A potential head and shoulders top pattern has been forming on copper prices since August 2018. With China continuing to show signs of a slowdown, weaker copper prices underline global growth concerns and will only add to the negative sentiment if they break lower. Of course, this will have a material impact on copper miners which have also come under pressure in recent weeks.

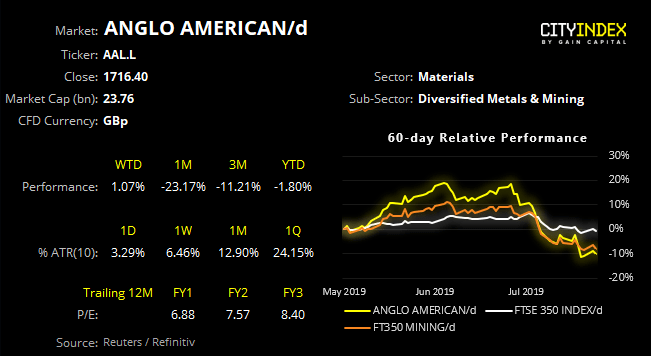

One stock of particular interest is Anglo American which is listed on the FTSE 350. Classified as a diversified mining company, its three largest commodities are coal, platinum and copper which account for around 68% of its entire business.

Anglo American: Top 5 Revenue Streams

- Coal: 28%

- Platinum: 21%

- Copper: 19%

- Iron Ore: 14%

- Nickel: 6%

Coal prices are within an established downtrend, platinum is under pressure and copper is on the cusp of breaking key support. Put together, we’re keeping a close eye on Anglo American for potential shorting opportunities. We take a look at key levels within today’s video.