An injection of optimism from vaccine news has spurred stocks higher. Asian markets advanced overnight with the upbeat mood spilling into Europe for the open. Bourses in Europe are pointing to a stronger start, paring losses from the previous session.

Vaccine news has been in short supply over recent weeks. News that a vaccine from Pfizer and Germany’s BioNTech produced a strong immune response and is being well tolerated in early stage human trials has been well received. Particularly as the number of coronavirus cases top 10.5 million globally and the cases in the US are increasing at a daily rate of around 50,000 a day, whilst reopening measures are being halted.

Hong Kong & Brexit concerns pushed aside for now

Investors are doing a good job at shrugging off other market woes, including the arrest of 300 protesting in Hong Kong following the introduction of sweeping Chinese laws to control dissent. The latest developments will raise concerns over already strained relations between China and the rest of the western world.

In the UK, the mood remains upbeat with both the Pound advancing and the FTSE set to open higher, despite growing doubts over whether a post Brexit trade deal will be reached. Angela Merkel confirmed that progress in talks had been minimal and that the EU must prepare for the prospect of a deal not being reached. This would see the UK leave the EU on unfavourable World Trade Organisation rules.

The NFP test

Attention will now turn towards the keenly awaited US jobs report which will shed light on whether the US is able to sustain its fragile economic recovery even as covid-19 numbers surge across the south of the country.

Attention will now turn towards the keenly awaited US jobs report which will shed light on whether the US is able to sustain its fragile economic recovery even as covid-19 numbers surge across the south of the country.

Expectations are for 3 million jobs to have been created in June, following an unexpected increase of 2.5 million in May, whilst extending the recovery from 20 million lost in April. The unemployment rate is expected to tick lower to 12.3% from 13.3%. Wage growth is expected to remain elevated as mainly low wage employees lost their jobs

Yesterday’s ADP payroll report revealed a disappointing, albeit record, 2.3 million private payrolls added in June when 3 million had ben forecast. Given the strong correlation between ADP payrolls and NFP’s there is a good chance that we could be in for a disappointing print today. That said, NFP has a tendency to surprise and data recently has been anything but predictable given the rapid nature of developments and possible errors in classification.

As reopening plans are put on pause or are being rolled back in areas of the US, a weak report could refocus market fears and drag stocks lower whilst boost the safe haven US Dollar. On the other hand, a strong report, combined with vaccine optimism could see stocks surge towards the weekend.

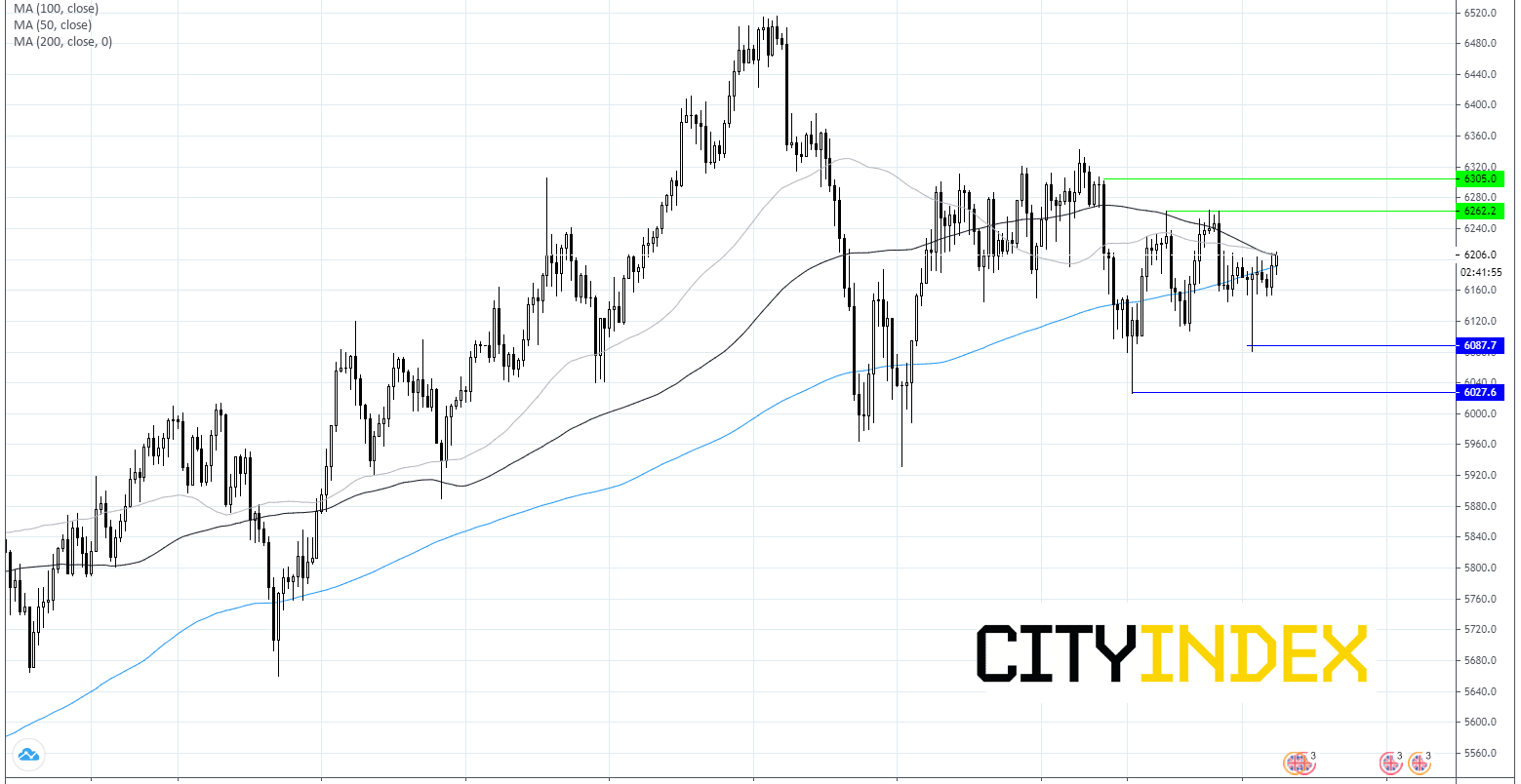

FTSE Chart

Latest market news

Yesterday 08:33 AM