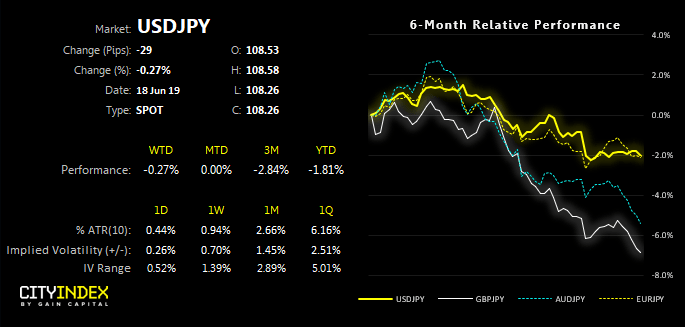

[Video] USD/JPY: Resistance Zone Holds Ahead Of Key FOMC Meeting

We’ve been patiently monitoring corrective price action on USD/JPY in hope of it confirming a swing high. With an FOMC meeting on tap, the meeting could spark the volatility required to make or break the bearish bias.

We can see on the daily chart the USD/JPY has had a decent relationship with the 50% retracement level during its downtrend. We previously highlighted a likely resistance zone bears could fade into, by using the 38.2% and 50% retracement levels below 109. Indeed, whilst the correction has dragged on a little, the area continues to hold as resistance. Furthermore, we’ve seen a few upper spikes within the zone to show a reluctance to push higher.

Of course, we have the FOMC meeting and this is currently capping volatility. As my colleague Fawad Razaqzada pointed out in his Week Ahead report, a consensus is growing they’ll use tomorrow’s meeting to guide markets towards a July cut. At the time of writing, markets are pricing in a 20.8% chance of a cut tomorrow and a 67.9% chance of a cut in July. And, with USD/JPY rising into resistance, the FOMC meeting could provide the catalyst for a swing trade short if they deliver a dovish hold tomorrow.