USD/JPY Leaves Blood on the Street Heading into Halloween Night

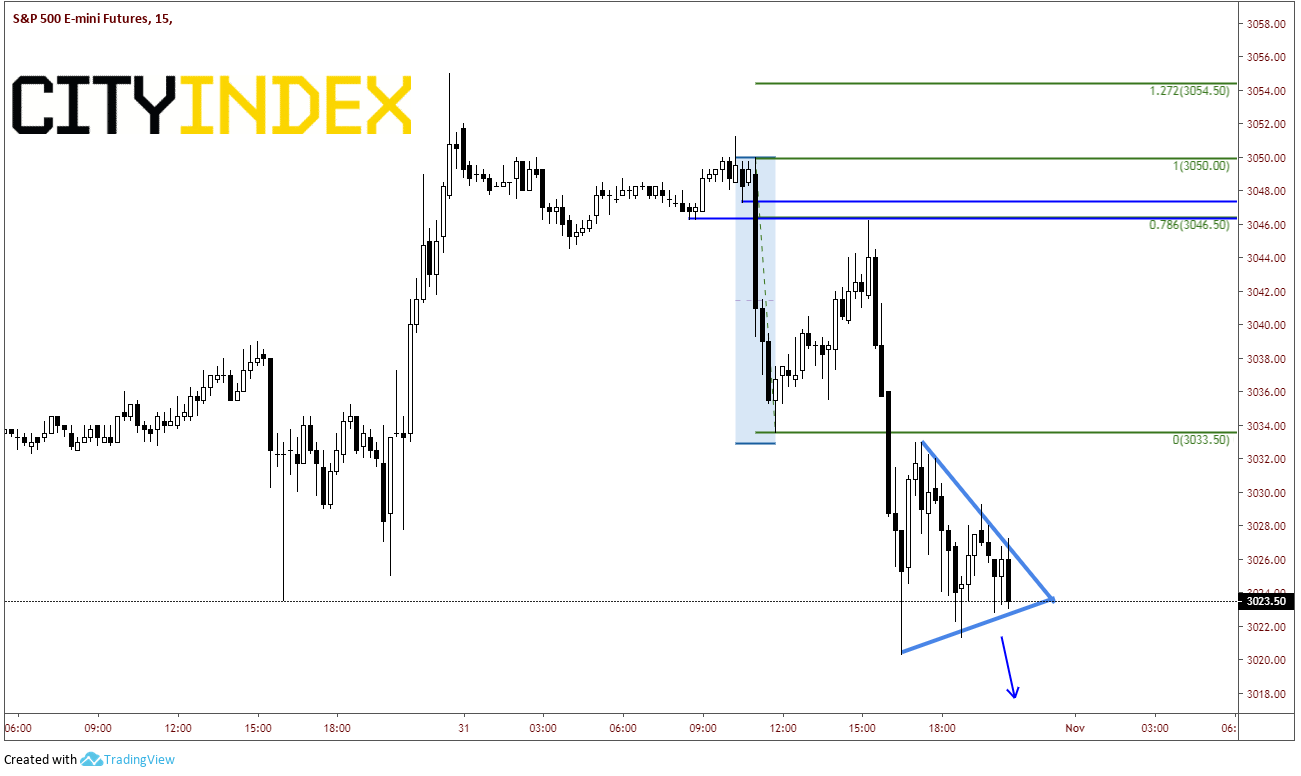

As we discussed earlier on the week, USD/JPY and stocks are highly correlated. As stocks scream higher, so does USD/JPY. The same is true for the reverse. When stocks get killed, so does USD/JPY. With Halloween (coincidentally) on October 31st in the US, its no surprise to see sharp moves into the close, as large funds often need to rebalance their portfolios into month end. Stock longs appear to be scared to death and running for the exits into the Halloween night.

Source: Tradingview, CME, City Index

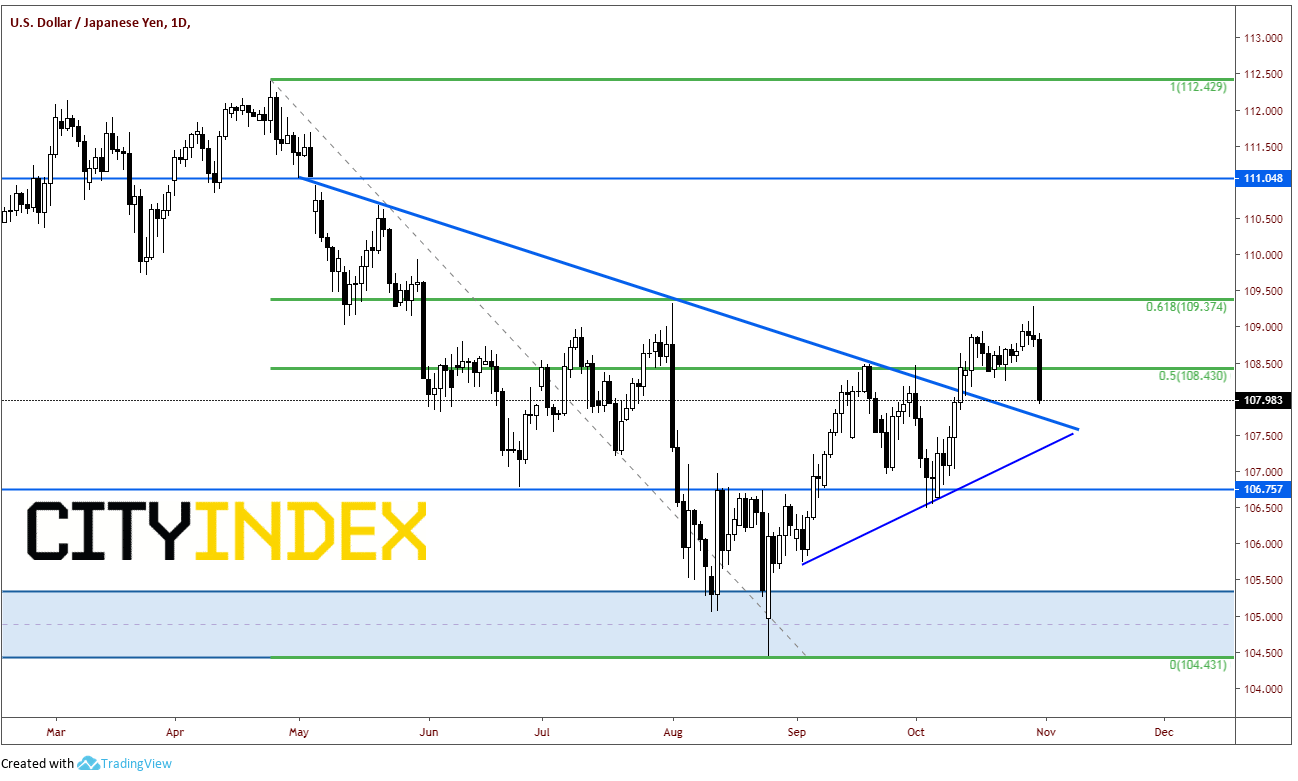

As such, USD/JPY is getting slaughtered itself, off almost 100 pips from today’s highs and slicing through support like a knife through…well, you know. Yesterday’s shooting star formation on a daily time frame should have cautioned USD/JPY longs as it reversed right at the 61.8% Fibonacci retracement level from the highs on April 23rd to the lows on August 26th. The pair is close to testing its recent breakout of the downward sloping trendline from May 3rd, near 107.75.

Source: Tradingview, City Index

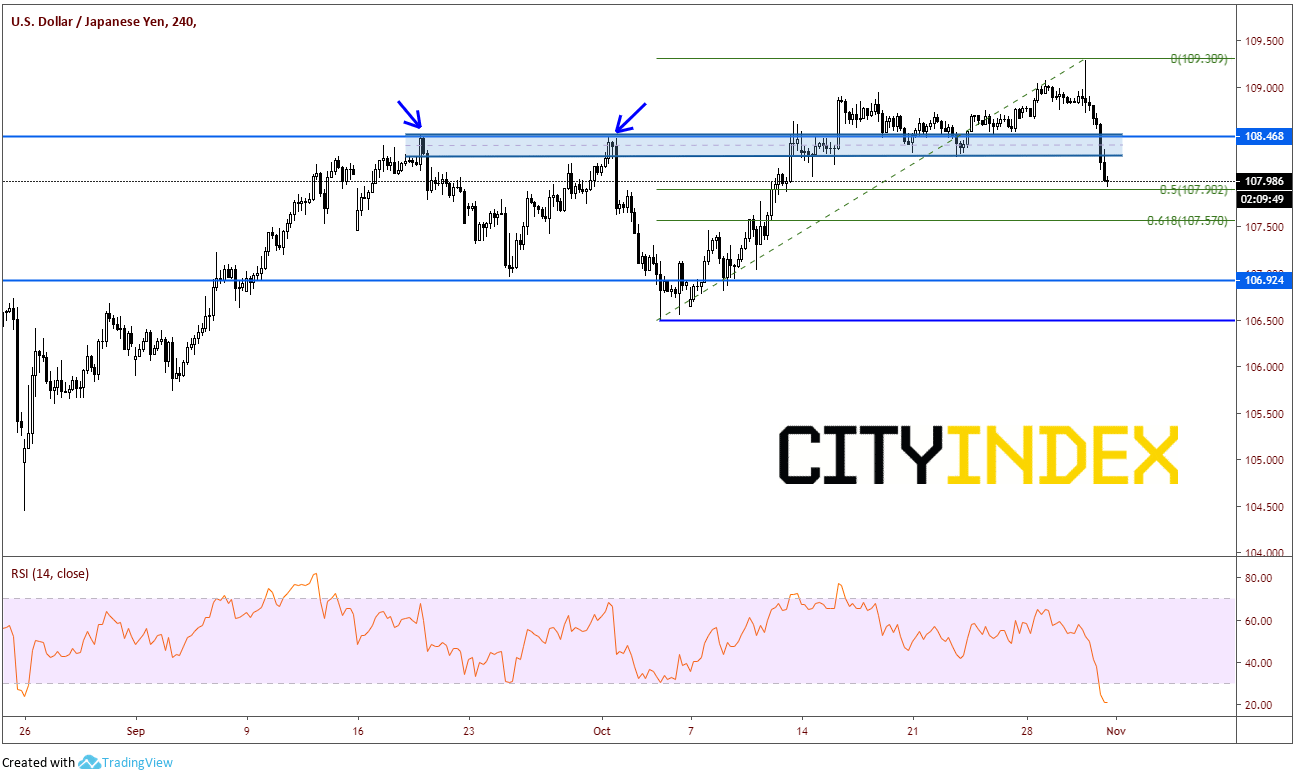

On a 240-minute chart, one can see how USD/JPY didn’t even pause at a strong support zone between 108.25 and 108.50. However, the pair did stall at the 50% retracement from the low on October 3rd to the high at 109.30, which is 109.90. The trendline support mentioned on the daily chart at 107.75 is the next level of support. The 61.8% retracement of the same time period is at 107.57, which is also near the upward sloping trendline on the daily. Below that, USD/JPY could slice through the neckline of the double top pattern at 106.92 and drop to the lows from October 3rd at 106.50! Caution the oversold RSI, which may need to unwind if the pair decides to move lower. Resistance is above at the 108.25/50 level, and then todays highs at 109.28.

Source: Tradingview, City Index

But tomorrow is a new day. And those that have survived the night will be around for Non-Farm Payroll data in the morning. For those still around today and participating, have a Happy Halloween.