USD/SEK Nearing All Time Highs

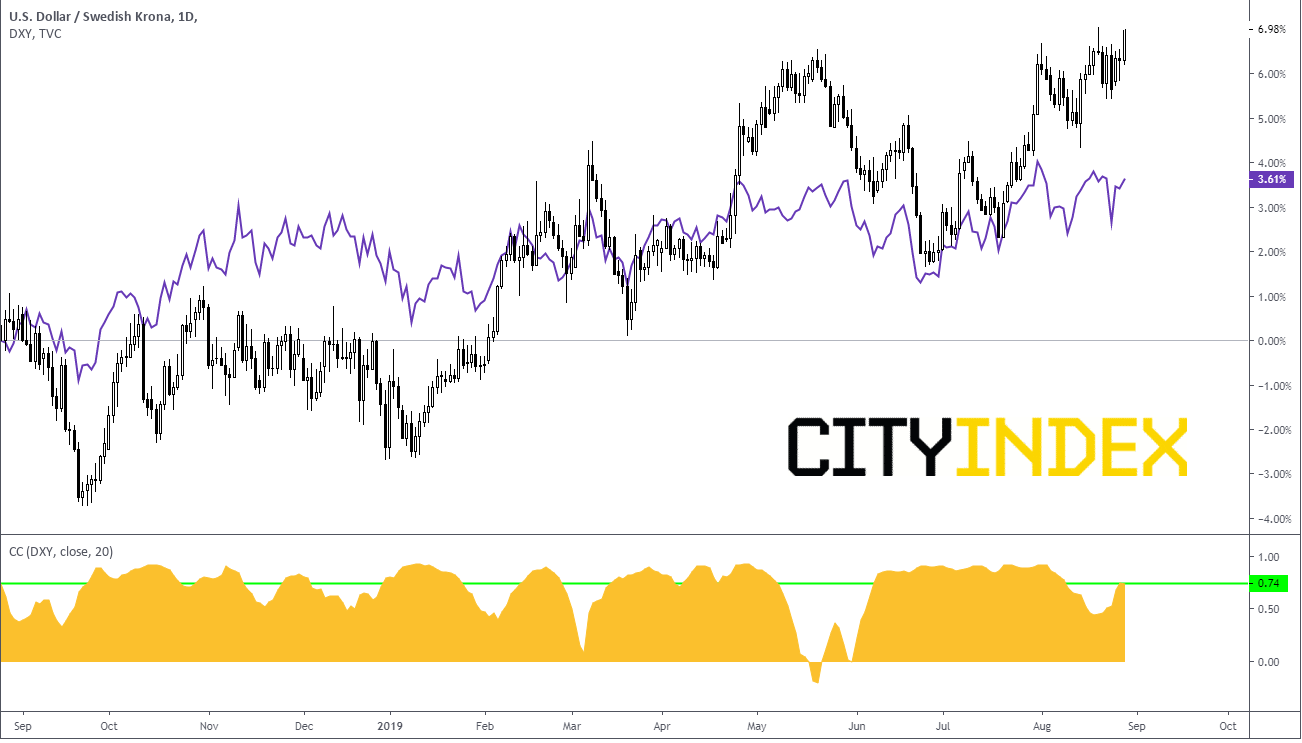

The Swedish Krona generally moves inversely to the US Dollar. That is to say that generally, as the DXY moves higher, so does the USD/SEK. Looking at the correlation coefficient, the correlation between the USD/SEK and the DXY is .74. However, over the past year, the USD/SEK is up almost 7% while the DXY is up only 3.61%.

