The South African Reserve Bank (SARB) meets on Thursday this week to decide how much it should raise interest rates. Expectations are for a 25bps hike to 4.25%, however it is possible the central bank may hike 50bps in the wake of the sudden explosion is commodities, specifically oil, since the beginning of the Russia/Ukraine war. The last time the SARB met was in January, before the invasion began and it hiked 25bps. It has now hiked rates by 25bps at each of its last 2 meetings. Ahead of the meeting on Wednesday, South Africa will release February’s CPI report. Expectations are for 5.8% YoY vs 5.7% YoY in January. If the inflation reading comes in hotter than expected, will the SARB hike by more the 25bps?

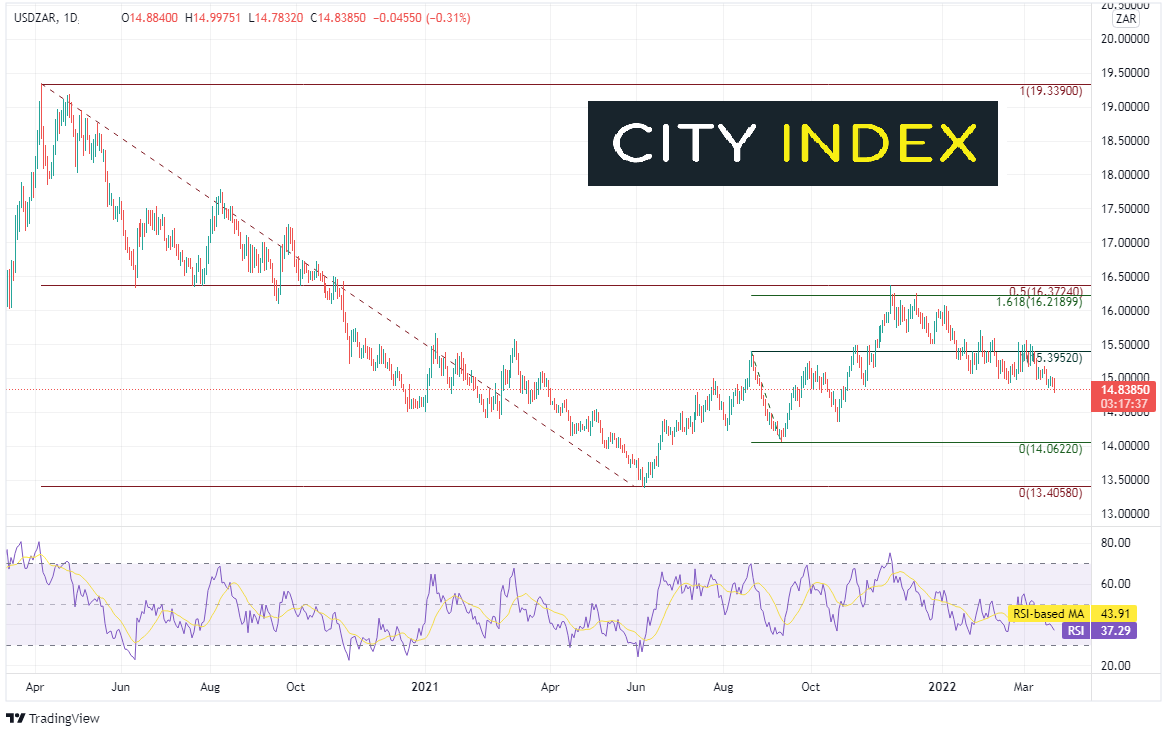

USD/ZAR has been moving lower since making a high in March 2020 near 19.3390. The pair pulled back and made a low on January 8th, 2021 at 13.4058. USD/ZAR then bounced to the 50% retracement level from that timeframe near 16.3724 on November 26th, 2021. This was also the 161.8% Fibonacci extension from the high of August 20th, 2021 to the low of September 10th, 2021. The pair has been moving lower since.

Source: Tradingview, Stone X

Trade USD/ZAR now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

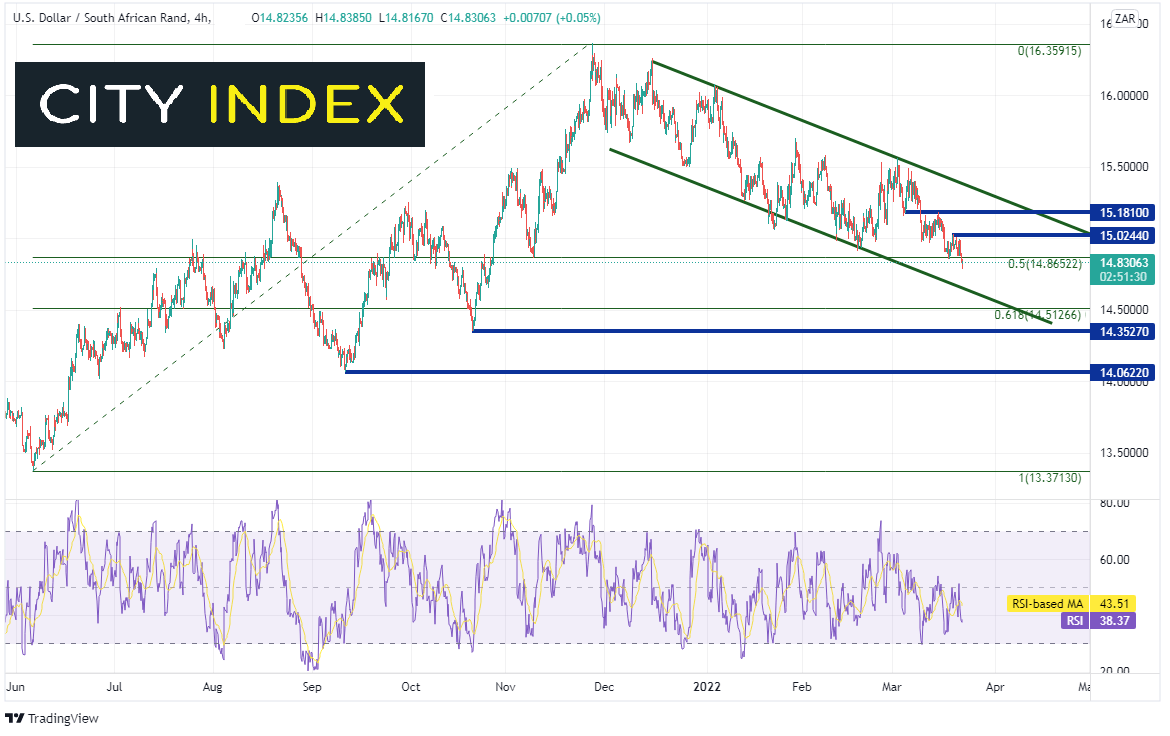

On a 240-minute timeframe, USD/ZAR has been moving lower in an orderly channel since the November 26th, 2021 highs. On Tuesday, the pair broke below the 50% retracement level from the low of June 4th, 2021 to the November 26th, 2021 highs, near 14.4127. Support below is at the bottom trendline of the channel near 14.6500, then the 61.8% Fibonacci retracement level from the recently mentioned timeframe near 14.5127. Horizontal resistance is above at 15.0244 then again at 15.1810. Above there, resistance is at the top, downward sloping trendline of the channel near 15.3800.

Source: Tradingview, Stone X

The South African Reserve Bank meets on Thursday and is expected to hike rates by 25bps. However, on Wednesday, South Africa will release CPI. Whether the central bank raises rates by 25bps or 50bps may depend on the outcome of the CPI report!

Learn more about forex trading opportunities.