In a continuation of the trend that was 2020, the previously unthinkable has unfolded as supporters of outgoing US President Donald Trump broke into the US Capitol Building, while Congress was in session, forcing evacuations and resulting in one fatality.

Images of the ultimate symbol of American democracy under siege have prompted world leaders to call for calm and a “peaceful and orderly transfer of power”. The hope now is that the final chapter of a contentious US election will soon be closed by Joe Biden's formal confirmation.

For traders, this would mean they can go about the business of repricing asset classes following the surprise win by the Democrats in the Georgia Senate runoff, which gives the Democrats control of both chambers of Congress.

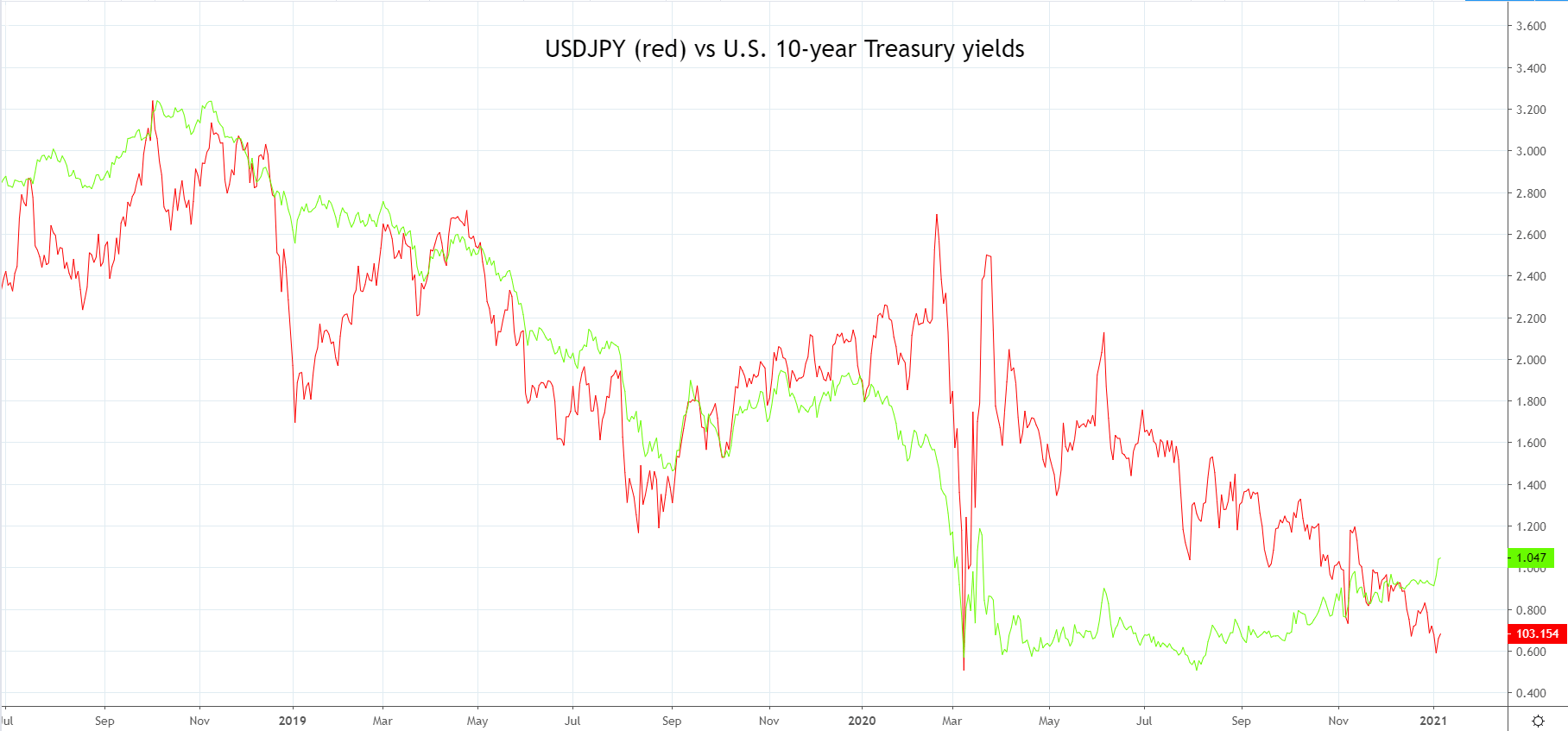

The delayed Democratic “Blue Sweep” increases prospects of further fiscal stimulus and limited tax increases, and prompted US 10 year yields to close 8bps higher overnight - back above 1% for the first time since mid-March 2020.

