European stocks are seen opening higher on Tuesday amid continued optimism surrounding covid vaccines and improving clarity over the political situation in the US as Trump clears the way for Joe Biden.

Three weeks after the US elections, Joe Biden received official acknowledgment that he effectively won the race to the White House. Trump liked the tweet, sending the message that he has come to terms with the election outcome even though he vows to keep fighting it.

The prospect of a disorderly transfer of power has dragged on the market for the past three weeks since the election; a line can now be drawn under this risk.

Vaccine optimism continues

The dominant driving force behind the market has been progress in vaccine development with AstraZeneca announcing yesterday that under a particularly dosage, it vaccine is 90% effective and can be stored at room temperature making it significantly easier to distribute than Moderna and Pfizer’s vaccine.

The dominant driving force behind the market has been progress in vaccine development with AstraZeneca announcing yesterday that under a particularly dosage, it vaccine is 90% effective and can be stored at room temperature making it significantly easier to distribute than Moderna and Pfizer’s vaccine.

Germany’s GDP beat

Adding to the upbeat mood Germany’s final reading for Q3 GDP printed at 8.5% QoQ ahead of the 8.2% expected and an impressive recovery from Q2’s historic 9.7% contraction. However, following yesterday’s disappointing PMIs, which points to a double dip recession, the GDP figures seem out of date. More attention could be paid towards German IFO due to be released shortly.

Adding to the upbeat mood Germany’s final reading for Q3 GDP printed at 8.5% QoQ ahead of the 8.2% expected and an impressive recovery from Q2’s historic 9.7% contraction. However, following yesterday’s disappointing PMIs, which points to a double dip recession, the GDP figures seem out of date. More attention could be paid towards German IFO due to be released shortly.

Airlines soar as quarantine cut

Lockdown restrictions in Europe are still very much in place but there is talk of these easing which is offering support to sentiment. Aviation stocks, which have been one of the worst hit sectors across the crisis continue to post a strong recovery. News that the UK government is offering tests as a way to cut quarantine periods could give travel a boost over the Christmas period. IAG trades +4.4%

Lockdown restrictions in Europe are still very much in place but there is talk of these easing which is offering support to sentiment. Aviation stocks, which have been one of the worst hit sectors across the crisis continue to post a strong recovery. News that the UK government is offering tests as a way to cut quarantine periods could give travel a boost over the Christmas period. IAG trades +4.4%

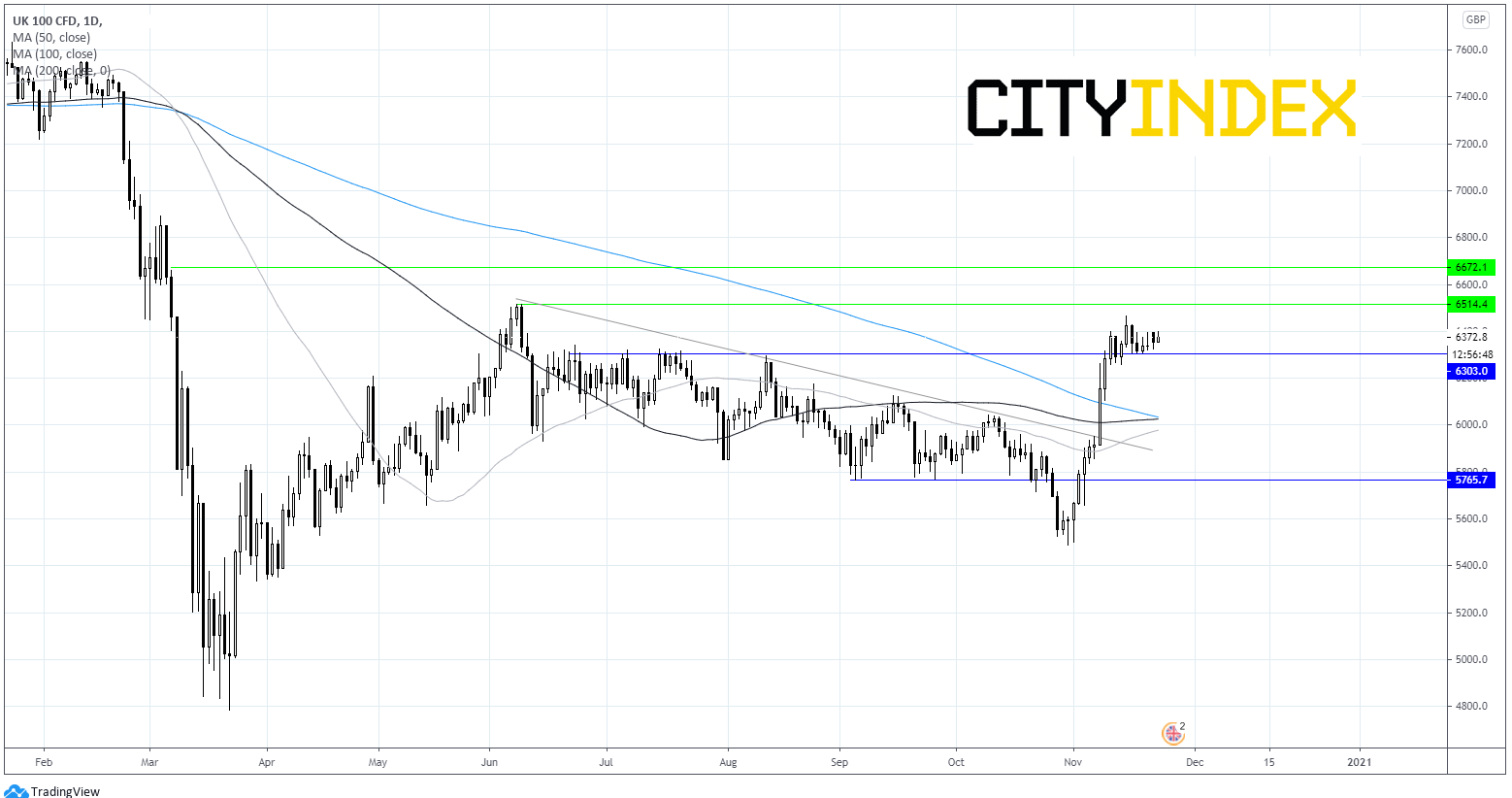

FTSE Chart

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM