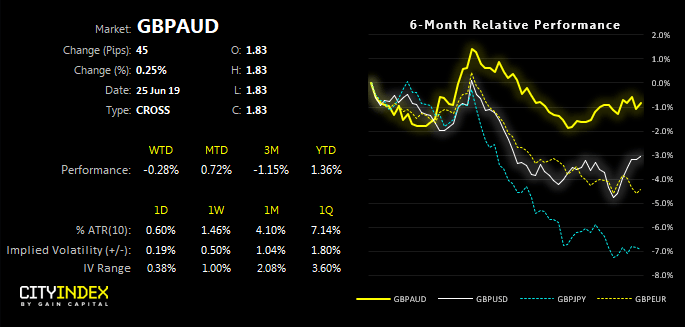

GBP/AUD is making hard work on its rebound from the June low, suggesting the move is corrective and a break lower could be on the cards.

GBP/AUD’s ‘rebound’ from support lacks momentum. We can see support has been found at the April and June lows around 1.8100/18, yet gains this month have been relatively lacklustre, compared with the decline from the 1.8880 high. Furthermore, the retracement has found resistance around the 38.2% Fibonacci level and the overlapping nature of candles points towards a corrective more (not a bullish impulsive one).

Market positioning points towards a longer-term reversal on GBP/AUD. Since early March, large speculators have gradually increased gross long positions whilst short exposure his hit extremely bearish levels, to suggest an inflection point could be approaching (for AUD strength). Meanwhile, traders have reduced long exposure on the British pound and gradually increased short exposure yet positioning remains far from an extreme.

- We remain bearish beneath June’s high and would look to fade into intraday rallies beneath this level.

- Whilst a break higher wouldn’t invalidate the core bearish view, it would be enough for us to step aside until bears relinquished control.