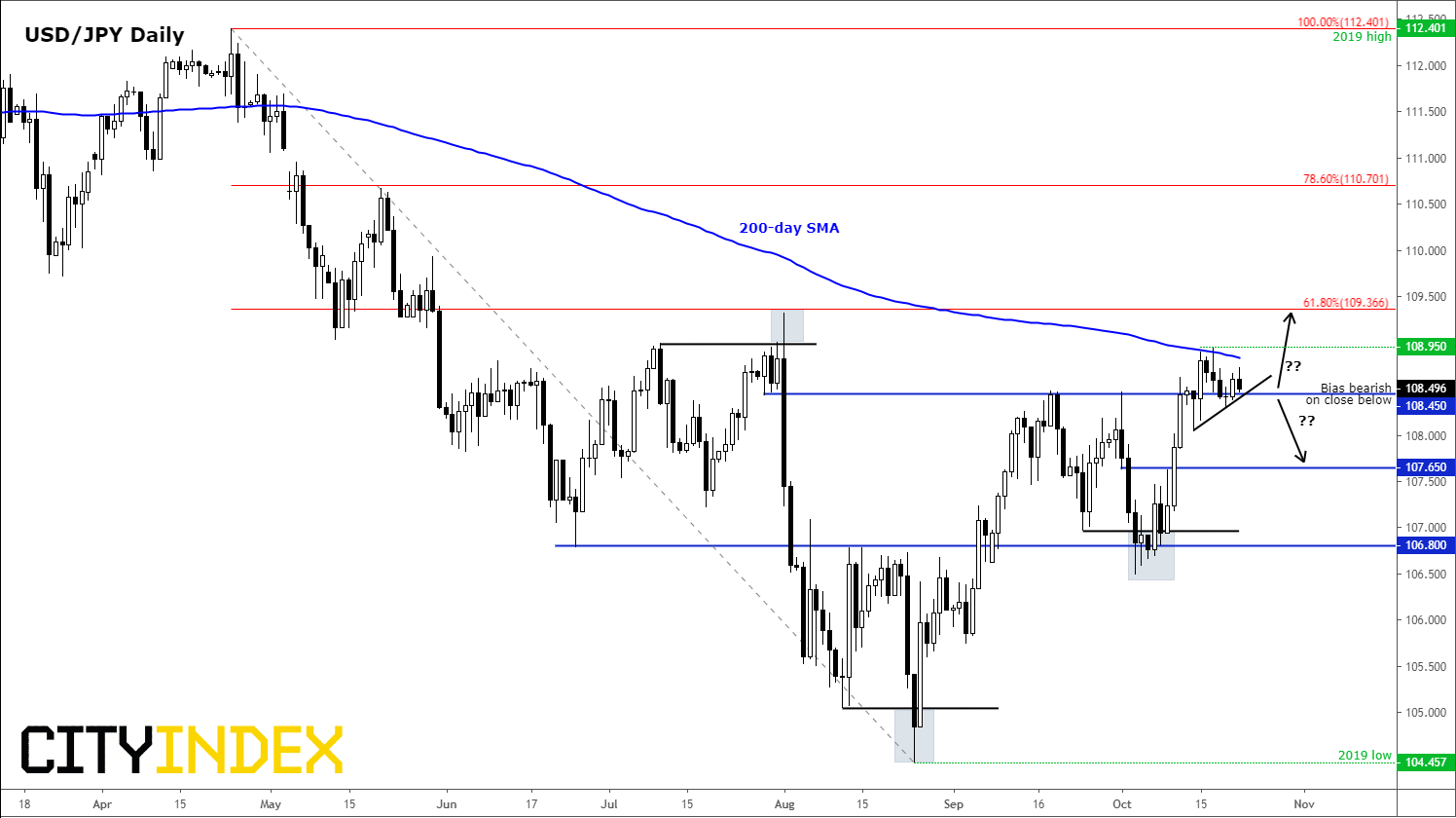

Today I am once again drawn to the USD/JPY’s price action. Not that it has moved a lot – far from it – but because there is the potential for a sharp, technically-driven, move. As mentioned, rates haven’t moved much higher after breaking through 108.45 key resistance last Tuesday. The USD/JPY managed to make a high so far of 108.95, before returning back to this breakout level. Its next move will be important so far as the technical considerations are concerned:

- If the USD/JPY manages to cling onto the 108.45 today and posts a bullish-looking daily candle here, then that would suggest the buyers are happy to remain in control. As such, they may go on to drive the exchange rate higher, possibly beyond the 200-day average and recent high of 108.45, over the coming days. There is even the potential that the UJ could go on to achieve much higher levels over time.

HOWEVER:

- If the bulls fail to sustain the breakout, then the long-term bearish trend could resume here. So, watch out for a potential closing break below the 108.45 level today or in the coming days. The deeper the potential close away from this level, the better it would be for the bears. If this scenario plays out, rates could drop to the next potential support at 107.65 or possibly go on to re-test the more significant 106.80 level next.

Source: Trading View and City Index.

So, the USD/JPY is currently trading around a pivotal technical juncture. This means that whichever direction it eventual goes, there may well be some momentum behind it which could potentially lead to a sharp move in that direction. While the underlying trend is still arguably bullish for this pair, the bigger move may come if the breakout fails. Remember, false breaks often lead to fast moves in the opposite direction.