USD/JPY Fades Pfizer Move, but May Be Ready for a Bounce

The positive Pfizer vaccine news from last Monday caused a spike in USD/JPY, as the pair moved from 103.30 up to 105.35, a gain of 205 pips! However, as shown by the price move in USD/JPY yesterday, positive vaccine news may already be priced into the pair. USD/JPY opened at 104.60 and closed at 104.07, a loss of 53 pips. Technically though, traders may see a good risk/reward opportunity near current levels.

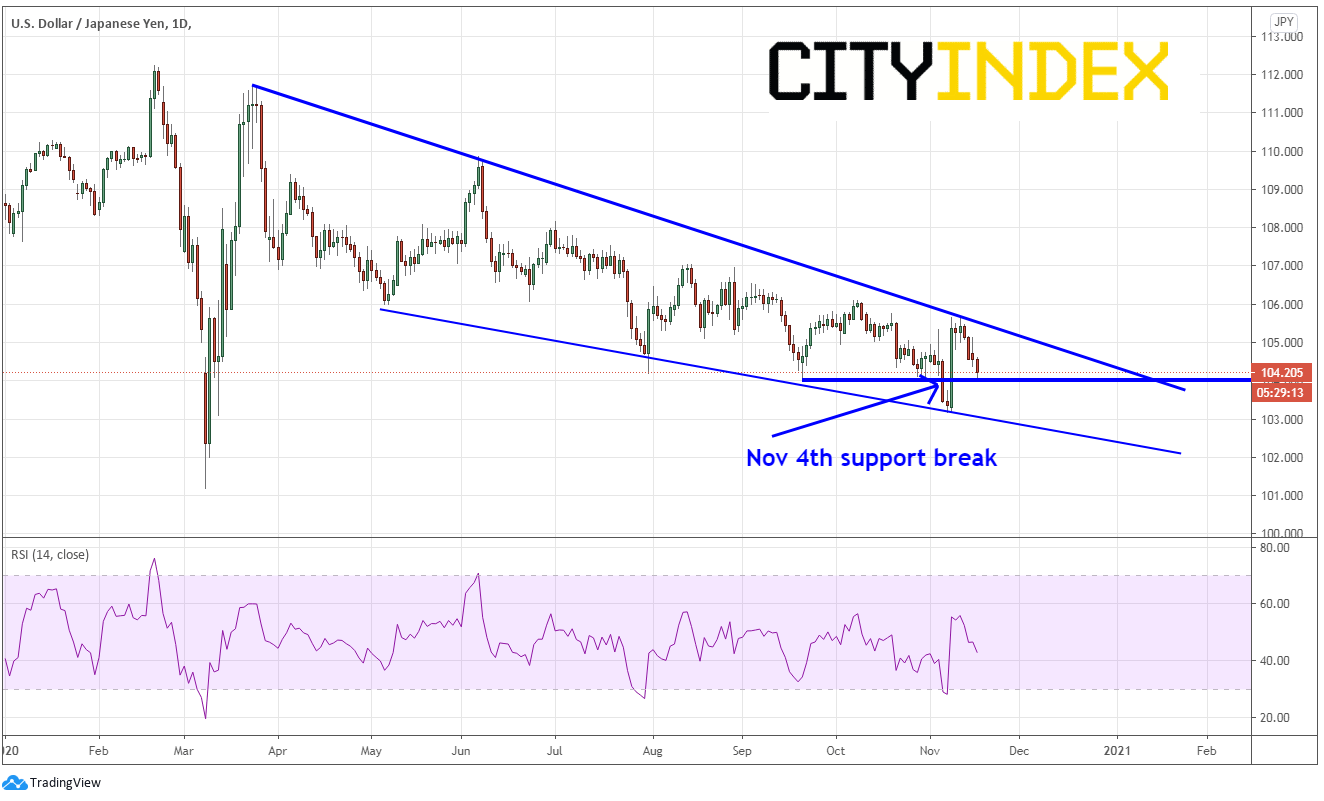

On a daily timeframe, USD/JPY has been moving lower since the March 24th highs at 111.715 in a descending wedge formation and is currently nearing the apex of the wedge. On November 4th, the pair pushed lower through horizontal support, and tested the bottom trendline of the wedge.

