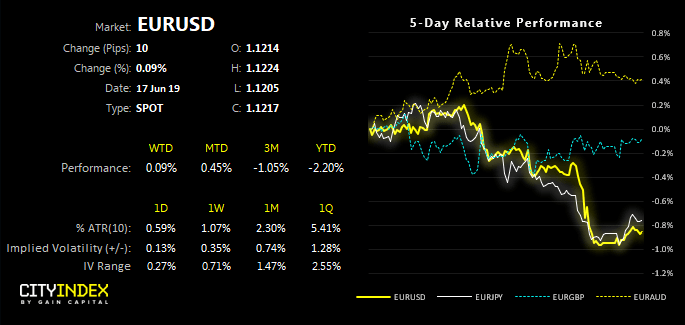

Stronger-than expected retail sales from the US saw EUR/USD break key support amid its most bearish session in seven weeks. This places it firmly back within range, where traders could look to fade into rallied below the 1.1265 area and target the 1.1100 lows.

However, given 1.1100 has so far provided solid support with three failed attempts to break it, counter-trend bulls could look to buy at the lows.

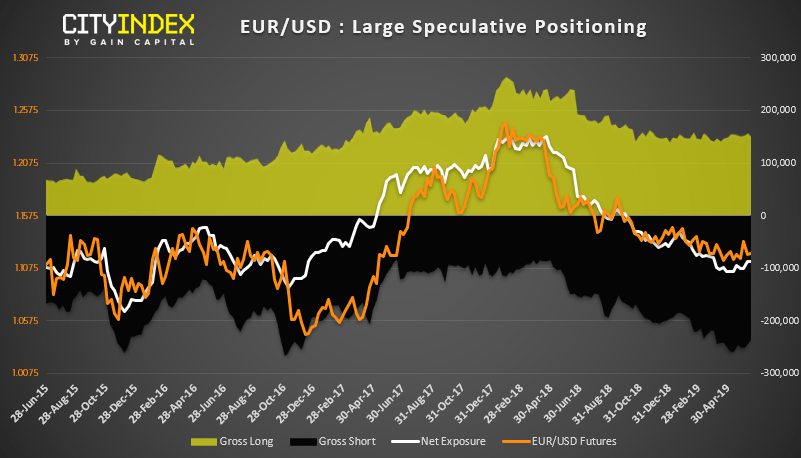

Large speculators have slightly reduced their net-short exposure, by a mere 759 contracts. However, over the past three weeks 14.5k gross shorts have been closed. So there is an argument to be made that the tide could be turning for the Euro whilst it remains above 1.1100. And we’ll be keeping a very close eye on Wednesday’s Fed meeting to see if they lay the groundwork for a July cut.