US futures

Dow futures +1% at 31235

S&P futures +1% at 3848

Nasdaq futures +1.2% at 13070

In Europe

FTSE +1.3% at 6568

Dax +0.9% at 13918

Euro Stoxx +1.3% at 3683

Learn more about trading indices

Stocks cheers the covid stimulus bill progress

US stock markets are pointing to a stronger start amid a calmer mood in the bond market and leaving the focus firmly on the US covid stimulus bill which was voted on in the House of Representatives over the week and now makes its way to the Senate where it is expected to be voted on next week.

Calmer bond market

After the bond market rout roiled financial markets last week, the picture is notably calmer this week. The 10 year US treasury yield continued to ease back from its spike higher to 1.6% last week to current levels of 1.43%.

However, speeches by Federal Reserve policymakers John Williams and Lael Brainard could well push the focus back on inflation expectations and the bond market.

Manufacturing PMIs in focus

The latest round of manufacturing PMIs have revealed broadly upbeat readings; China being the notable outlier. China’s Caixin PMI dropped to its lowest level in 9 months, although the market has shrugged off the figures given the likely distortion from the Lunar New Year.

Final PMI’s were upwardly revised across Europe with the Eurozone PMI recording its highest level since 2018 as demand surged.

US ISM manufacturing PMI is due at 15:00 UTC.

FDA approves Johnson & Johnson vaccine

Reopening optimism is adding to the upbeat mood after the US regulators approve the Johnson & Johnson one shot cobid vaccine. This is the third vaccine to receive approval stateside and has the potential to speed up the reopening process dramatically boosting risk sentiment.

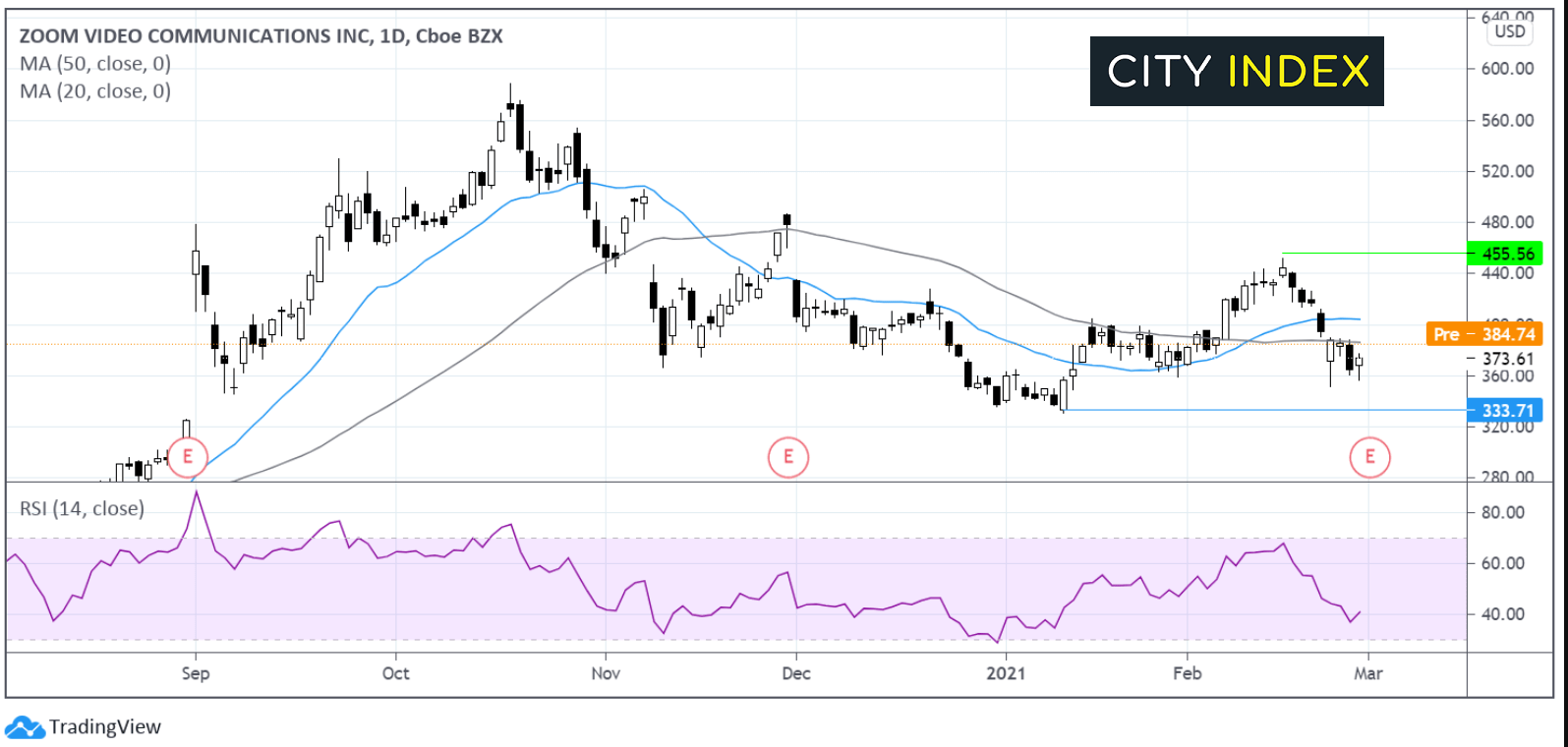

Zoom earnings

One of the main beneficiaries of the pandemic has undoubtedly been Zoom. It’s share price has soared across the year from an IPO price of $36 in late 2019 and valuation of $9 billion to its current price of $370 and a valuation of $120 billion.

Revenue has also surged with Q3 seeing a 367% jump in revenue to $777.2 million, well ahead of the $694 million expected and significantly up from Q1 2020 revenues of just $328 million. The share price has been on the decline since late October’s all time high of $588 as the prospect of a successful vaccine rollout and economies reopening have raised fears that growth will slow. So guidance will be closely eyed. Expectations are for EPS $0.78c.

For more on Zoom's earnings read here

FX – EUR shrugs off accelerating German inflation

The US Dollar is extending 0.6% gains from the previous week. US Dollar Index DXY +0.15% holding above 91.00.

EUR/USD – trades depressed versus the stronger USD despite German inflation accelerating in February. German CPI February jumped 1.7% vs 1% Jan and 1.2% expected. The ECB weekly bond purchases are awaited.

Analyst Fiona Cincotta looks at EU/USD price action and levels to watch here.

GBP/USD trades -0.20% at 1.3906

EUR/USD trades -0.25% at 1.2045

Oil resumes uptrend

Oil along with other risk assets is on the rise at the start of the week owing to the upbeat market mood. Investors continue to cheer the ongoing economic recovery and the prospect of a vaccine led reopening of the economy.

Iran’s rejection of the EU and US’s invitation for direct nuclear talks is also underpinning the price. Iran refuses to restart talks without the US first halting sanctions.

Attention will turn to this week’s OPEC+ meeting with chatter surrounding a production hike increasing.

Fina Cincotta looks at the price action of WTI here.

US crude trades +2% at $62.25

Brent trades +0.4% at $64.81

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

14:30 Markit Manufacturing PMI

15:00 ISM manufacturing PMI

15:00 Construction spending

16:10 ECB Lagarde Speech