Source: Tradingview, City Index

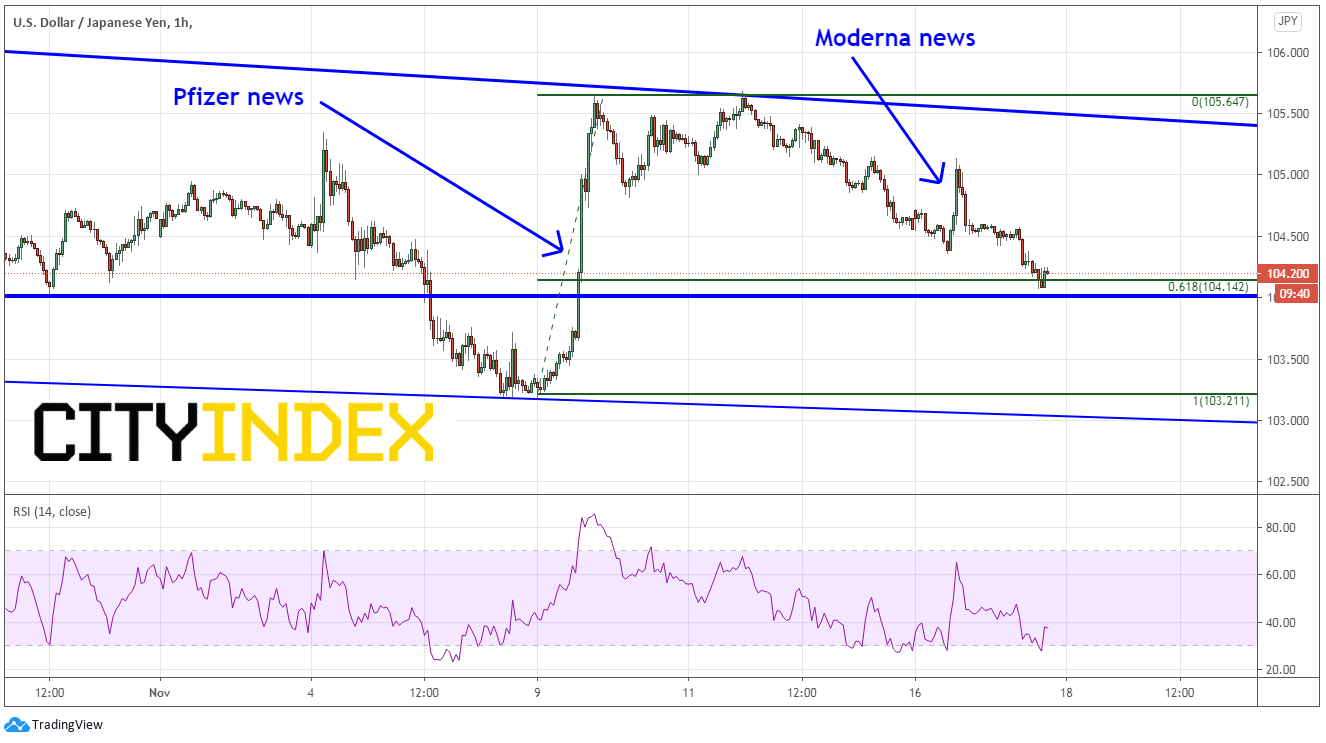

On a shorter, 60-minute timeframe, traders can see the large move from the bottom trendline of the wedge to the topline of the wedge. But notice the price action after the positive vaccine news from Moderna. Price did spike higher but was quickly faded. USD/JPY now sits at the 61.8% Fibonacci retracement level from the low to high on November 9th. In addition, it is sitting just above horizontal support near 104.00 and the RSI has just moved from oversold territory back into neutral territory.

Source: Tradingview, City Index

Bulls will look to buy between 104 and 104.20, targeting the top trendline of the wedge and place stops below the horizontal support just below. If price breaks below 104, watch for bears to sell retests of the 104.00 area, targeting the recent lows at 103.20 and then the downward sloping trendline, with stops above 104.00.