The USD/JPY looks very interesting as the new week begins. It has hit a new high for 2020 despite Friday’s disappointing US jobs report, with the yen also weakening amid ongoing risk-on sentiment as investors anticipate the signing of the much-touted phase one trade deal between the US and China on Wednesday.

If the price action on this pair is anything to go by then gold could head in the opposite direction as demand for safe-haven assets drop back with the US-Iran tensions easing. Indeed, gold and the USD/JPY tend to have a strong negative correlation with one another. Gold bugs better hope then that either the negative correlation breaks down or the breakout in the USD/JPY turns out to be a fake one.

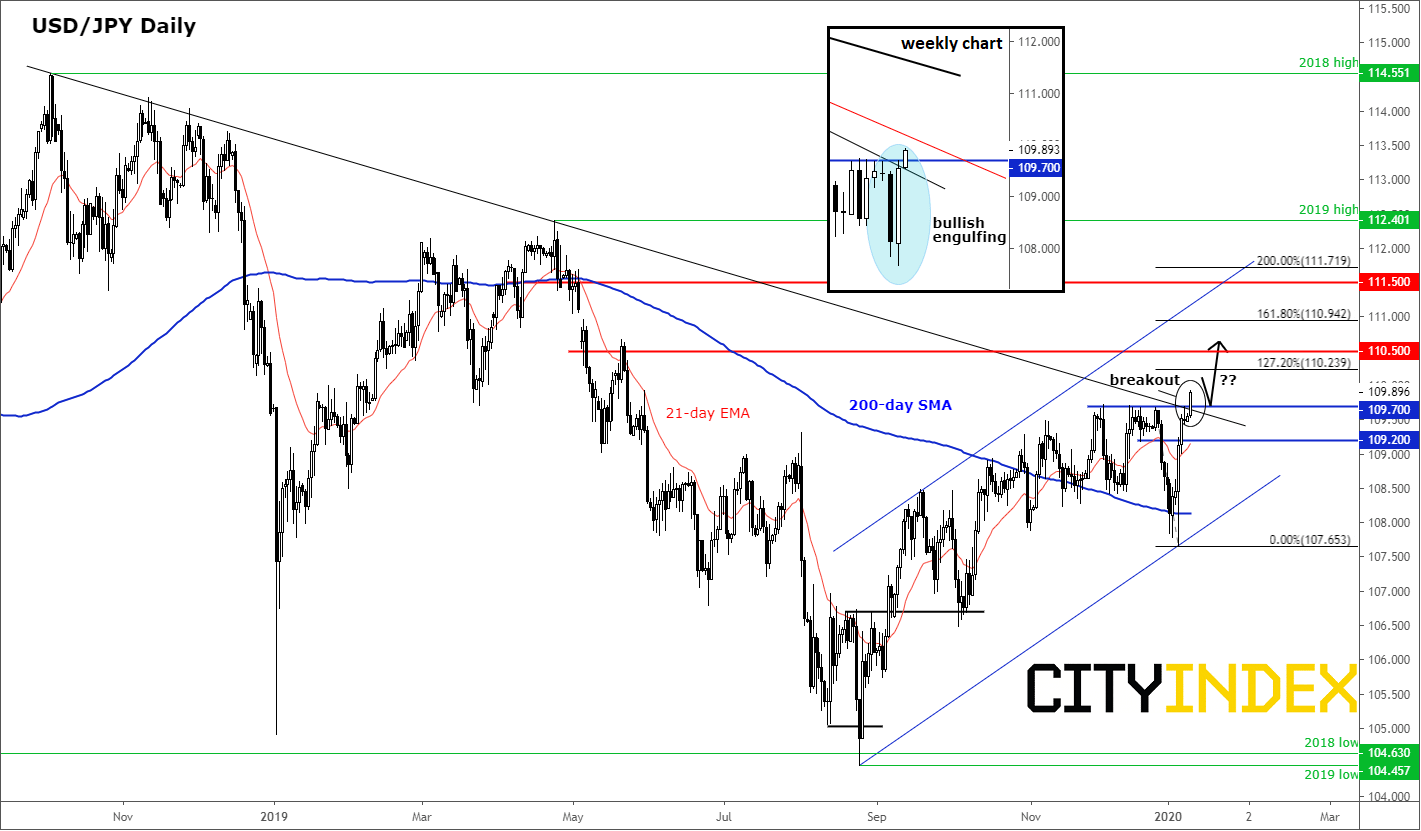

Source: Trading View and City Index.

But for now, price action on the USD/JPY appears rather bullish. On the weekly (inset), it formed a large bullish engulfing candle last week, with the reversal price action causing rates to peak above a bearish trend line and key short-term resistance at 109.70. Price now needs to hold above this level if the bulls want to take full control of near-term price action. However, a daily close back below 109.70, if seen, would complicate the outlook.