Source: Tradingview, City Index

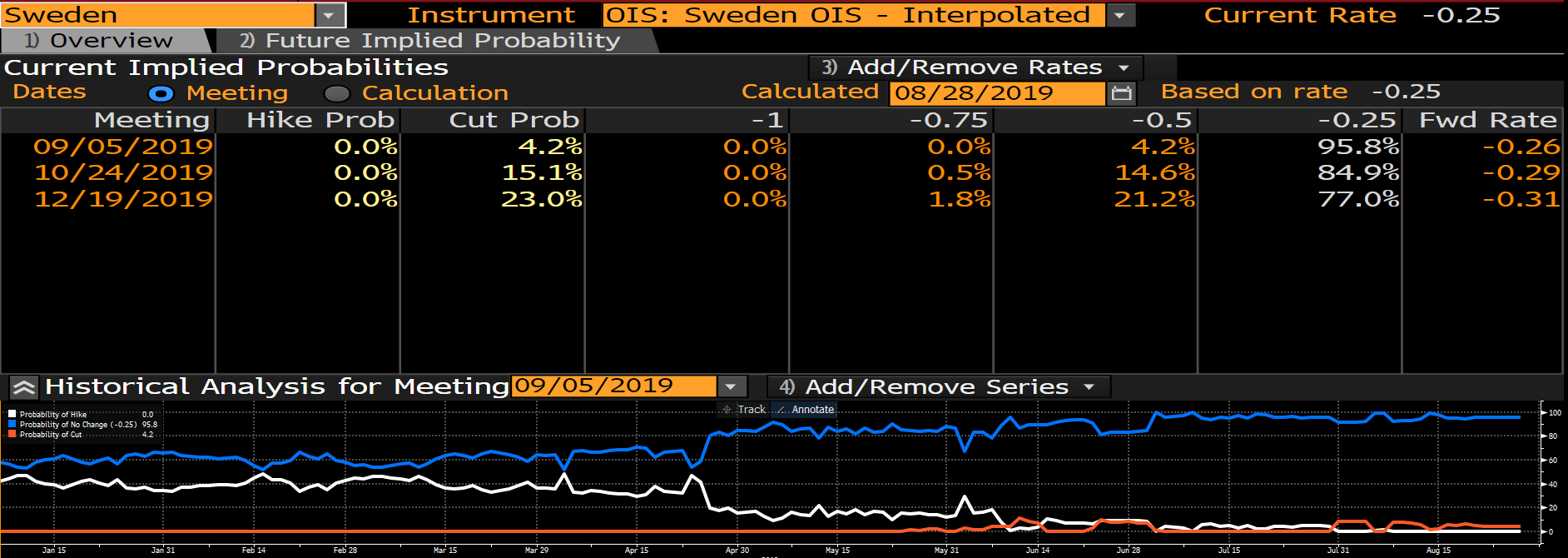

The USD/SEK currently looks ready to break to all-time highs. One reason for the move is that although the key repo rate stands at -0.25%, there are concerns in the market that the Riksbank may have to maintain their neutral bias for longer than previously expected. The market is indicating a 95% chance the Riksbank will hold rates steady at their next meeting on September 5th, an 85% chance they will hold steady in October, and a 77% chance they will hold rates steady in December. At the July meeting, they were indicating a possible hike later this year.

Source: Bloomberg

Another reason for the move higher in USD/SEK is that as with much of Europe, Sweden’s 10-year bond yield is negative, today at -0.37. The US 10-year bond yield is 1.47. This interest rate differential is causing the US Dollar to strengthen vs the Swedish Krona.

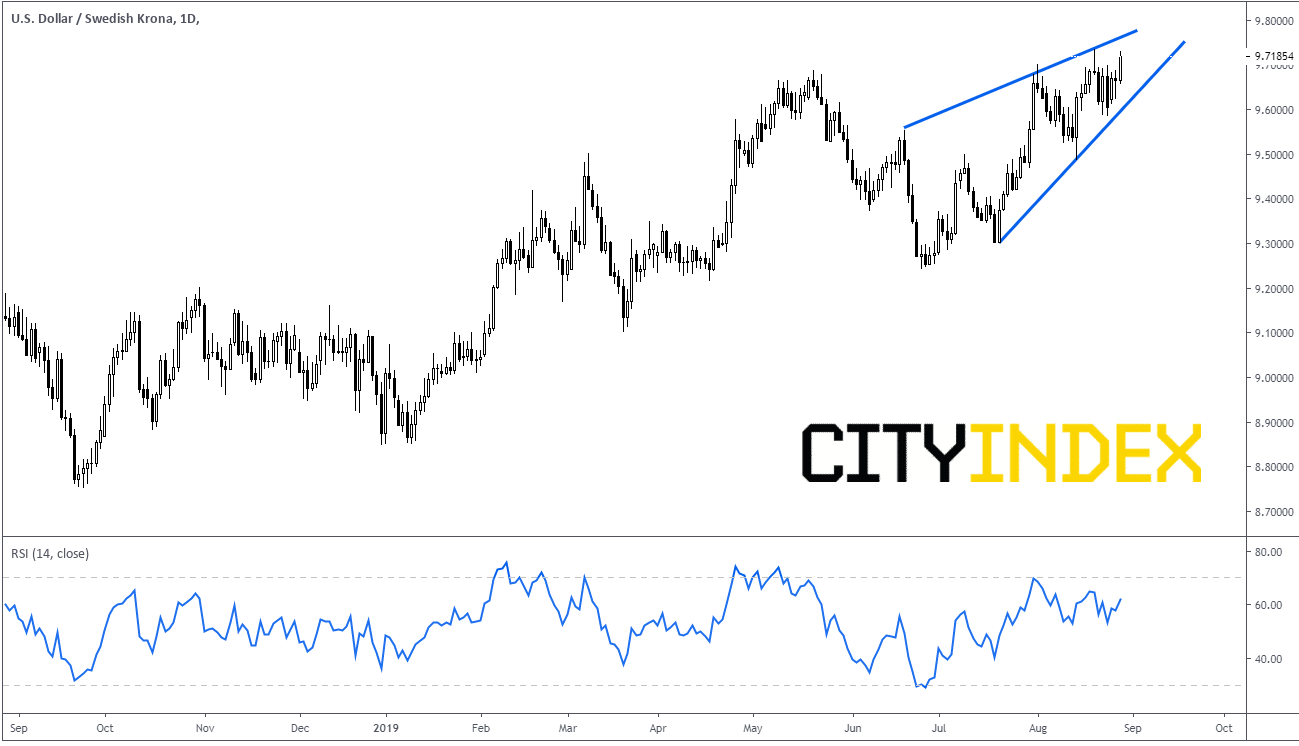

A daily Chart shows that although USD/SEK is trading in a rising wedge near 9.72, there is still room to move higher within the wedge (a break of the bottom trendline of the wedge would indicate a move lower). The top trendline comes in near 9.76. In addition, there is still room for the RSI to move higher, as it currently stands at 62. Overbought conditions are considered to be above 70. This means that there is still more USD/SEK buying that can occur before the RSI is considered overbought.

Source Tradingview. City Index

Over the next two weeks, perhaps there may be some volatility in USD/SEK as the Riksbank meeting gets closer. However, in general the trend is higher, and barring any impactful headlines, conditions have not been met yet to look for a strong pullback.