The most important topics right now are trade wars and the relentless rally in the bond markets as concerns grow over the health of the global economy. Those concerns were evidenced by three central banks across the Asia Pacific almost frantically cutting interest rates overnight. Central banks of New Zealand and India cut rates deeper than expected while in Thailand the rate cut was almost completely unexpected. The latest sign of an economic slowdown was provided by German data once again, as industrial production there slumped by 1.5% in June compared to a smaller decline of 0.5% expected.

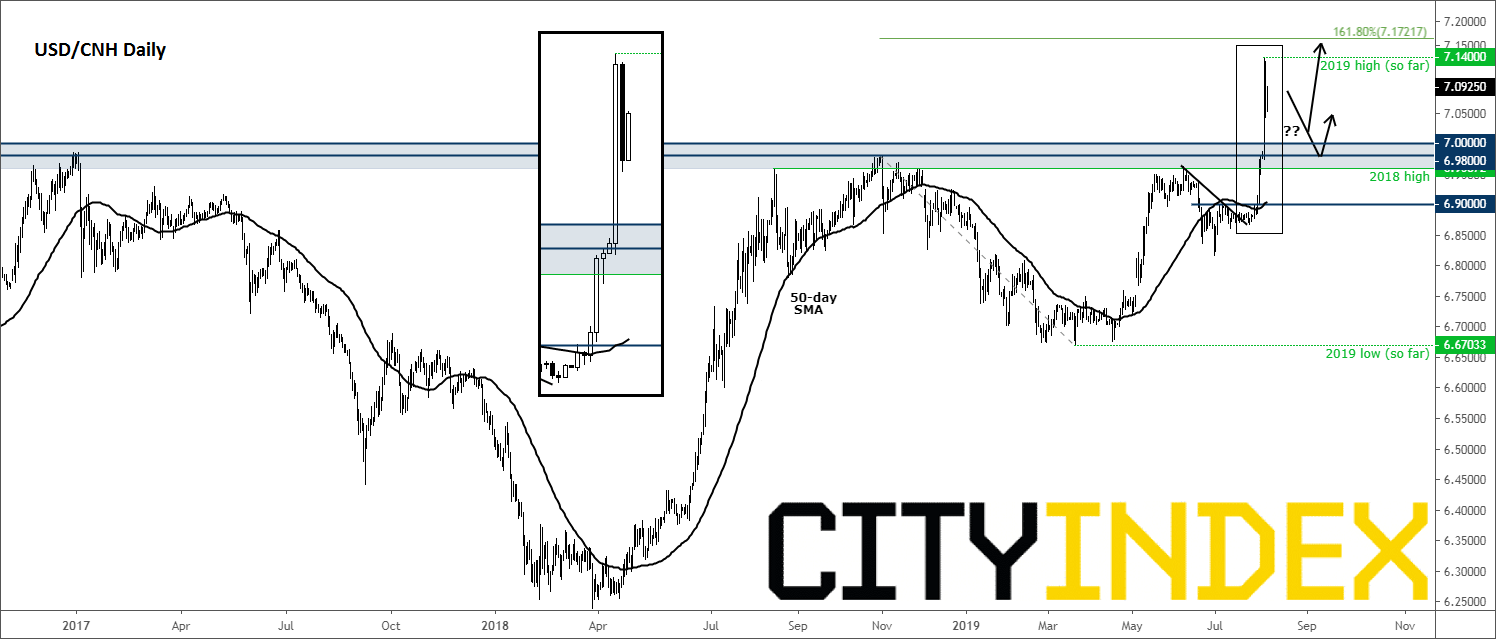

While it is always a good idea to keep track of the changes in fundamental developments, there may be a simpler way of being on top of things right now: watch the USD/CNH volatility. The PBOC has again allowed the Yuan to trade near the key 7-per-dollar level. As there are no signs of US-China tensions easing anytime soon, rates could break further higher – and, in turn, cause more chaos elsewhere, such as the equity markets and commodity dollars.

From a technical point of view, for as long as rates hold above the breakout area of 6.98-7.00, the path of least resistance should remain to the upside. The next bullish objective would be the liquidity resting above this week’s high (also the YTD high) at 7.1400, with the 161.8% Fibonacci extension level coming at 7.1720.

Source: Trading View and City Index.