USD/JPY at decision point after Suga resignation

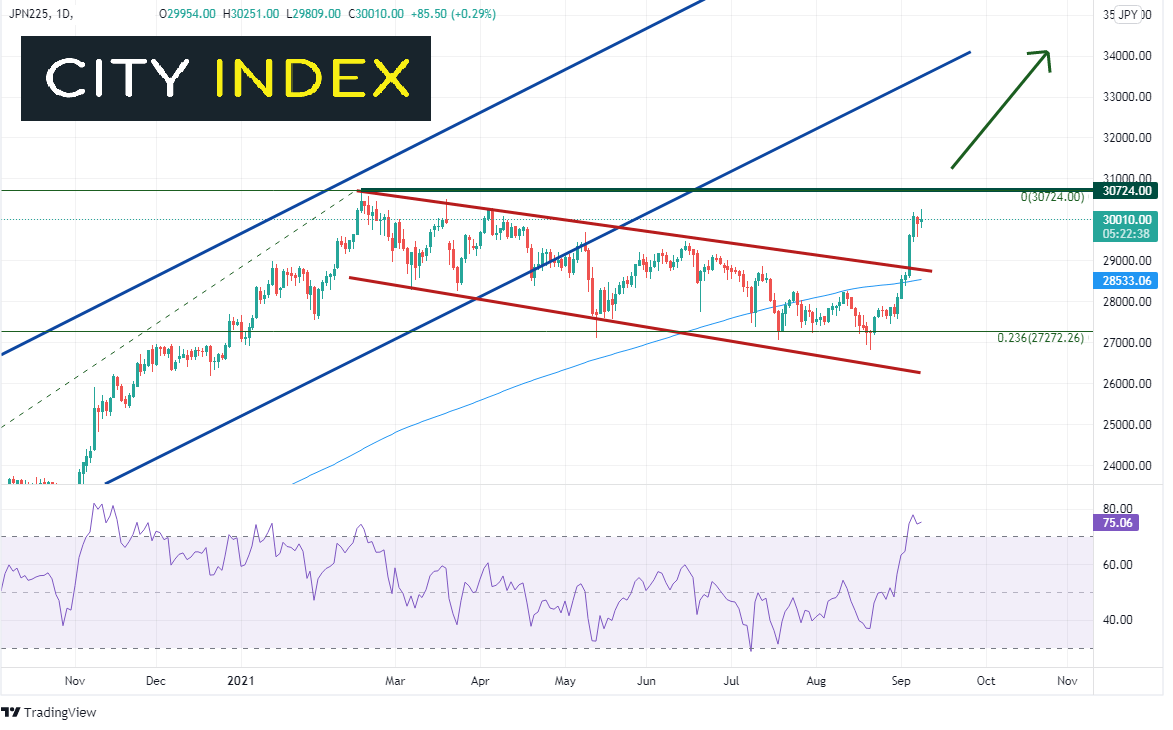

With the resignation of Prime Minister Suga, projected leading candidates are offering new Covid relief programs. One of the leading candidates has offered a package worth as much as 30 trillion Yen to help stimulate the economy. This has driven Japan’s Nikkei to 5-month highs and the Topix to levels not seen in 31 years! In addition, with stronger stock indices and a stimulus plan on the way, the Yen is weakening vs other currencies, including the US Dollar.

Everything you should know about the Japanese Yen

Check out the Nikkei 225:

