A dull start to the week yesterday as G10 currency pairs traded within very tight ranges whilst major trading centres the U.S., Singapore, and the U.K were out for public holidays. Amongst the most frugal, USDJPY barely managed to scrape out a 20 pip range, continuing a trend of range compression seen in recent sessions.

Looking for possible reasons behind USDJPY’s diminishing ranges, the JPY is viewed as a safe-haven currency. The latest IMM report confirms the market remains long JPY, likely as insurance against a possible second wave of COVID-19 infections after economies re-open and if U.S. – China tensions continue to escalate.

Offsetting this, risk sentiment remains resilient, buoyed by optimism surrounding a vaccine and an encouraging re-opening of economies from “early openers” such as New Zealand and Australia.

Locally Japan commenced its own re-opening yesterday as the emergency virus controls established in Mid-April were lifted. Japanese Prime Minister Shinzo Abe told a news conference that reviving the economy is his top priority and tomorrow the government would approve a second budget to assist the economic recovery.

Following Abe’s announcement, a resumption in Japanese investor activity is anticipated, and combined with Japan's shrinking current account surplus, demand for JPY is likely to be muted from these avenues.

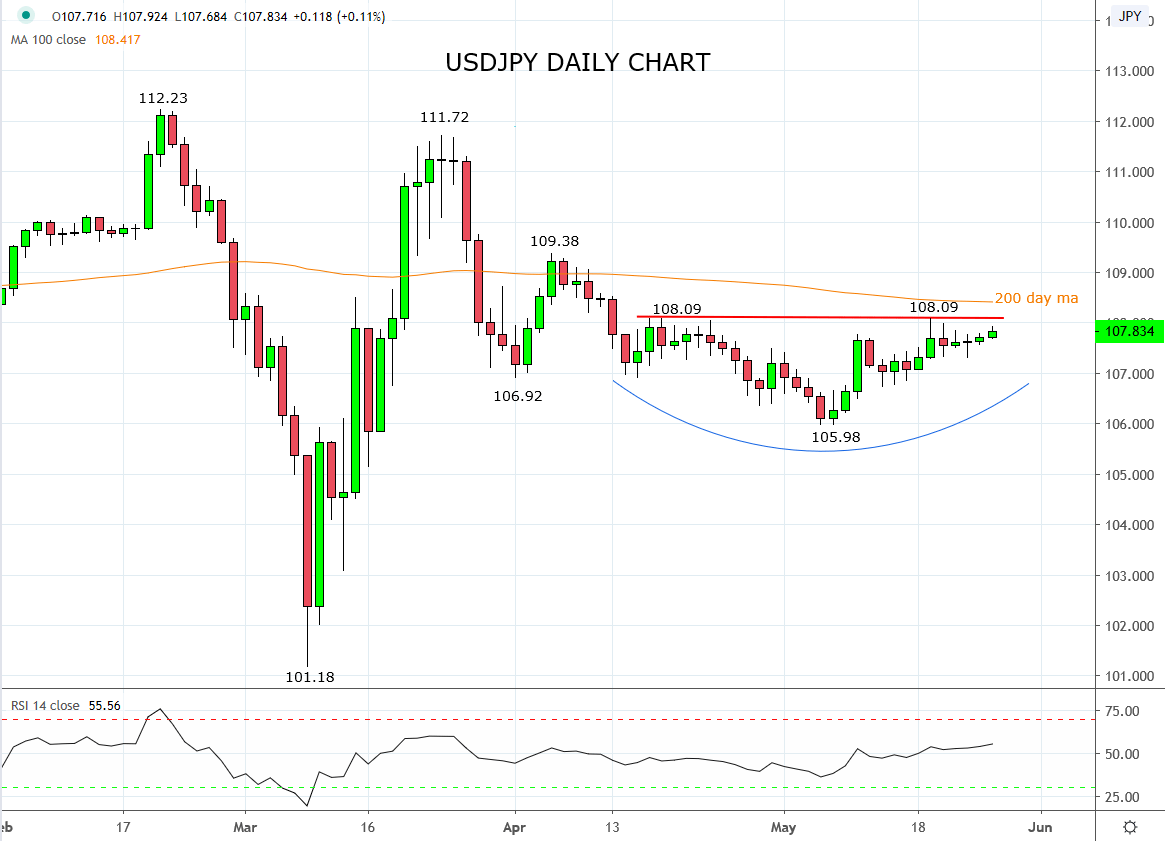

When we look at the chart of USDJPY below, it can be observed that following USDJPY’s rejection from resistance 112.25/50 (the Feb 112.23 high and 2019, 112.40 high), USDJPY fell back to 105.98 in early May near the middle of its 112.00/101.00 range.

Because of the V-shaped bottom at the March 101.18 low, we favor that when USDJPY’s extended range breaks, it will be to the topside. To that effect in the short term, USDJPY is currently eyeing crucial overhead resistance from recent highs 108.10 and the 200-day moving average 108.40 area.

A sustained break above 108.40 would be initial confirmation that a tradable low is in place in USDJPY at the 105.98 May low and the catalyst to look to enter longs in USDJPY, in anticipation of a rally towards range highs 112.25/50 area.

Source Tradingview. The figures stated areas of the 26th of May 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation