USD/SEK: Will Sweden’s “Herd Immunity” Strategy Backfire?

Across the globe, different countries are taking different approaches to managing their own experiences with the COVID-19 pandemic, running the gamut from the aggressive testing and medical intervention of South Korea to the UK’s brief experiment with continuing “business as usual” in an effort to accelerate “herd immunity.”

Of course, the UK quickly abandoned its herd immunity strategy in favor of the more common “flatten the curve” mantra of other developed nations, but one Western country is leaving its malls, restaurants, and ski resorts open: Sweden. As detailed by The Wall Street Journal earlier this week, the country is relying on “voluntary advice and a big dose of hope” to limit the spread of the virus in contrast to the more aggressive mandates and interventions of other developed nations.

Based on the early results, which show the country’s death toll increasing by approximately 25% per day (up to nearly 60 as of yesterday and doubling every 2-3 days), Sweden’s approach to “managing” the virus may ultimately prove to be a colossal mistake for both its populace and its economy. Traders who agree may want to explore short positions in the Swedish krona (SEK), and when it comes to the FX market, no currency is in more demand that the US dollar.

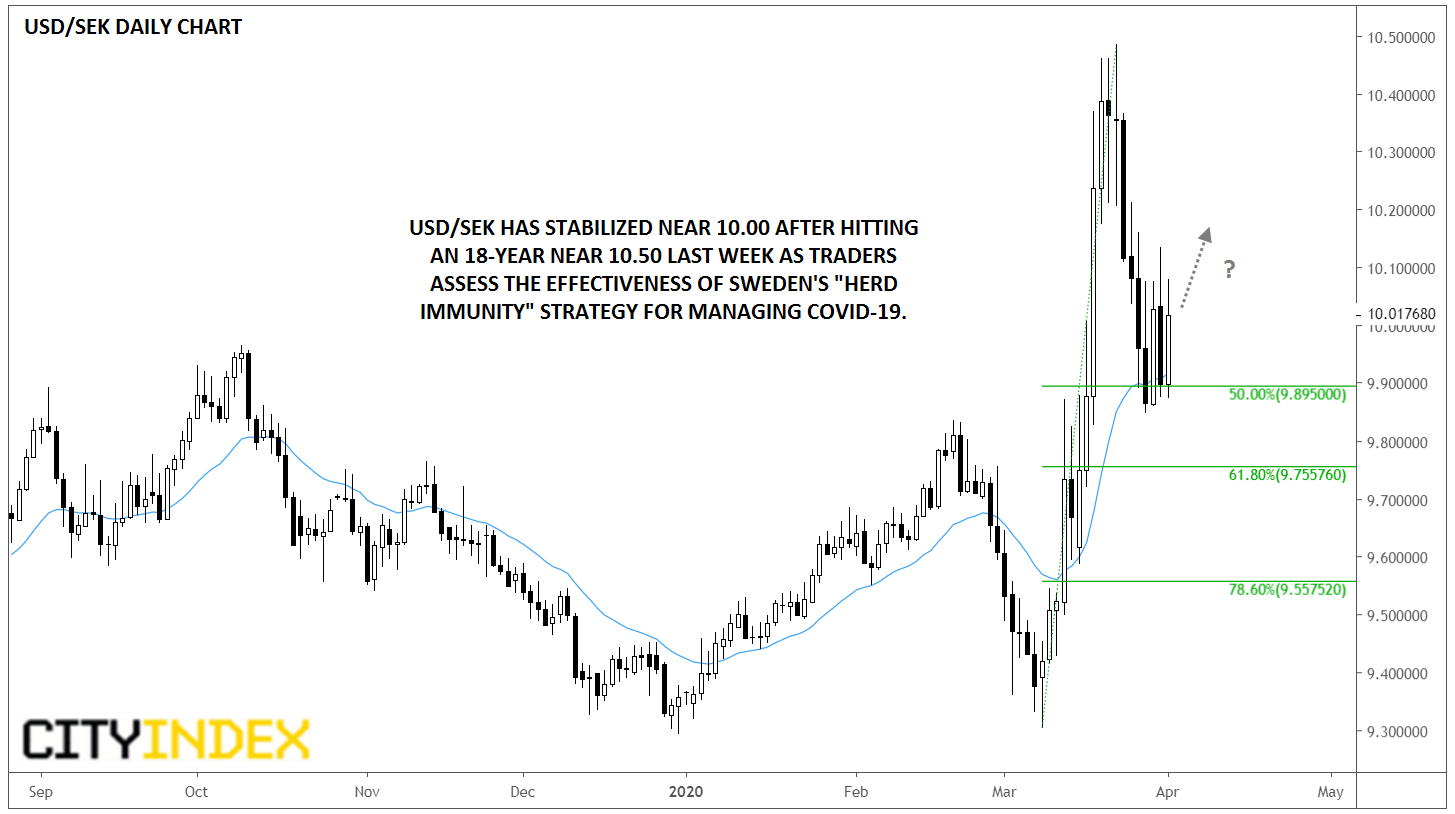

From a technical perspective, USD/SEK tagged an 18-year high near 10.50 last Monday before ultimately falling every day that week to retrace 50% of the mid-March surge. So far this week, rates have stabilized above that 50% level and the 21-day exponential moving average, suggesting that bulls are aggressively defending the 9.90 area:

Source: TradingView, GAIN Capital

If the public health/economic toll in Sweden continues to surge, USD/SEK could resume its recent uptrend and retest the March highs at 10.50, if not beyond that, in the coming days and weeks. Of course, a break below last week’s low near 9.85 could indicate that Sweden’s unconventional is effective and could open the door for USD/SEK to drop toward the Fibonacci retracements at 9.75 (61.8%) or 9.55 (78.6%) as we move through April.