Source: Tradingview, Stone X

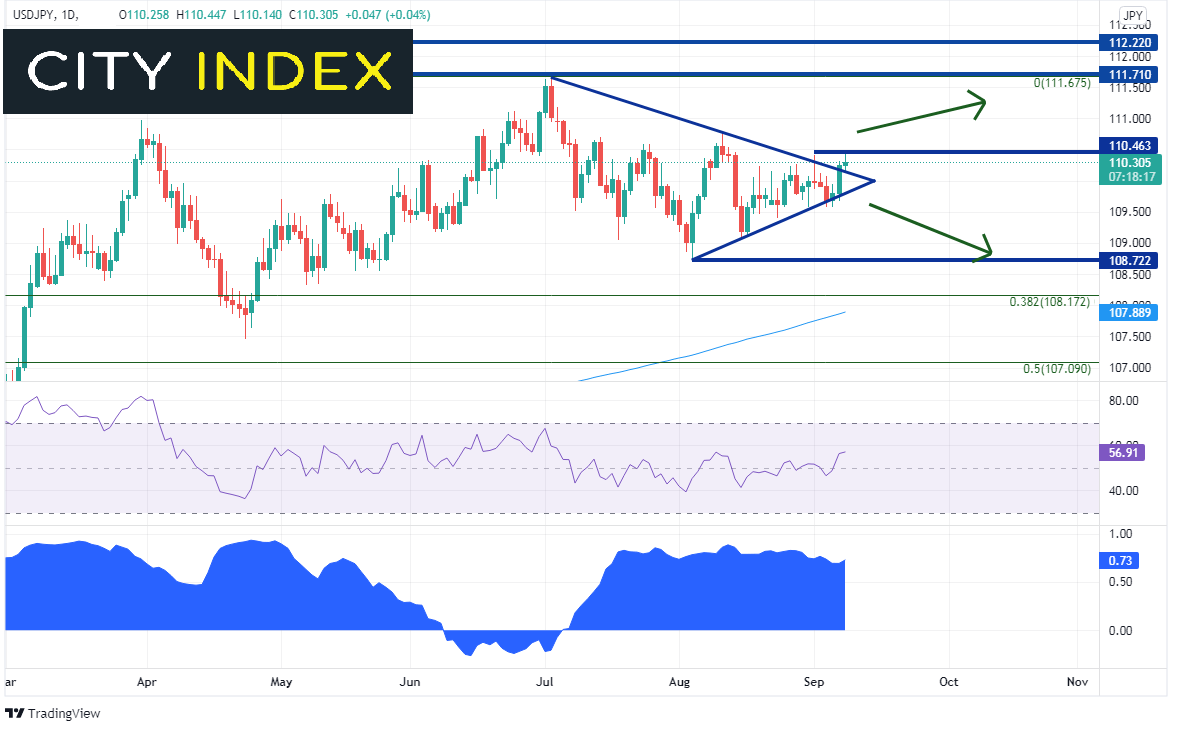

Looking at a daily timeframe of USD/JPY, the pair has been coiling in a symmetrical triangle since making a high of 111.71 on July 2nd, testing the March 2020 highs. Yesterday, USD/JPY was so close to the apex of the triangle, that it actually traded on both sides of the converging trendlines. It closed the day above the top trendline and thus far, is continuing to move higher out of the triangle. However, the pair is stuck between a rock and a hard place, as it has run into horizontal resistance at 110.46. A break above would open the door for a move back up to the July 2nd highs.

Source: Tradingview, Stone X

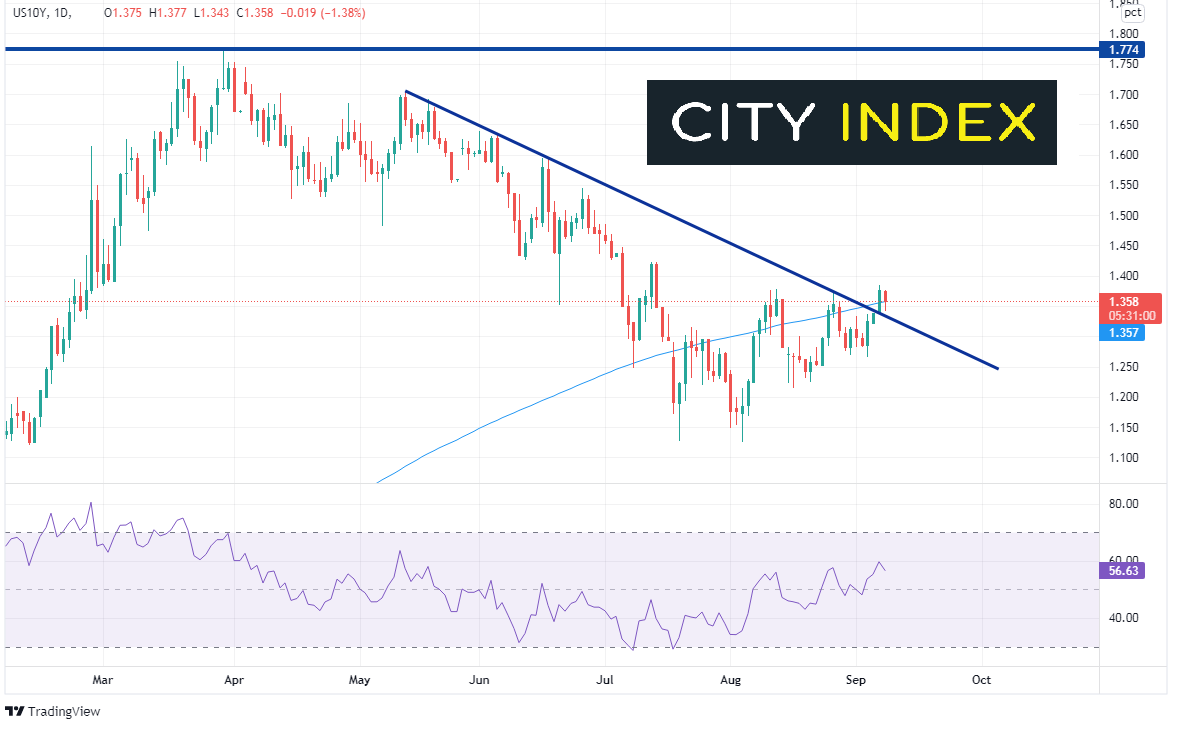

However, USD/JPY is still mainly driven by US 10-year yields, particularly for the last 2 months. Yesterday we showed a strong short-term correlation between Bitcoin and USD/CAD. The correlation coefficient between USD/JPY and 10-year US yields on a DAILY timeframe is currently +0.73. Typically, we look for correlation coefficients above +0.80 or -0.80 for a strong correlation. However, the correlation between these 2 assets has been above +0.80 for most of the summer. (Perhaps it is decoupling?) It is still relatively strong at +0.73. Therefore, watching yields is still helpful!

As far as US 10-year yields, they have broken above a downward sloping trendline dating back to the May highs. In addition, yesterday they broke above the 200 Day Moving Average at 1.357 and are hovering near there today. A close above the 200 Day Moving Average and yesterday’s highs (1.385) would be bullish for yields and could bring USD/JPY higher with them. A close back below the trendline near 1.338 would be bearish for yields, and they could head back towards the August 4th lows near 1.127. This would be bearish for USD/JPY.

Source: Tradingview, Stone X

With Prime Minister Suga on his way out the door in Japan, the new PM will likely bring with him a new Covid stimulus plan. USD/JPY is currently trading between tight resistance and support. With more yen in the system, this should cause USD/JPY to rise, however, watch US 10-year yields for conformation of the next move in the pair!

Learn more about forex trading opportunities.