Whilst escalating US – Sino tensions dominated trading at the end of last week, traders were keen for positive news as they roll back from long weekends in many countries. Optimism surrounding easing lockdown measures and a potential vaccine by Novavax provoked risk on trading in Asia which is spilling across into Europe for the open.

After Moderna’s encouraging vaccine news last week, Novavax, another American company has said it is progressing to human trials in Australia with results expected in July. Given that a vaccine is considered the only way to rapidly return to pre-coronavirus normality any positive vaccine news is well received by traders.

Over the long weekend, Americans were out in force enjoying their newfound freedom, Japan announced billions more in stimulus and indicated that remaining lockdowns in cities were drawing to an end. Singapore also bet expectations with GDP printing at -4.7%, significantly better than the -7.4% forecast.

Boris Johnson clarifies UK reopening path

Here in the UK clarity from Boris Johnson over the timetable for easing lockdown restrictions has boosted sentiment and lifted the Pound. Local street markets and car dealerships can open as from next week whilst all shops will be able to reopen from 15th June if they adhere to the governments social distancing rules.

Whilst the reopening of shops is a huge step forward, the sector still faces huge challenges. Highlighting the struggles of the sector CBI data will be released later today ad is expected to show another record decline to -65, down from -55.

Here in the UK clarity from Boris Johnson over the timetable for easing lockdown restrictions has boosted sentiment and lifted the Pound. Local street markets and car dealerships can open as from next week whilst all shops will be able to reopen from 15th June if they adhere to the governments social distancing rules.

Whilst the reopening of shops is a huge step forward, the sector still faces huge challenges. Highlighting the struggles of the sector CBI data will be released later today ad is expected to show another record decline to -65, down from -55.

Project Birch

Also propping up sentiment in the UK is Project Birch, a plan authorised by Rishi Sunak to bailout strategically important companies facing acute financial difficulties. This would see the UK government adopt the French and German route of major state investment in private businesses. Following Lufthansa’s bailout by the German government, big names and UK employers such as Jaguar Land Rover be quickly queuing up.

Also propping up sentiment in the UK is Project Birch, a plan authorised by Rishi Sunak to bailout strategically important companies facing acute financial difficulties. This would see the UK government adopt the French and German route of major state investment in private businesses. Following Lufthansa’s bailout by the German government, big names and UK employers such as Jaguar Land Rover be quickly queuing up.

Oil climbs on supply cuts & rising demand

Oil prices climbed in early trade on Tuesday as easing lockdown restrictions sees more cars back on the road boosting demand for fuel. Crucially, at the same time, expectations are firming that producers will stick to agreed production cuts. Russia reported that its production had nearly dropped to its target 8.5 million barrels per day. Quite simply increasing demand coupled with mounting evidence that the supply cuts are coming through is lifting the price of oil.

WTI is trading +3% as it looks to target $35. Oil majors on the FTSE could see a jump on the open.

Oil prices climbed in early trade on Tuesday as easing lockdown restrictions sees more cars back on the road boosting demand for fuel. Crucially, at the same time, expectations are firming that producers will stick to agreed production cuts. Russia reported that its production had nearly dropped to its target 8.5 million barrels per day. Quite simply increasing demand coupled with mounting evidence that the supply cuts are coming through is lifting the price of oil.

WTI is trading +3% as it looks to target $35. Oil majors on the FTSE could see a jump on the open.

Consumer confidence no strong rebound expected

Looking ahead US consumer confidence will be in focus. Given the US economies dependence on the consumer, morale can help gauge what the recovery will look like. The numbers are expected to be an improvement on April’s plunge to 86.9, however is still expected to make for grim reading. With initial jobless claims indicating that around 25% of the US workforce has signed up for unemployment benefits this is hardly a backdrop for a strong rebound in consumer confidence.

