Happy Veteran’s Day to anyone who has served their country anywhere!

Veteran’s Day is a bank holiday in the US, and therefore the US bond market is closed. As bond traders are off, many other market players take the day off as well. With low participation during the US session, moves in the market on bank holidays should be taken with a grain of salt. This is to say, with light liquidity, especially after the London fix, moves can be enhanced if one player decides to add to or take from a large position.

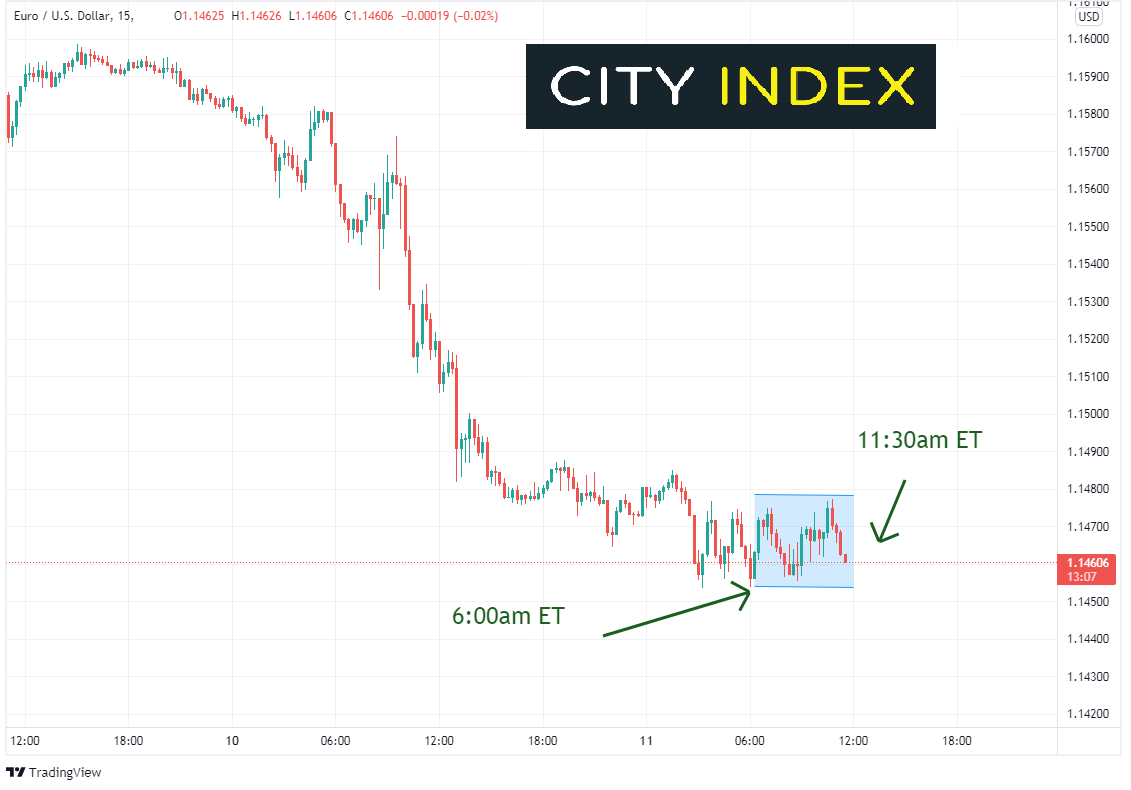

On the other side of the coin, traders also should not be concerned about little price movement in a particular asset. For example: just because there is no volatility in EUR/USD today, doesn’t mean that there won’t be tomorrow. Notice that in EUR/USD, the range between 6:00am and 11:30am ET is only 22 pips:

Source: Tradingview, Stone X

On bank holiday’s such as Veteran’s Day, traders need to remember that despite lack of activity, or if there is a large move on light volume, that markets will tend to move in the direction of the larger trend when the traders return.

Trade EUR/USD now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

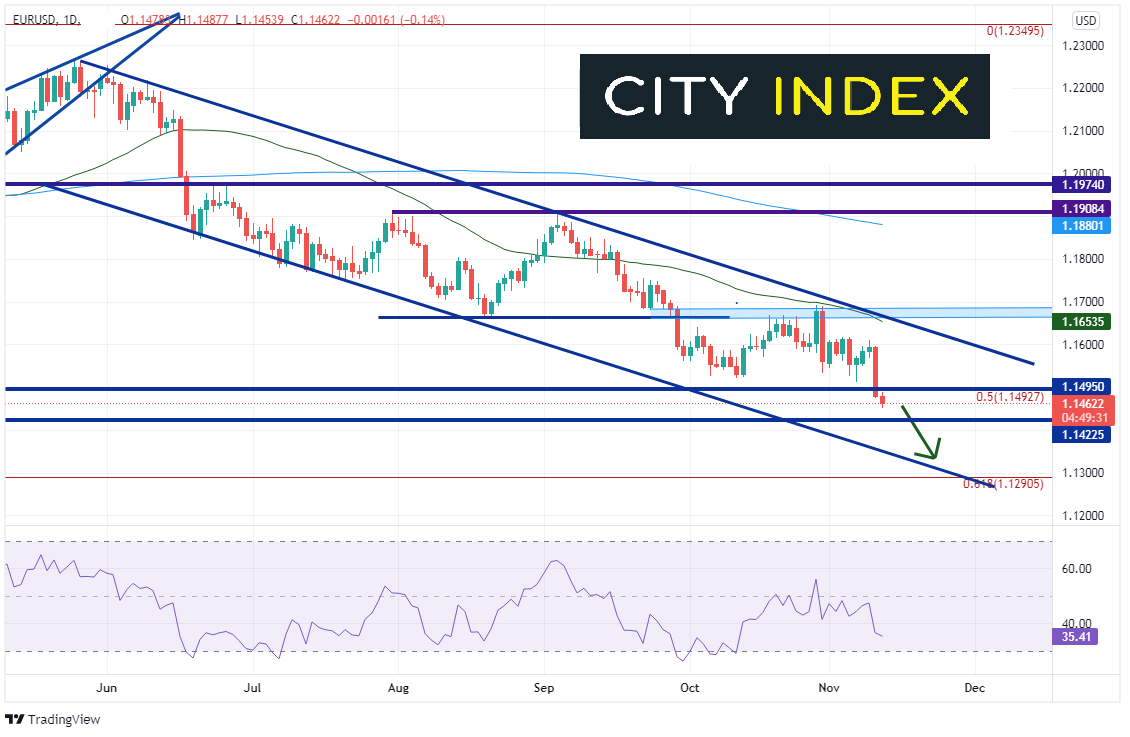

The longer-term trend since early June in the EUR/USD has been lower. Therefore, bears may wish to take advantages of any bounces to position themselves for a continued move lower in EUR/USD, looking for a longer-term move in the same direction. Levels that bears will be looking to sell are the horizontal resistance just above at 1.1495 and the November 5th lows at 1.1513. Of course, there is always a risk of a move back to the top trendline of the channel, but that’s what stops are for. If one chooses to short EUR/USD, targets can be the bottom channel of the downtrend near 1.1350 or the 61.8% Fibonacci retracement level from the lows of March 2020 to the highs of January 2021 near 1.1290.

Source: Tradingview, Stone X

Remember that Veteran’s Day, like most bank holidays, tends to be slow and have tight ranges, absent a catalyst. However, there could always be that one fund who enters a quiet market to adjust a position. Regardless, traders should be anticipating a resumption of the move in the longer-term direction of the trend when traders return the next day.

Learn more about forex trading opportunities.