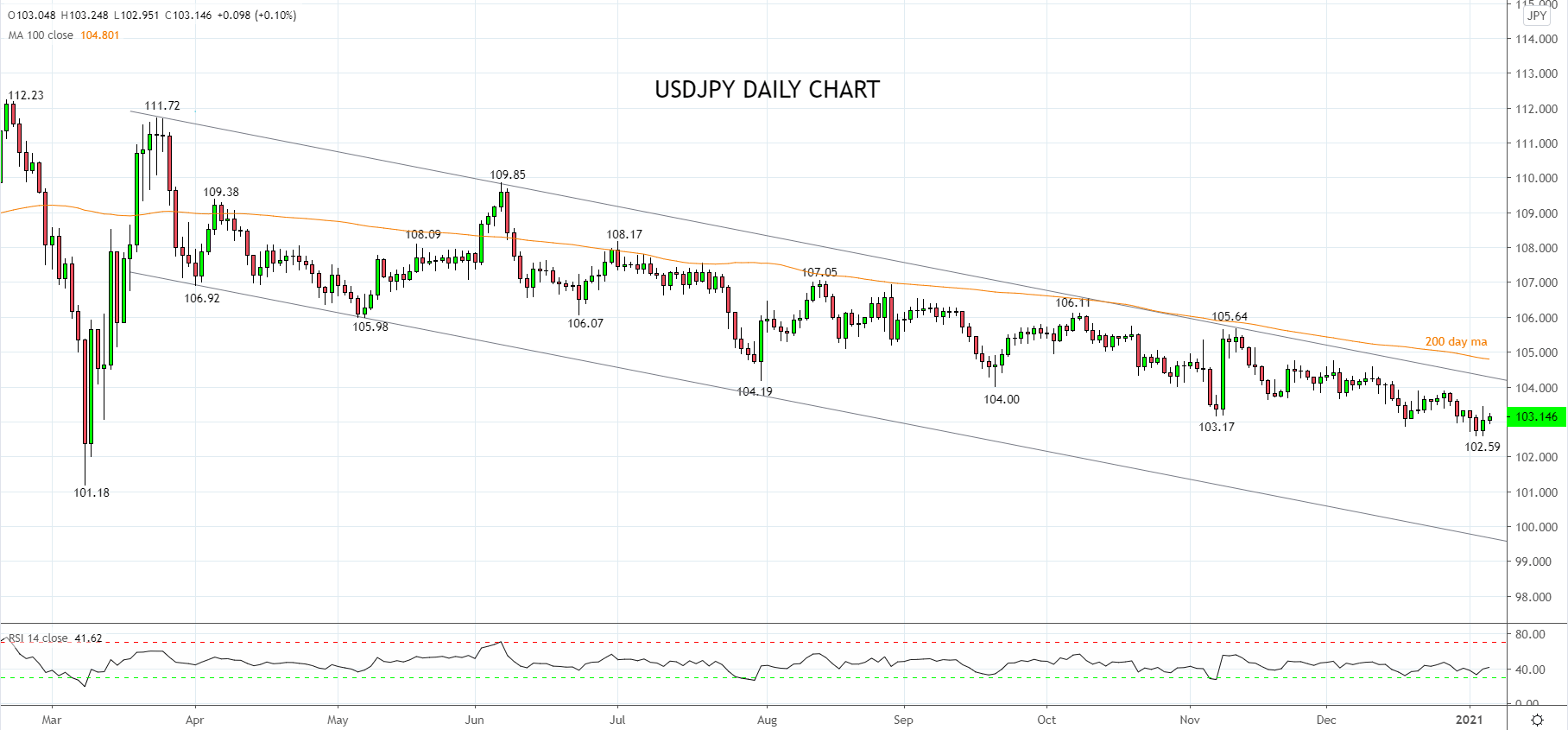

The rally in US yields has provided some relief to USD/JPY that has spent the last nine months trading within a downtrend from the 111.72 March 2020 high. Despite the dominant downtrend the value in trading USD/JPY from the short side at current levels, ahead of very strong weekly support 102.00/101.00 area appears limited.

Rather after the formation of a potential double low this week at 102.59 and supported by the rally in U.S yields, there appears to be scope for USD/JPY to rally towards recent highs 103.70/90 area in line with the chart below.

If US 10 year yields were to continue higher again into the 1.10/1.15% region, it would then open the way for USD/JPY to push towards the band of resistance 104.30/82, coming from trend channel resistance (104.30) and the 200-day moving average (104.82).

Source Tradingview. The figures stated areas of the 30th of December 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation