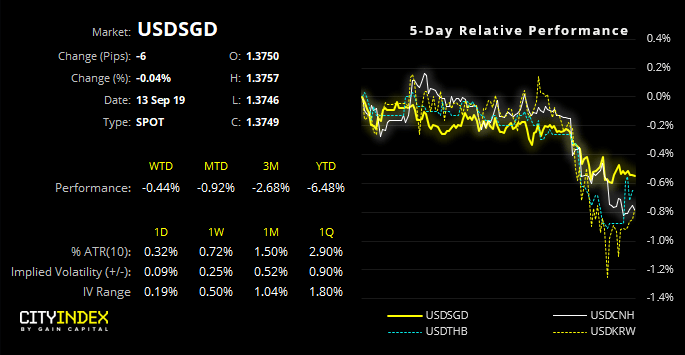

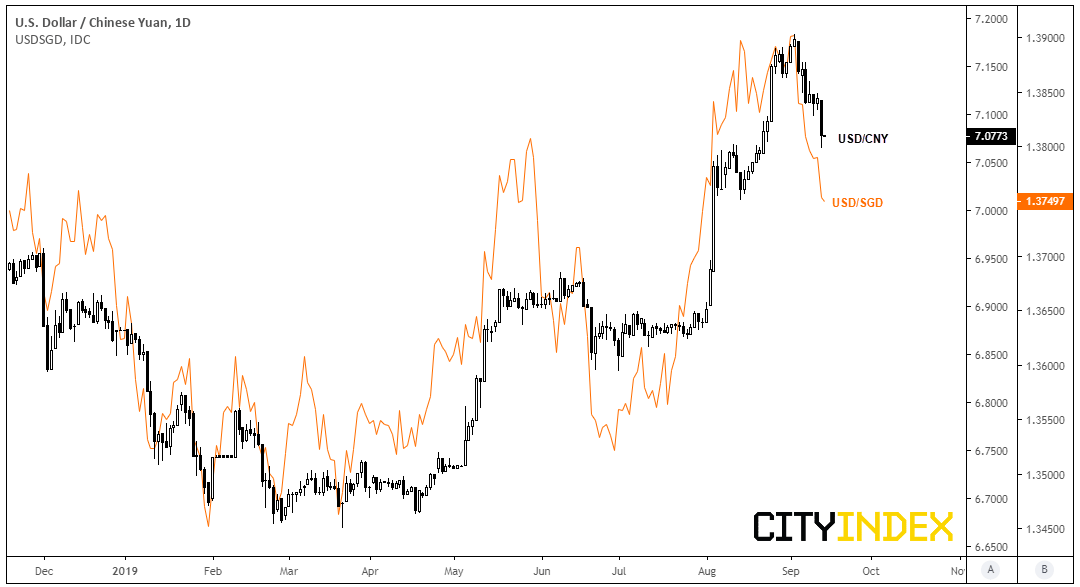

Having reached support, we’re looking for a potential swing trade short should a lower high form. Last week we highlighted the potential for the Yuan appreciate and suggested a bearish theme for USD/SGD as it correlates very well with USD/CNY. Since the original analysis, the Yuan has strengthened, which has seen USD/CNY fall over 1% and USD/SGD track it lower.

Given that trade tensions have continued to thaw, talks are back on and both US and China are seemingly exchanging good will gestures ahead of China’s 70th birthday celebrations, it’s likely Beijing (sorry.. the ‘markets’) will continue to allow the Yuan to appreciate. Which keeps the bearish UD/SGD theme on the table

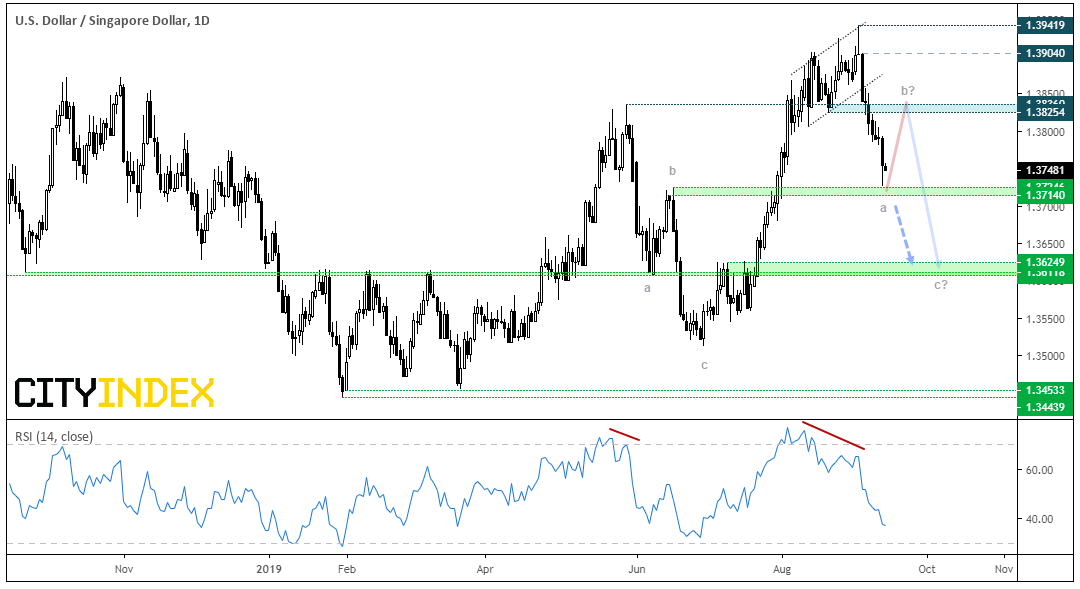

We can see on the daily chart that USD/SGD’s decline has found support just above the 1.3114/24 support zone. As of yesterday’s close, bears have enjoyed 8 consecutive down days, making it the longest daily bearish streak since January 2018. Therefor it’s possible we could see prices consolidate or retrace before its next leg lower. However, RSI is not oversold and there are no signs of a bullish divergence on this timeframe, so we suspect there is plenty of downside potential should it break below 1.3700.

Interestingly, the decline from September’s high displays a similar velocity to the initial leg lower from the May high. If history were to repeat and maintain a similar structure to the 3-wave move in June, we could see prices rebound to 1.3825 before falling down towards 1.3620. Of course, as the saying goes “history doesn’t repeat but it does rhyme”, it’s unlikely we’ll get an identical move. But we can monitor to see if prices form a lower high before considering a swing trade short, or wait for prices to break below support before assuming a run for the 1.3620 area.

Related analysis:

A Stronger Yuan Could See USD/SGD Drop