USD/JPY intraday breakout

USD/JPY intraday breakout

The US Dollar was bearish against most of its major pairs on Tuesday with the exception of the CHF and JPY. On the economic data front, no major economic data was released.

On Wednesday, the Mortgage Bankers Association's Mortgage Applications for the week ending May 29th are expected. Automatic Data Processing's Employment Change for May is expected to decline to -9,000K on month, from -20,236K in April. Factory Orders for April are expected to fall 13.4% on month, from a revised -10.4% in March. Finally, Durable Goods Orders for the April final reading are expected to remain at -17.2% on month, in line with the April preliminary reading.

The Euro was mixed against all of its major pairs. In Europe, in the U.K., the Nationwide Building Society has published its house price index for May at -1.7% (vs -1.0% on month expected). The Bank of England has released the number of mortgage approvals in April at 15,800 (vs 24,000 expected).

The Australian dollar was bullish against all of its major pairs.

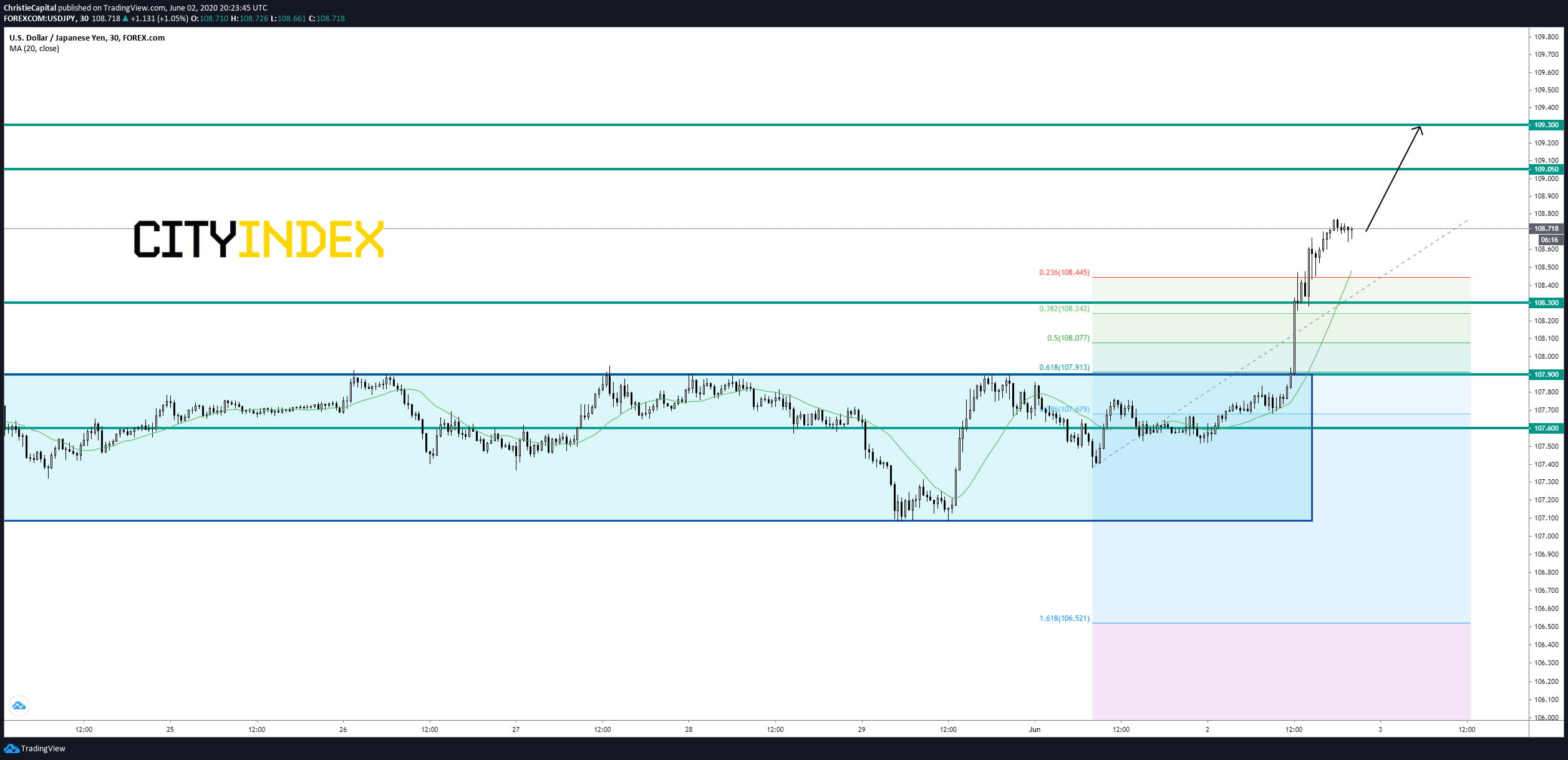

Looking at active majors, USD/JPY jumped 110 pips to 108.69 the day's range was 107.51 - 108.77 making the pair one of the most active in Tuesday's trading. Price action broke above a consolidation pattern in place since May 20th. As long as price action remains above the 20-period moving average look for a continuation higher riding the trend. Traders that are bullish might want to consider a stop-loss near the 108.30 support area with targets of 109.05 and 109.30 in extension. A break below 108.3 support may move the pair down back into a consolidation.

Source: GAIN Capital, TradingView

Happy trading.

The US Dollar was bearish against most of its major pairs on Tuesday with the exception of the CHF and JPY. On the economic data front, no major economic data was released.

On Wednesday, the Mortgage Bankers Association's Mortgage Applications for the week ending May 29th are expected. Automatic Data Processing's Employment Change for May is expected to decline to -9,000K on month, from -20,236K in April. Factory Orders for April are expected to fall 13.4% on month, from a revised -10.4% in March. Finally, Durable Goods Orders for the April final reading are expected to remain at -17.2% on month, in line with the April preliminary reading.

The Euro was mixed against all of its major pairs. In Europe, in the U.K., the Nationwide Building Society has published its house price index for May at -1.7% (vs -1.0% on month expected). The Bank of England has released the number of mortgage approvals in April at 15,800 (vs 24,000 expected).

The Australian dollar was bullish against all of its major pairs.

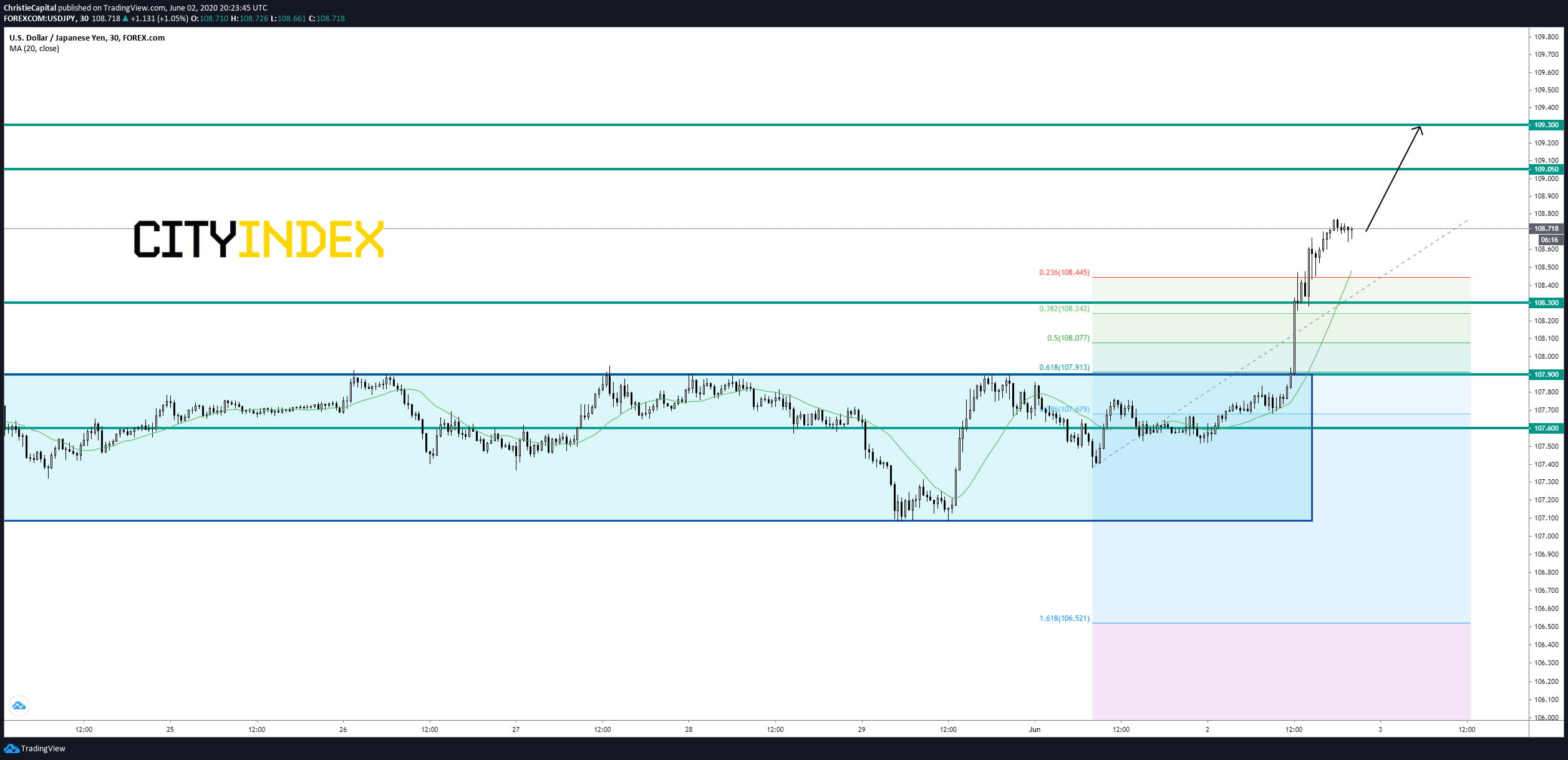

Looking at active majors, USD/JPY jumped 110 pips to 108.69 the day's range was 107.51 - 108.77 making the pair one of the most active in Tuesday's trading. Price action broke above a consolidation pattern in place since May 20th. As long as price action remains above the 20-period moving average look for a continuation higher riding the trend. Traders that are bullish might want to consider a stop-loss near the 108.30 support area with targets of 109.05 and 109.30 in extension. A break below 108.3 support may move the pair down back into a consolidation.

Source: GAIN Capital, TradingView

Happy trading.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM