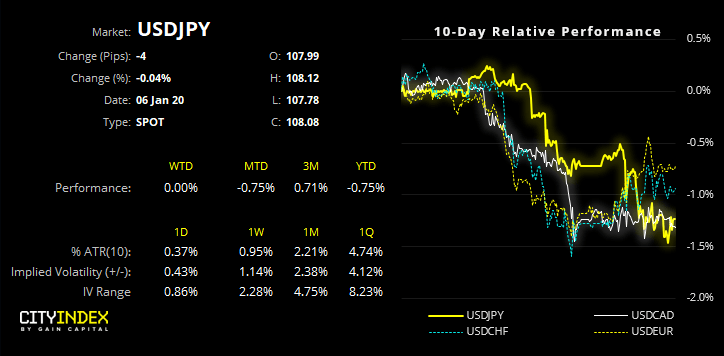

As noted earlier, there were some impressive gaps at this week’s open for gold, WTI and S&P futures after a slew of headlines over the weekend saw tensions in the Middle East escalate further. Yet it’s worth noting that the gap didn’t make it over to USD/JPY, despite then yen being clearly bid on Friday.

So, what does this suggest? If bad news didn’t make it drop, then it could leave USD/JPY vulnerable to a corrective bounce if markets (somehow) revert to risk-on. Although it may not even require risk-on to take over, as bears may be tempted to close out if tensions don’t escalate further from here, would which help lift USD/JPY from its lows.

However, it’s too soon to be complacent and assume all is well and also its plausible that market’s haven’t fully priced in the magnitude of these events. Therefore, our core view if for USD/JPY to break to new low, but for now we’re left wondering how large a corrective bounce we could be in for, ahead of its next bearish leg. Watch today’s video for the key levels we’re watching.

Related Analysis:

It's Gap Galore Around Middle East Tensions | Gold, SPX, WTI

Gold – A Thing of Beauty

OIL MARKET WEEK AHEAD: Iran’s Possible Scenarios