USD/JPY: All Eyes on 107.00 This Week

Despite (or perhaps because of) signs of coronavirus “curve flattening” in the US, the greenback is among the day’s weakest major currencies. Meanwhile, the Japanese yen is holding up relatively well for a traditional safe haven currency on a generally “risk on” day (stocks up, bond yields down, gold flat).

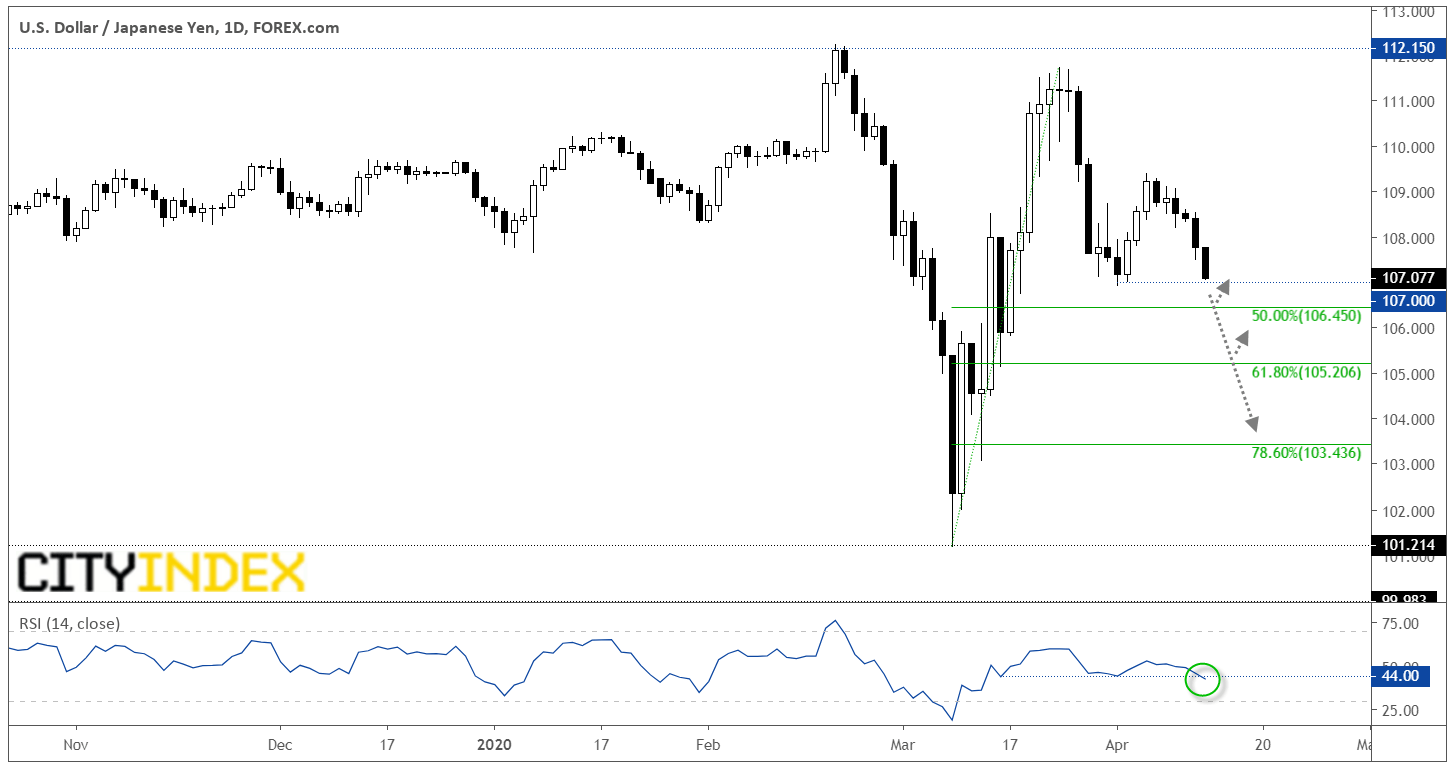

A quick look at the USD/JPY daily chart reveals that this weak USD / strong JPY pattern has been playing out over the last week, taking the pair down from the mid-109.00s to test support near 107.00 as of writing:

Source: TradingView, GAIN Capital

As the chart above shows, the RSI indicator has already broken below its equivalent low from the start of the month, signaling that the selling pressure has grown over the last two weeks and that rates may be more likely to follow the indicator lower in the coming days. If USD/JPY does break support, bears may look to target the Fibonacci retracements of the March rally at 106.45 (50%), 105.20 (61.8%), and 103.45 (78.6%) next. On the other hand, if bulls can defend that line in the sand, the pair could bounce toward 108.00 or 109.00 by early next week.

Fundamentally speaking, the US retail sales report morning and initial unemployment claims on Thursday will be the key updates on the economic front over the rest of the week. Of course, traders remain hyper-focused on coronavirus news, especially regarding economies “restarting,” so that’s likely to trump (no pun intended!) any traditional economic data releases.