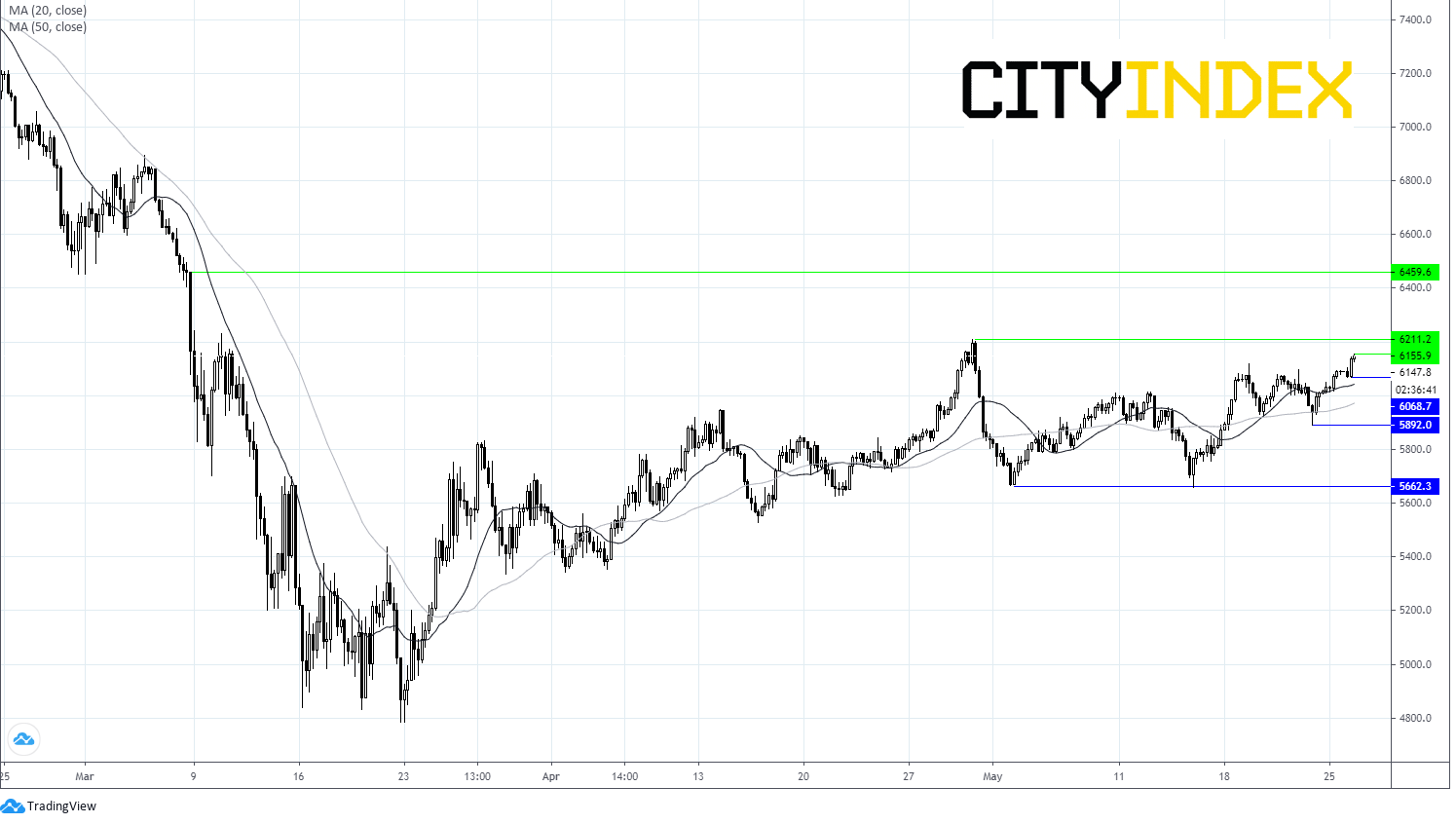

FTSE Chart