The US dollar has started the new week on the front foot after being hammered in the last couple of weeks on rising probabilities of a rate cut by the Federal Reserve. As my colleague Matt Weller noted earlier, traders are now pricing in an over 80% chance of a rate cut by the end of July. Despite this, the USD/JPY fell only slightly last week and was up at the start of this week. The safe haven yen is undoubtedly undermined by the ongoing “risk-on” rally – owing to news that the US and Mexico have reached an agreement over migration, allowing the latter to avoid the 5% tariffs threatened by Trump.

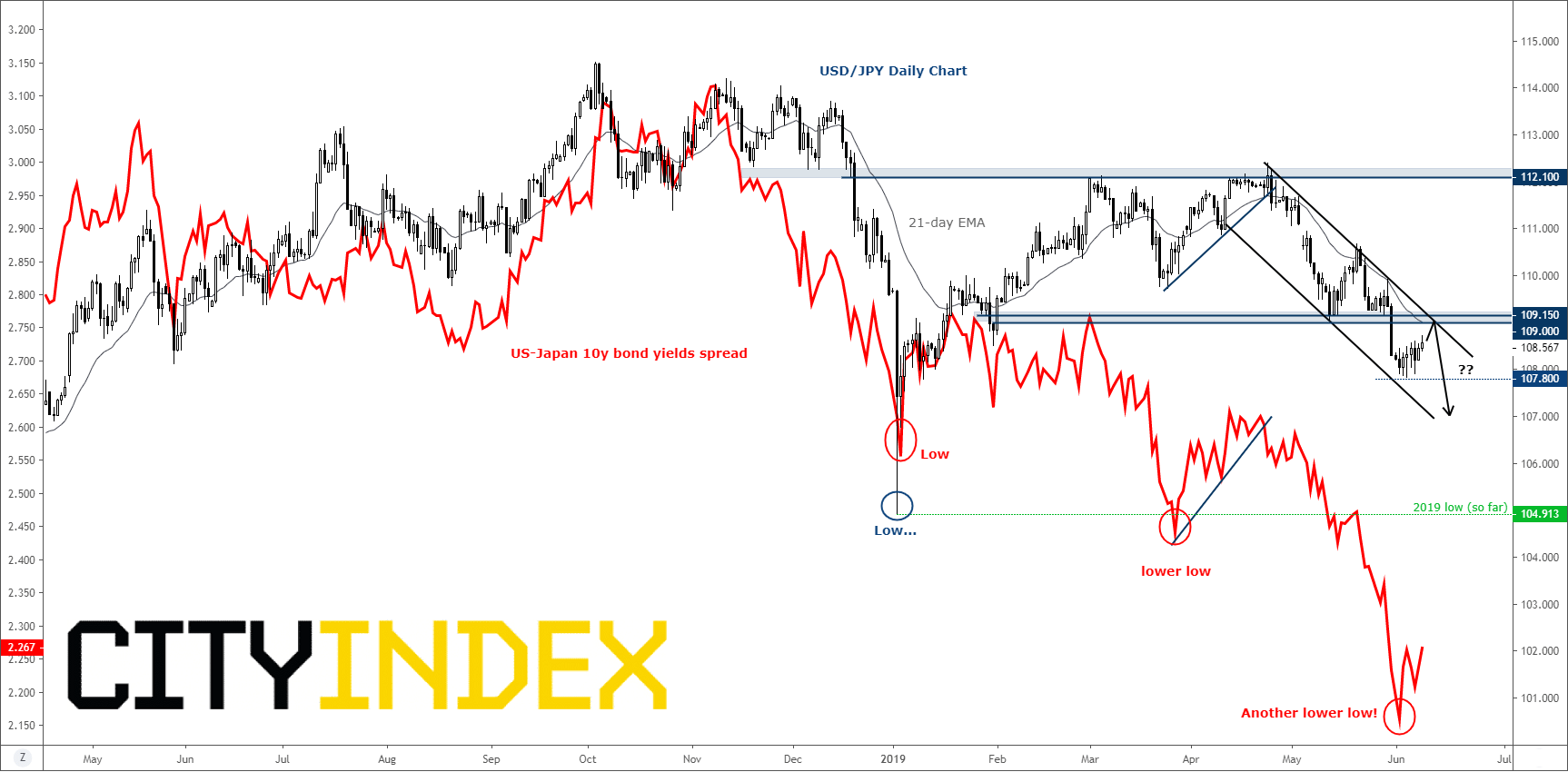

However, once the impact of the Mexico news is absorbed, we reckon the UJ will probably decline further and catch down with the falling US-Japan bond yield spreads – especially if Wednesday’s release of US CPI fails to positively surprise the downbeat expectations. The Fed’s U-turn on interest rates has gathered significant momentum over the past few weeks but the dollar has not made a similar move. Yet. But if the slumping US-Japan 10-year yield spread is anything to go by, then the fact this has made a new lower low suggests the USD/JPY could be on the verge of dropping below the January’s flash crash low over the coming weeks.

A potential resistance area to watch is around 109.00-109.15 on the USD/JPY, which was previously support. This area also ties in with the down trend of the bearish channel and the 21-day exponential moving average. Of course, rates need not get there before turning; essentially what we are looking for is a failure to hold above last week’s high at 108.60ish. The first downside target is the liquidity below last week’s low at 107.80, with the ultimate bearish objective being the low beneath the January low at 104.90. However, a clean break above the aforementioned 109.00-109.15 resistance area would probably invalidate this bearish outlook, until rates find stronger resistance at higher levels.

Source: TradingView and City Index