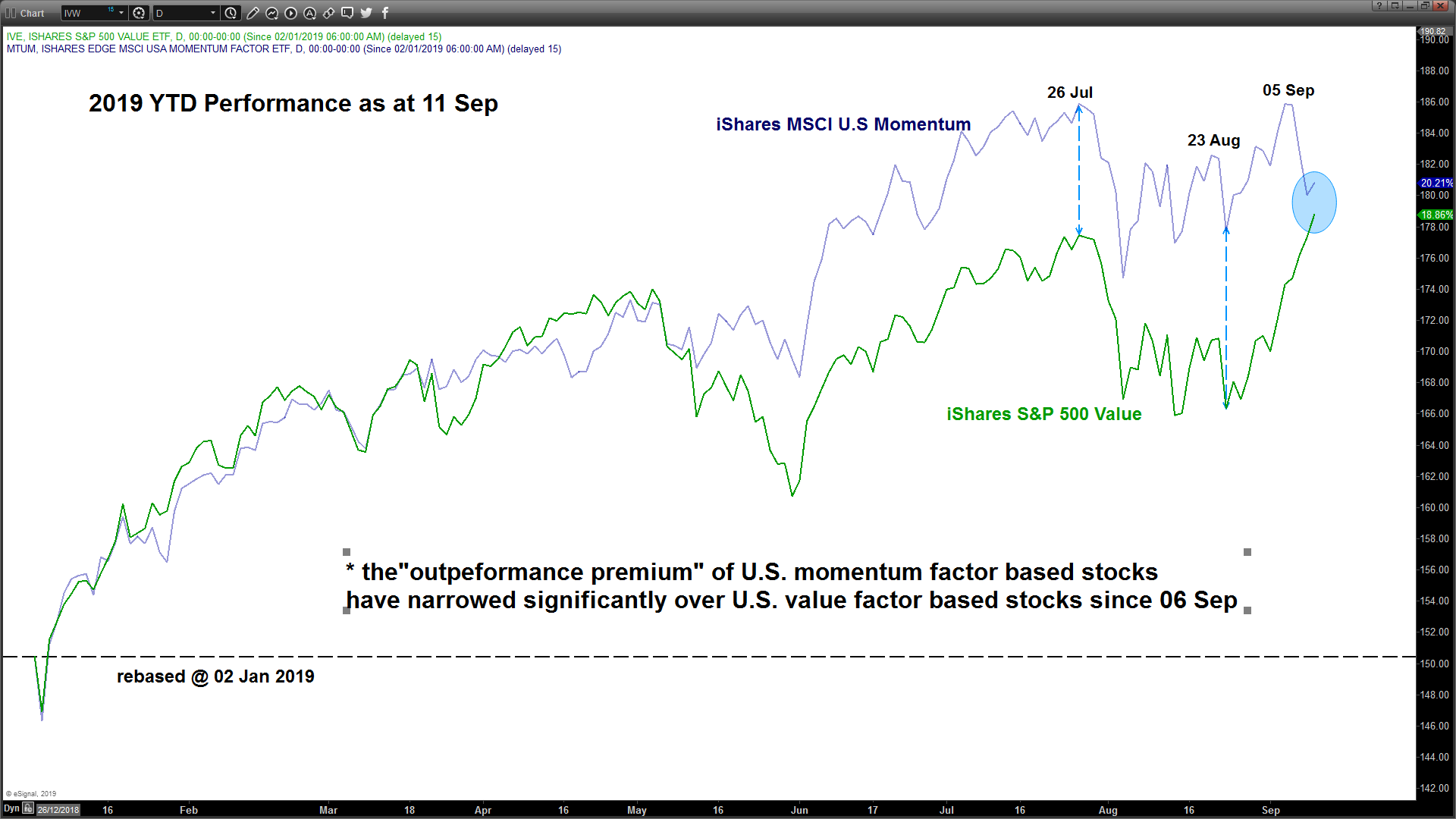

For traders who follow the U.S. stock market very closely, an interesting phenomenon has started to take shape. Since this Monday, 09 Sep, momentum factor-based stocks have seen a significant sell-off and in contrast, value factor-based stocks have rallied.

- A clear factor style-based rotation is at play in the U.S. stock market where the outperformance premium since the start of the year on momentum driven stocks over value-factor based stocks has narrowed significantly.

- Interestingly, Apple is a key component stock with the highest weightage in the iShares S&P 500 value ETF where its share price has benefited indirectly from this factor rotation.

- From a technical analysis perspective, Apple has managed to stage a bullish breakout from a 4-month range configuration in place since May 2019 accompanied by a relative high volume and positive momentum as indicated by the daily RSI oscillator.

- Key medium-term support to watch for Apple will be at 211.50 in any pull-back for a further potential up move to retest its current all-time high at 233.47 before targeting the next resistance at 243.80 which is defined by the upper boundary of a medium-term ascending channel in place since 03 Jan 2019 and a Fibonacci projection cluster.

- On the other hand, a break with a daily close below 211.50 negates the bullish tone a slide back to test the ascending channel support at 195.30

Latest market news

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM